We are getting awfully close to the final quarter of the year. This year has been a lot of work, more than anticipated and I’m finally looking forward to some time off.

However, a new problem has reared its ugly head. Its a good problem to have, but as my portfolio grows my taxes are becoming something that should be looked at more carefully.

This got me thinking about retirement accounts. You see for the longest time I have had my company matched 401K slowly chugging along. Its been in a Fidelity target year fund and I have been using it as a sort of fallback. Just in case I fail at my own investing venture.

But, as I become a better investor, I may not need it. I may just want to take control of it myself and there are a few ways to do this.

- Rollover my 401K into a Roth IRA

- Sell my target fund and invest myself.

- Move my 401K to a better broker.

Currently I’m deciding on what my best options are since I have some years ahead of me. Taking the tax hit and rolling my 401K into a Roth IRA might be worth it.

Roth IRA Can Boost Returns in the Long Run

Roth IRA’s are tax advantaged accounts. This means no taxes are owed on the capital gains accrued in the account. This is great when you are young, since your portfolio can compound tax free.

There are also many reasons why the Roth IRA can be a better choice than the 401K.

- Roth IRA can withdraw principle amounts of capital tax free and without penalty.

- There is no limit to the number of Roth IRA you can have.

- There are no taxes owed on the gains in a Roth IRA at the point of withdraw in retirement.

This makes it extremely beneficial to own a Roth IRA when you are young and probably a reason many millennials are gravitating towards them. They offer both flexibility and tax savings.

Contribution Limits to a Roth IRA

The contributions limits to a Roth IRA are a big drawback. Only $6,000 can be added per year to an account and its not tax deductible.

This makes it impossible for me to transfer my entire net net portfolio into one, and this may be for the best since I may want to use my earnings sooner rather than later.

However, it does make some sense to put as much into it now as possible for those tax savings in the future.

I’m also currently employed and my Employer has a 401K match which makes it difficult to rollover my 401K and turn it into a Roth IRA. This may be a good reason to hop jobs and find a better paying one just to rollover my old 401K.

If you have already changed jobs yourself this may be a good time to look into rolling over an old 401K, just be aware that you will have to pay taxes on your entire portfolio at that time.

Owning Multiple Investing Accounts

Right now I currently have 3 different investment accounts. Two at brokerages and one 401K. But, there is theoretically no limit to the number of accounts you can have. However, what’s the best way to keep track of them all?

I’ve been thinking a lot about this lately, as I want to keep certain portfolios separate, but also require reporting at a glance. Luckily, brokerages like Interactive Brokers allow you to import other accounts. I have yet to use this feature but plan to in the near future.

The ability to track smaller sums of money and move them more easily will also allow me to take advantage of brokerage account bonuses for moving capital. I currently do this with credit cards and track it easily with Mint, so its something to think about.

August 2021 Net Net Portfolio Results

Earnings season is in full swing this month and many companies are reporting excellent earnings. After earnings are reported I typically update my google spreadsheet to see where my investments stand in comparison. I rebalance rebalance when necessary and offload stocks that may not be performing to my expectations after a long period of time.

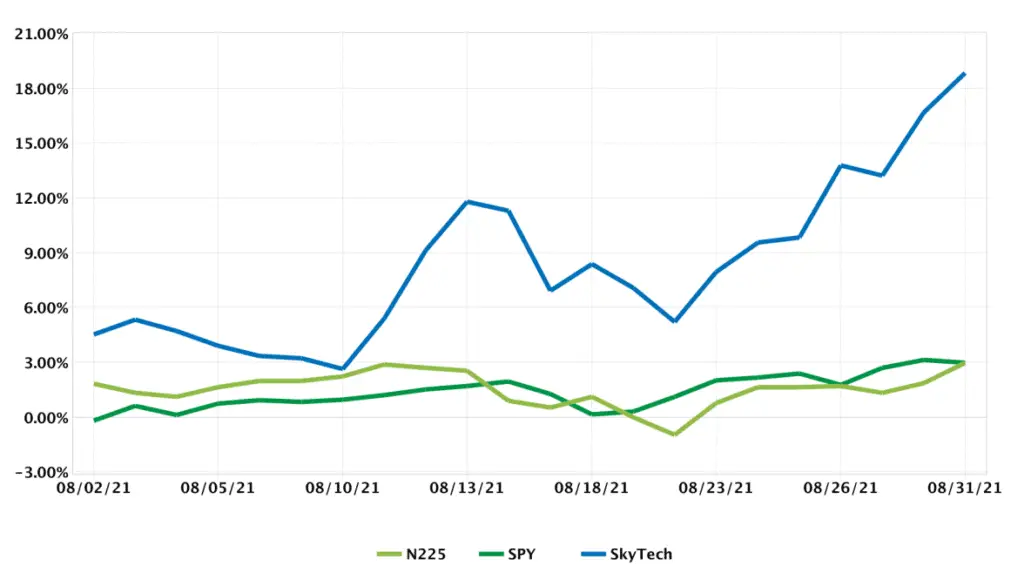

This month’s returns far exceeded my expectations. Out of all the stocks I own many of them had amazing earnings, but only one stock really took off. So the entire return you see below is because of one stock that has nearly doubled.

These kinds of returns are not typical on a month to month basis and should not be expected frequently. However, it is very common for net nets and especially Japanese stocks to be fairly flat most of the time until of course they aren’t.

I know everyone says this time in Japan it’s different and they are often proved wrong. I truly believe this time it may be different. After all one of these days it will be, why not now?

Keeping My Tax Bill Low

This month has me thinking a lot about my upcoming tax bill.

