A company I invested heavily in recently, used to lose money by the boatloads, but it began to make money. Two quarters in a row in fact! Even after that its share price remained stagnant. This seemed absurd to me so I decided to plow as much money as I could into it, only for the share price to nearly double shortly after.

It was because of that stock that I decided looking at unprofitable companies might prove beneficial. After all PE ratios track backwards for about a year, so if a company has recently become profitable not many would know.

This led me to Futaba (6986), while it may be a little early to start investing heavily in this company, it is certainly one to watch as Novembers earnings could prove good.

Thesis: Futaba is a recently profitable company that is engaging in cost cutting. Its dividend was cut to focus on new sources of revenue. It is trading below its net current assets which is made up of over 50% cash.

There are many things to be excited about when looking at Futaba, so join me as I analyze the stock in further detail below.

Futaba a Quantitative Valuation

Futaba is quantitatively undervalued, mostly because it has been losing money for so long. Because of this the share price has been battered. It is at its lowest valuation in what looks to be company history. This might trouble some people, but from what I’ve learned reading There’s Always Something To Do, all time low share prices are a great way to spot extremely undervalued stocks.

Futaba is a small cap stock that clocks in at around $300 million US dollars in market cap. Below are the important relevant indicators of undervaluation.

- NCAV: 71.06%

- PE ratio: Negative

- Dividend yield: 3.65%

- Payout ratio: NA

- Total debt to equity: 1.62%

While it does not currently make a consistent profit, its most recent quarter results show some promise. It also pays a dividend while you wait for a turnaround, and with almost no debt and a load of cash the dividend should remain where its at for some time to come.

Management Plan of Cost Structure Improvement

Management has been burning cash even before 2020 and the resulting lockdowns. But, it seems that this has kicked management to expand offerings in areas that have high potential for profit. These include:

- Shifting from physical store sales to online sales.

- Reviewing the supply chain for risk avoidance.

- More work from home and internet utilization.

Management also have plans to expand their production equipment into IoT monitoring and Web contract processing. Alongside their Drone and robotics efforts they are preparing for a technological future.

Management is focusing more on software services centered around hardware. This focus on services rather than production will lead to higher margins and better profitability.

At first I thought the dividend was lowered because of the pandemic in 2020 but on further investigation it was lowered in 2019 well before the shutdowns. This gives me even greater confidence a turnaround was delayed but is currently underway.

With all of these plans it’s no wonder the dividend was decreased to conserve cash, as many of the tech research will need some investment and the company surely has a plan to utilize that capital in a better way that investors can.

Management explains in its report that it plans to keep the dividend payout ratio around 30% and a payout of 28 Yen per year is the lower limit for stable dividends. Thus if results turn out to be better than expected dividends could potentially increase in 2022 or 2023.

Income Statement Shows Signs of Recovery

Just as I discovered with the company I profited from before, I ran to the income statement to see if there were any signs of a turnaround. To my surprise there was, however, it is not nearly as pronounced as the one I noticed before. We may just be in the early stages.

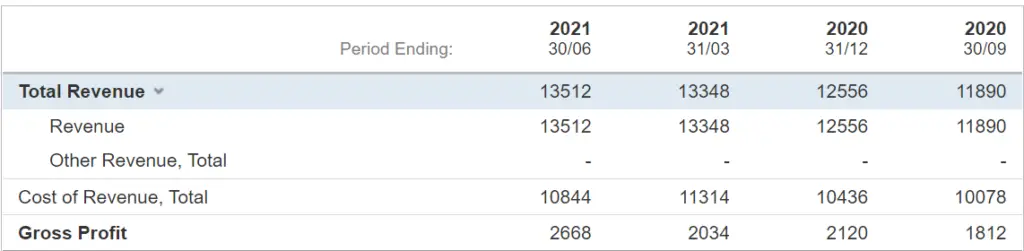

According to quarterly income statement shown below a slight increase in the gross profit is shown while the revenue remains the same.

The cost of revenue seems to have decreased while revenues have increased implying that the cost structure improvements are beginning to take effect. This would align with managements stated goals.

While this does look like an overall positive it could just mean less production took place due to bottlenecks and more revenues from improving sales as the global economy recovers. However, a rise in inventory seems to negate that risk. In order to know for sure reviewing another quarter of financials would prove beneficial.

Reviewing 2019 numbers may also prove to be enlightening, although due to Japanese financials being difficult to translate I am unable to review those numbers at this time.

Diluted Weighted Average Shares

Another point on the income statement I take special note of is the diluted shares. This is because I don’t want an undervalued company selling shares especially when the have a lot of cash on hand.

Upon investigation Futaba’s shares have remained the same for many years, signifying management is aware of the company and its undervaluation.

Domestic vs International Sales Segments and Yen Valuation

Futaba breaks down their sales into two segments:

- Electronic device connection.

- Production equipment.

Note: Below information is for April-June 2021 (Caution :All information is translated from Japanese and subject to error.)

Of these two segments the production equipment segment is larger at about 62% of overall sales. This makes both segments fairly equal in importance.

The majority of sales are international with domestic sales accounting for 43% of all sales both domestic and international.

The months of October and September have seen the Yen fall in value internationally. This will likely improve international sales increasing revenues and hopefully profits for Futaba with its cost structure improvements.

Currently it seems like everything is aligning to make Futaba profitable into the future, and as investors in this undervalued company we will be there to reap the benefits.

Risks Related to Futaba’s Recovery

Manufacturing at Futaba is split between multiple countries. This makes supply chain management difficult and one of Futaba’s primary medium term management plan goals. Currently the breakdown is as follows:

- China: Electronics and precision parts.

- Taiwan: Electronics.

- Korea: Electronics and precisions parts.

- Japan: Design and manufacture.

Currently the world is experiencing unprecedented supply chain issues which can create bottle necks with parts. This is seen in the semiconductor market. Most of the Worlds Semiconductors come from Taiwan at TMSC.

Luckily, it seems Futaba’s inventory is fairly high, although it has experienced an increase of around 20% in the recent quarter, signifying a possible bottleneck.

China also proves problematic as energy concerns moving into the winter pose a potential threat as many factories have been asked to shut down and conserve power.

Conclusion and a Word of Caution

Futaba looks like its on the road to recovery, but unprofitable companies sometimes never fully recover. In the case of net nets I did a bit of research when I was writing an article specifically on profitable net nets. I found out how treacherous unprofitable companies can be. Buying just a few of them has much higher risk and volatility than profitable companies that pay a dividend do.

In the case of Futaba its important to look for factors that give it a higher chance of succeeding where other unprofitable companies either declare bankruptcy or keep losing money until their value completely erodes. The analysis conducted above attempts to weigh the beneficial factors that may contribute to a higher chance of company turnaround.

Disclosure: I currently have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it from Futaba or any interested parties. I have no business relationship with any company whose stock is mentioned in this article.

How to Invest in Small Cap Japanese Stocks

In order to invest in Japanese stocks you will need to have your base currency exchanged into yen. Depending on which currency is your base currency this can give you better or worse buying power.

I live in the United States and currently the only way I have found to efficiently invest directly into small Japanese stocks is through Interactive Brokers.