This site is dedicated to deep value investing and exploiting mistakes that markets make. Since one of my favorite investing strategies focuses on stocks that trade between a book value of 0 to 1 it got me thinking; Can price-to-book value be negative? And is there any merit to negative book value stocks?

Stocks can have a negative price-to-book value if the market capitalization of the company is less than its stated book value. This occurs in companies that have more liabilities than assets. It also results in a negative shareholder equity.

This is usually an unfavorable position to be in for any investor in a company. Although a lot of mega caps operate this successfully for many years.

Below, I’ll delve in a bit deeper into these situations and how they can continue to operate, and maybe we can find a few opportunities in the market along the way.

Negative Book Value Among Major Corporations

Starbucks is an interesting example of a company with a negative book value and an equally negative price-to-book value. This company is wildly profitable and yet if it were wiped out tomorrow its investors would be left with nothing.

Starbucks has a negative book value because its liabilities exceed its assets, leading to a negative shareholder equity.

How Starbucks Supports It’s Negative Book Valuation

Starbuck’ negative book valuation isn’t an issue for two reasons:

- Much of its debt is long term debt and since Starbucks is a profitable company future debt is discounted due to inflation.

- Continued profitability supports the business more than its assets less its liabilities.

Starbucks is likely able to do this due to its large and likely extremely undervalued brand. If its brand were listed on the balance sheet accurately it would like boast a more positive book valuation.

Starbucks could eventually run into a problem if it was unable to support its loan payments with its cash flow, which it currently could still easily do by cutting its dividends or share repurchases.

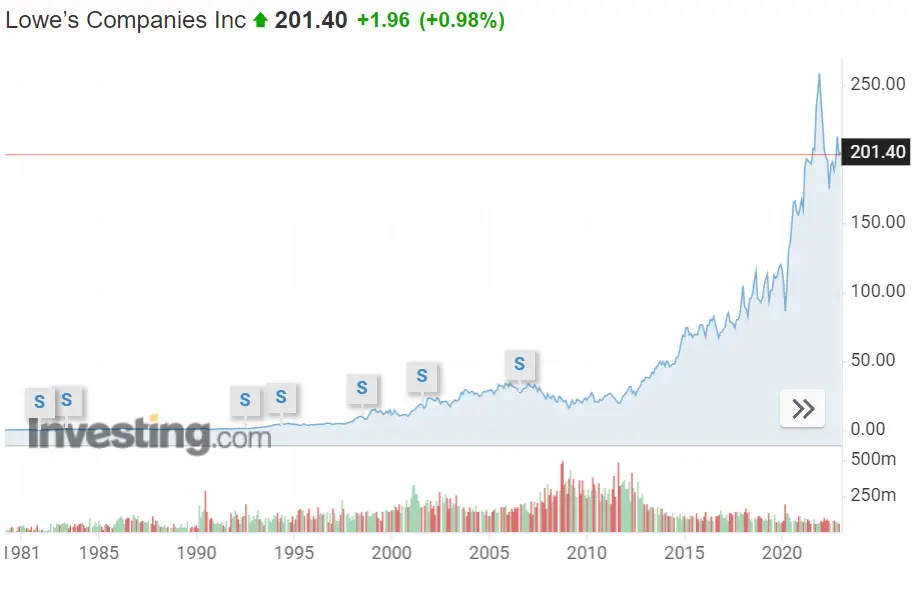

Lowe’s Yet Another Example of Negative Book Value

Lowe’s fell into the same trap as Starbucks with its large negative book valuation. It’s share buybacks have resulted the company taking on excess debt above what it can support with its cash flows.

While on the surface it’s share valuation may seem excellent and its performance over the past 10 years stunning, it does highlight a common trap large companies seem to fall into.

They are sacrificing future sustained growth for short term share price gains. This short term viewpoint will lead to competitors overtaking them as they struggle to maintain cash flows from destroying shareholder value through share dilution.

The Risks of Negative P/B Value Stocks

As I’ve stated earlier in the article negative book value can be risky, since if operations ceased the following day shareholders would be left with nothing.

While this is extremely unlikely with most large businesses its a thought exercise that needs to take place.

And in fact a loss of sustained profitability could be the match that sets fire to the entire enterprise.

When Financing Dries Up

There are a number of stocks that can operate for years with negative book valuations and others that may struggle.

Below are a few reasons why a stock may struggle when financing dries up:

- It’s more difficult to issue shares without tanking the stock price.

- Corporate bond issues will have to be made at higher rates exacerbating cash flow problems.

- Growth will slow down, in the case of Starbucks because debt was issued to fund expensive share buybacks.

The biggest risk to negative book value stocks is slower future growth. While many may still be able to grow revenues, profitability may not grow alongside it as financing costs rise to match.

Price-to-Tangible Book

Price-to-tangible book differs in that it does not include goodwill or intangibles that are listed on the balance sheet. This is important to value investors worried about a stock potentially declaring bankruptcy, since those assets are essentially worthless.

Tangible book value will always be negative if book value is negative and should be used to better understand liquidation value. In the case of negative tangible book value not all hope is lost as I’ll explain further below.

Negative Book Value Can Be Misleading

Negative book value is not always accurate as there are many variables that are not accounted for.

Here are a few examples:

- Depreciated assets: Buildings, land and equipment is not always worthless even if its been depreciated to zero. Which many long lived assets potentially are.

- Intangible assets: Some intangible assets are understated but do have very real value. This value may not be beneficial in liquidations, but certainly impacts cash flow through sales.

- Inventories: Not all inventory is worth less than its listed under current assets. Some inventories may be worth more because of increased raw material pricing or inflation.

So everything is not as it seems with negative price-to-book value stocks and there may even be opportunities lying in wait if we look hard enough.

Finding Rewards in Negative P/B Stocks

You know how I explained depreciated assets may depreciated to zero? Well land, buildings and equipment are never totally worthless. In the case of land it could even rise in value.

Smart Sand Wrote off Land Assets

Smart Sand a company I have written about on Seeking Alpha wrote off two land assets and it no longer is carried on its balance sheets. But, last I checked those assets were still worth a few million dollars. They also are likely still being taxed and contributing to company costs.

Selling these assets will realize hidden book value that could be enough to push a stock into positive shareholder equity.

Examples of Hidden Assets

Two stocks I’ve followed that have resulted in far more than I would have previously thought possible in shareholder returns:

- Imperial Ginseng Products: Has been creating value by selling off farmland that has appreciated in price.

- DallasNews Corporation: This company sold of buildings and brand assets boosting its book value and rewarding shareholders with large dividends.

While the examples above may not contribute to long term success it does show than liquidation does not always result in negative value from fire sales. Shareholders can still generate a return if the stock price is low enough.

If your motivated enough I’m sure you can find negative book value situations that are actually positive, I’ll let you know if I find any in the future. I’m sure they are out there!

Negative Book vs Enterprise Value

Negative book value and negative enterprise value can sometimes be confused with each other, but it’s important to understand the distinction. While negative book value is always a bad sign in the event of a liquidation, a negative enterprise value can actually be positive if the company was purchased at a low enough price.

If you’re interested in learning more about negative enterprise value click the hyperlink and see how they can make exceptional investments.

Hopefully I have not dissuaded you from investing in negative book value stocks entirely, but you must understand the risks. Cash flow is a must when dealing with these types of stocks and any sign that cash flow will be stifled long term should be a red flag for any long term investor.