Luckily, I have not sold most of my gains, so it won’t trigger the entire amount. The plan is to sell slowly so that I don’t spook my individual stocks. After all my entire holding in many stocks are the size of the daily volume, so it actually would have a detrimental impact on the price.

It is also very important to wait for long term gains. The tax benefits are equal to 7% of my stock returns, which is no small amount. This means that there has to be a great deal of confidence in the company over the next year. In this case I do have confidence the stock will continue to be profitable and maybe gain more as I hold.

The plan is always to hold onto any stock for a year and a day in order to reap the tax benefits.

Portfolio Since Inception Breaking out of Negative Returns

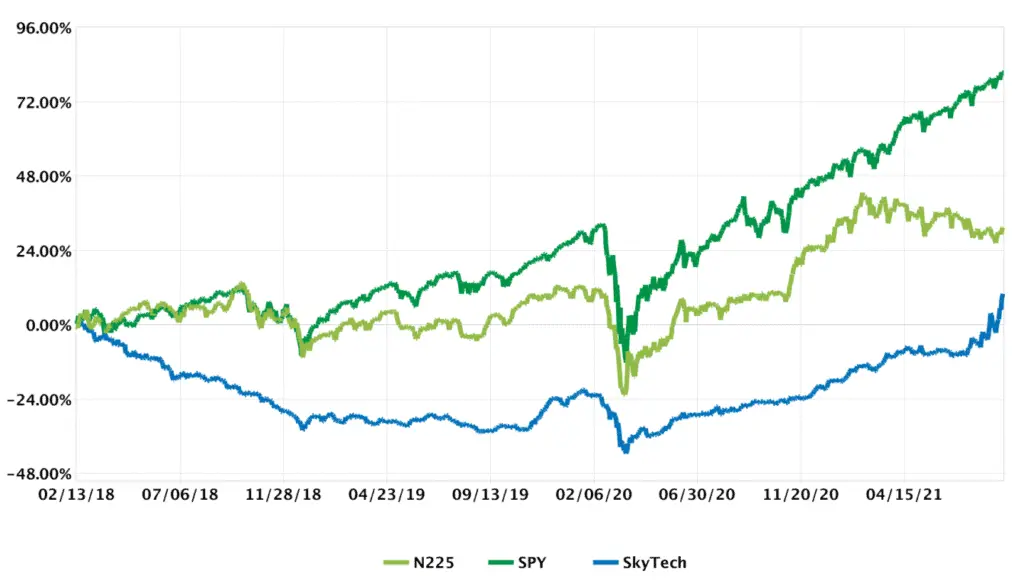

This month’s returns have been stellar. So it is important to remain humble and I believe the best way to do this is to show my returns since inception.

My returns vs time have finally become positive. Net net investing is not always fun and games and I’ll explain my story.

When I first started my net net portfolio I was worried about American markets hitting all time highs. So I decided to diversify and invest internationally. When the trade wars began my portfolio took a massive hit and did not recover until this year.

Fortunately this is a time weighted basis, I have done much better on a money weighted basis, because as I added more money to the stocks when they began to have better returns. Nevertheless, time weighting is an important metric to measure skill over time.

Here is my time weighted graph of the portfolio since Inception.

The above percentage is CAGR. This means that those are the total returns over the over 3.5 years invested. This means my yearly return was a paltry 2.8% and just barley beating inflation.

I made some investing mistakes early on as well. Mistakes I have learned from so I expect this average to improve.

If you calculate my money weighted return I’m sitting at 22.2%. This puts me above the 20% yearly return that I am aiming to beat. If I can continue to beat it, then I will be among the returns of other net net investors. I look forward to joining the ranks of past net net investors and improve my skills.

Over time my time weighted returns will balance out and skew towards my money weighted returns as the first year of my net net portfolio becomes less important.

Portfolio Rebalances Sales This Month and Goals for September

I’m sure everyone reading is curious what my actual holdings are. Unfortunately because of the size of the stocks I risk having a material impact on them by merely mentioning them, getting myself in hot water by frontrunning.

I do know that it is helpful to see my winning and losing investments so in order to give everyone a better understanding I will share stocks that I am no longer invested in this month. I may invest in these same stocks in the future but as of this writing I do not own any.

Stocks Sold in August

- TLV Holdings: I sold this Singapore based stock because it no longer had a dividend has been burning cash. It sat in my portfolio for two years offering nothing but negative returns. I will invest the funds in stocks with better prospects.

- Ohmoriya: This one was tough to sell. I actually like this stock but unfortunately it wont move much at all. This is based on past performance and share price movement. It also offers a shareholder perk which is interesting. Problem is I don’t live in Japan and I’m not eligible to accept the food box they give out every year.

- Toso Co: Again nothing wrong with the stock it just had a bad earnings but is still profitable I just had a better opportunity.

- Cofidur: This is an interesting one. It cut its dividend and has gone from positive to negative earnings. Everything seems worse about it, but for some reason it increased in price. I took the opportunity to sell.

This is not a recommendation to buy or sell any of the above stocks. I just want to explain my reasoning so that you all have a better understanding of what stocks to invest and which ones to avoid at certain times.

Goals For September

The book There’s Always Something to Do really resonates with me, and there is one part in particular that has me thinking a lot about how to structure taxes and returns. That is when Peter Cundill mentions, how you should plan when your investments may begin to spike. For example if you know that some changes in management or synergies between companies may begin to be realized, you can map out your investment timeframe.

I plan on trying to map out my investments in terms of timeframe, while nobody can see the future, this is the best way to plan for it.

If you are curious about my net net investment journey remember to read my previous portfolio recaps.

If you are ready to start investing internationally make sure to see which brokers I use and why.