Individual Stocks vs ETFs. This is a question I grappled with for many years. When passive ETF indexing became all the rage it seemed like individual investing was dead and there was no point in buying individual stocks. But, then something happened and I began to wonder what the point was investing in ETFs.

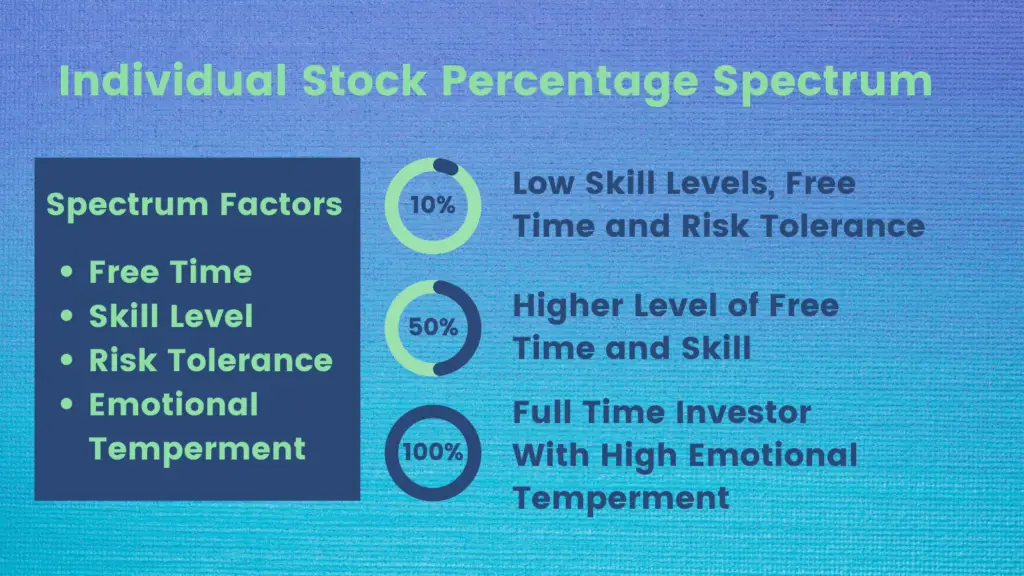

Free time, skill level and risk tolerance all factor into the amount of money that should be allocated to individual stocks. If you have a lot of all three, then 100% should be invested in individual stocks. Ultimately it is a spectrum and its perfectly fine to dabble with as little as 5-10% of your portfolio.

I was actually only 10% invested in individual stocks when I first began my investing career. No, I wasn’t day trading. But then I began to notice, I was investing in ETFs almost as if they were individual stocks. It was getting sort of ridiculous and then one year I decided to just invest 100% into individual stocks.

Recommendation on Who Should Invest in Individual Stocks

Individual stock investing is essentially a spectrum. Based on the below graphic there are 4 factors that determine your individual stock investing allocation.

Emotional Temperament is probably the number one reason why most investors probably fail at investing. You could be doing all the right things but in the end if your emotions get the better of you, it could lead to underperformance.

As your emotional temperament develops alongside the other factors you will naturally be able to devote higher percentages to individual stock investing.

Skill level and risk tolerance go hand in hand as your skill level increases your risk actually decreases. As Warren Buffett once said:

Diversification is protection against ignorance.

This skill level and ultimately knowledge also protects you from and is directly related to emotional temperament.

Ultimately it is important to realize your own strengths and weaknesses when it comes to investing in individual stocks. you should ultimately invest as much as you feel comfortable with investing into individual stocks. If you start with just 10% at a young age and you do well that percentage could naturally increase as you age and invest well. If you fail to beat the benchmarks your percentage allocation could even decrease.

The average person should invest just 10% of their portfolio in individual stocks.

Why I Invest in Individual Stocks

Technically, I am not fully invested in individual stocks since I keep a retirement portfolio that is a fidelity mutual fund. I like to use it as a bit of a barometer to my private investing. So technically, as of this writing I am 75% invested in individual stocks. My private portfolio is fully invested in individual stocks. But, there is a catch.

I don’t invest in large cap stocks.

If you are investing individually into large cap stocks it defeats the purpose, since you are going up against some of the best investors on wall street with insane amounts of capital and resources. Some like to counter this by investing in dividend growth stocks and holding long term.

In reality this is a lesson in futility since you may only ever beat the indexes by a small margin, and is it even worth your time and effort at this point? My conclusion is no.

I can achieve much better gains by competing in a field were large capital fund managers wish they could touch and that’s micro and small cap companies.

Not to mention it was a bit hilarious holding a large cap ETF that included the same individual stocks.

ETFs That Invest In The Small and Micro Cap Market

When I was investing in the ETF space I invested in a small cap, mid cap and a large cap ETF. I also started investing in the following:

- High Yield Dividend ETF

- International ETF

- Bond ETF

- Dividend Growth ETF

like I said before it was getting a bit out of hand. Not to mention each one of those variations had thousands of choices. While it was ultimately passive it required a decent amount of initial research.

But then I noticed some of the costs of these ETF’s were particularly high. Especially the international and small cap ETF space. I began to wonder why and discovered that active research, currency hedging and larger portfolios were to blame.

Now I know what your saying, active research? That’s not passive ETF investing. Well not all ETFs are passive nowadays some act almost like mutual funds, so you need to know the distinction.

Alternatively, many of the currency hedging that was taking place with international ETFs was eating into my profits, because those funds were so big it cost more to efficiently manage.

When it came to small cap investing the portfolios were much more spread out and a larger number of companies had to be purchased with small allocations. I would notice my small cap funds had tiny amounts of allocation below 1% even in some very compelling stocks.

It didn’t make much sense, but I realized it was because those funds had so much money it would ultimately drive the price up this is where I could take advantage.

How to Invest in Individual Stocks Intelligently

So you got this hot tip on Tick Tock. Everything seems in order, I mean that person is getting rich quick, or so it seems.

These hype stock pickers are preying on FOMO and this is the fourth pillar of my spectrum of individual stock investing. Emotional temperament. Don’t fall for it, you need to do your own analysis known as fundamental analysis.

The easiest form of fundamental analysis at least in my view is balance sheet investing. This style of investing takes into account the book value of a stock according to its current price. If a stock is priced below its book value than it is considered cheap.

These stocks are often poor quality so it takes some further research to know what a quality pick would be. I outlined 10 factors I look at when buying a value stock in another article that is worth a read.

There are of course other ways to invest but range in difficulty level. For example many large cap and growth investors utilize the discounted cash flow method. This is too difficult for me as of this writing but, in the future I may have to go this route.

Daytrading Individual Stocks is not Active Investing

It is important to note that active investing in individual stocks does not mean day trading. Active individual stock investing typically adheres to the one year holding period, otherwise the time and effort to invest large quantities of capital is almost meaningless.

I also believe day trading is a zero sum form of trading that has little contribution to society. Other than potentially providing the markets with liquidity. Your world impact and rewards for holding longer term are much higher.

Day trading as a form of investing in individual stocks should always be limited to play money in your portfolio and should never exceed what you are willing to lose.