May has come to a close and its time to take a look at the results of my net net portfolio. It’s also time to reflect on what I’ve learned and how I can become a better investor.

Part of being a great value investor is looking for trends and catalysts. The holy grail of which is finding a stock that just had a recent catalyst and has also positioned itself for a global trend to unfold. The current trend is of course the semiconductor chip shortage and massive supply chain disruptions.

Inflation as a Result of Supply Chain Struggles

It never really occurred to me that our perceived inflation was entirely the result of supply chain struggles. While it may have seemed like havoc has been unleashed on our supply chains from countries closing their borders it really lies deeper than that.

One of the YouTubers I enjoy watching. Wendover Productions, outlined how the supply chain disruption was not entirely the result of simple disruptions in the supply chain, but rather the fact that very little slack was built into the system.

This is a result of the Just in time method of manufacturing not being properly understood by all companies that employed it. The bottom line is not all components are treated equally. We can see this from what’s happened with semiconductors. While there are many reasons for the shortage, companies need to be prepared for such issues in their supply chain.

What Countries are Most Vulnerable

No country is completely invulnerable to supply chain disruptions but it is particularly apparent in the United States because of the large trade imbalances. Its thought that America’s number one export is actually empty cargo containers, or air if you think that’s funny.

The problem has recently become very apparent as cargo ships are unable to load their goods in the Los Angeles harbor. One country that doesn’t seem to have a big problem with these types of supply chain issues is Japan.

Because of its 2011 tsunami near Fukushima the supply chain at least for semiconductors has learned its lesson. Toyota is just one company that has been able to withstand the recent supply chain shock. There are also many small companies in Japan that are extremely undervalued that just so happen to manufacture semiconductors and help with logistics.

Over the past month I’ve made it my mission to find these cheap companies and buy as much of them as I can. In the current environment materials suppliers and logistics planning companies will have the best success. This also coincides with the recent commodity boom that we have seen.

Hard to Find Cheap Stocks in The United States

Before I jump into my net net portfolio results for the month of May, I wanted to touch on US markets. I currently run two portfolios, one that I buy cheap book to value stocks in the United States and the other of course an international net net portfolio.

I have been searching the entire month of May for something worthy of buying in the United States, but everything is far too expensive. There is just far too much capital in the markets inflating prices. That is why its best to look where nobody is looking. Better yet if you mention a stock market and people look at you in disgust you know your in the right place.

If you are interested in the cheapest stocks I think are currently a buy right now you can read some of my analysis on Seeking Alpha, but my current top picks for the start of June are:

- SpartanNash

- Smart Sand

- Consolidated Water

Note: These are not buy ratings but rather my opinion of what is cheap from some guy who writes occasional articles on the internet.

May 2021 Net Net Portfolio Results

It finally happened, I closed on my refinance and now have a fat chunk of capital that I can really put to work. Right now there are so many ideas I have for international stock picks that I really needed that extra capital.

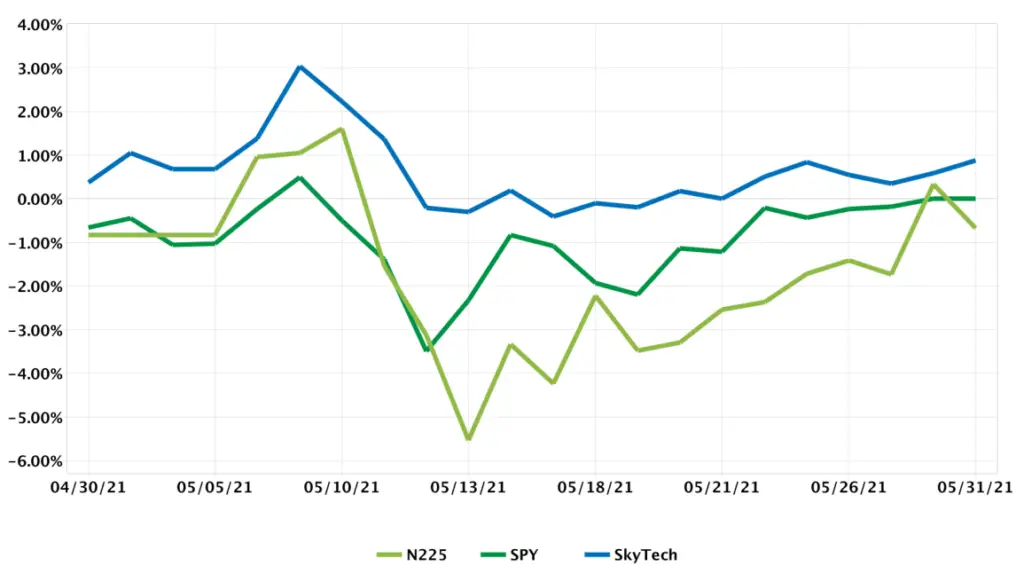

May started out well but quickly dropped as renewed lockdowns in Japan pushed stocks down. Alongside renewed fears of the now 2021 Summer Olympics being canceled forever. This initially dragged on my portfolio. But, just as I got my fresh cash it began to pick up very slightly.

I was able to outperform the Nikkei 225 for the month of May. Likely due to my defensive portfolio of cheap and undervalued stocks. Most of my portfolio is invested in profitable cash flowing dividend stocks. Its almost a form of dividend growth investing, with the added benefit of massive cash reserves for global supply chain shocks.

Even though I do enjoy investing in these defensive dividend stocks it is far from actual dividend growth investing. I’m not looking for dividends that will grow over time but rather companies with dividends around the 4% range. These typically indicate a stock is undervalued and if they have plenty of buffer in their payout ratio they will surely rise back up in price.

Notable Net Net Stock Sales

I recently sold one of my net net stocks. It had increased in price but was a really slow mover. It also recently posted a rather ugly earnings. At this point I had held the stock for 2 years and thought it would be best to take what I had and move it to a much more promising trade.

This is also part of my effort to concentrate my best picks if only a little bit more. Unfortunately I still managed to increase the number of stocks currently in my portfolio to 27. This rose by two as it was 25 at the beginning of May. Unfortunately I am just finding far to many good ideas investing internationally.

It would have been 26 if the stock that is going private had already bought out my shares but unfortunately it is taking more time than I would like.

Goals for the Month of June

I feel I am well positioned for the remainder of the year. However I plan on keeping at least some cash on the sidelines for minor dips for the remainder of the year. We have yet to see any real slowdown since the recovery that started in 2020.

I am also planning on being a bit more concentrated in my portfolio. I have been watching my returns for nearly four years now and am starting to get a good understanding on how to invest in net nets. Unfortunately I started at a really bad time in 2018 amid the beginning of a trade war.

It makes my returns look terrible and even made me question my abilities, but I’m starting to wonder if that made me a better investor overall. Only time will tell.

I’ve also been thinking a lot about interesting ways to boost returns. Share lending has come up as an interesting option. I will likely be trying this out with my US portfolio to see if it is detrimental to my portfolio or tax burden.

Reading, Writing and YouTube Goals

I have recently bought the book There’s Always Something to Do and plan on reading that while I wait for some great investment opportunities.

I am also going to be adding more content to the website and hopefully helping all of you become better investors. If you feel like reaching out to my the best place is currently Seeking Alpha, but hopefully soon I will have a proper email and YouTube Started.

If you are reading this at some point in the future when I’ve started the YouTube channel feel free to search Exploit Investing into YouTube.

Check out previous portfolio recaps.