Perhaps you have heard that it is wise to invest at least some of your portfolio internationally. Many portfolio advisors then offer you an ETF or mutual fund in order to satisfy that international portfolio sweet spot. In fact it seems there is very little do it yourself information on the internet about how to invest internationally and in this case in Japanese stocks. But, I’m here to tell you that investing in Japan and internationally is getting easier every year.

To buy shares in Japanese companies, find a low cost broker that has access to the TSE/TYO. You will need to convert cash from your base currency into Japanese Yen. Once the currency is converted you can buy shares in multiples of 100 on the Tokyo Stock Exchange.

Buying shares directly in Japanese companies can seem a bit complicated with the additional currency conversion but the rewards can be worth the extra headache. At first I was a bit scared exchanging my dollars for Yen, but then I realized it was easy and currencies don’t fluctuate as much as stocks do which alleviated currency fears.

Buying Individual Shares in Japanese Companies

I mentioned before that there is a lot of information out there explaining that you can buy ADR’s or ETFs that directly invest into Japan. This can make things easy for the average investor and that’s perfectly fine, however the Japanese stock market is huge, in fact its the third largest in the world.

Since the Japanese stock market is so large it doesn’t make sense to invest in these ADR’s or ETFs since some of the best opportunities in the market have yet to be uncovered. Typically ADR’s are only created if banks can make money off them. This means most of those companies are larger than I like to invest in.

Some of the ETF’s focus on smaller companies but even so they don’t invest in the smallest companies available on the Japanese stock market. These funds are just far to large to invest any meaningful amount in these small companies. On top of that the ETF market penetration is not as large as it is in the United States, leaving swaths of the market untouched.

The only way to buy some of the best opportunities on the Japanese stock market is to invest in them directly.

ADR’s and ETF Have High Fees

Another reason I believe its worth it to invest directly into Japanese shares are the fees are much smaller. I use Interactive Brokers to invest in Japan and I’m essentially paying pennies for the privilege. I would happily pay this vs paying a high expense ratio in an ETF or any hidden fees one might find in an ADR.

With ADRs and ETFs the currency exchange fees are built in, when investing directly you will need to pay for these exchange fees on every transaction. In order to reduce your fees it will be best convert your currency all at once rather than small chunks at a time.

You will also need to pay the currency exchange fee when you trade your currency back into your base currency. So keep this in mind when investing directly into Japanese shares. This money is not a short term investment it should be money earmarked for the long term.

I would also suggest any investors with less than 20,000 dollars invest in an ETF or invest in their own small business with that money first. This is because to achieve proper diversification will cost too much in fees since you will need around 20 stocks and to convert your currency.

What to Look For In Japanese Shares

Investing in Japan when you are unfamiliar with their customs and language can be tricky. Most of your investing will therefore rely on mostly on a quant strategy.

This means that you will need to look at a lot of investment ratios in order to decipher whether the stock is a good investment. Which honestly should not be too hard since a lot of the stocks are trading below book value.

Some of the things I look for in the numbers when investing in Japanese stock are:

- Dividend Yield (Yield should be over 3% signifying undervaluation).

- PE Ratio (Low PE ratios are profitable companies).

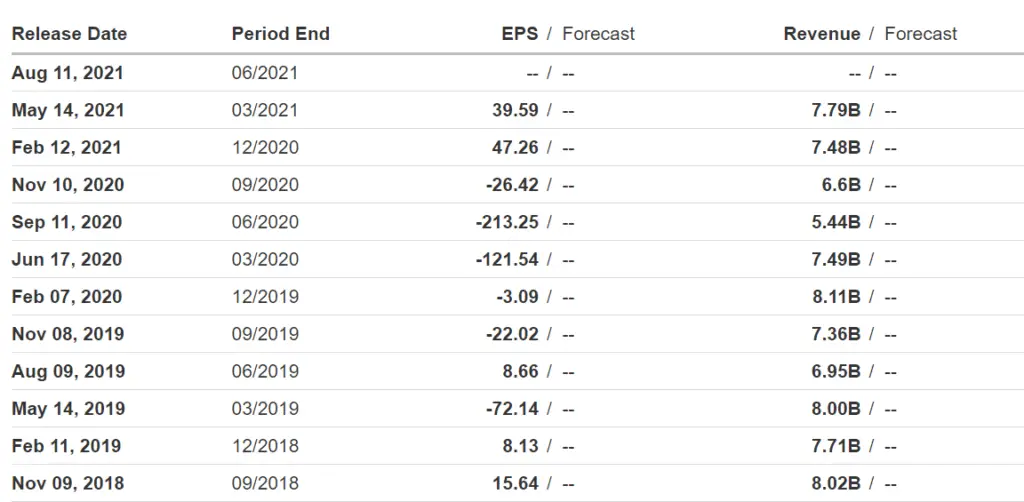

- EPS history (Is EPS lower than the average over 10-20 years?)

- Does the stock trade below net asset value?

- What is the company’s market cap? (It needs to be small).

Most Japanese stocks are very slow moving and incredibly risk averse. This can be great for retirees but terrible for younger investors. However, fear not, Japanese stocks can offer incredible returns if you know where to look.

The biggest advantage is looking for stocks trading for very low valuations compared to their assets. This is easy in Japan since there are not a lot of hard to value goodwill and intangibles on the balance sheets. Also looking for any opportunities in a companies reorganization is also beneficial.

The Headache in Buying Japanese Shares

Japanese shares have come a long way in a super short period of time. Since 2015-2018 Japanese shares have done many reverse splits and have been reduced from 1000 share lot minimums to only 100. This is allowing for far more individual investors to get in on these cheap companies.

Reverse splits at first seemed like a bad idea, but the more I think about it reducing the number of shares available creates a sense of scarcity and will hopefully create more upward price momentum.

The lot size reduction also makes it easier for smaller investors to purchase more shares. Although the reverse splits seem like a bit of a cop-out with the lot minimums. Overall its a trend in the right direction and as share prices rise will become more beneficial.

While I do believe the 100 share lots are a step in the right direction as more individual Japanese investors get into the game it is ultimately going to have to drop to 1 share lots and at that time Japanese shares will become very attractive to many individual investors.

Japanese Stock Market Value Trap

The Japanese stock market has been struggling ever since the beginning of the 1990’s. Low inflation, population decline, and long work hours all plague the Japanese economy. This has led to the perpetual undervaluation of the Japanese stock market as many investors leave it for dead.

But, as deep value investors that is the perfect place to look for returns. The Japanese stock market to me looks like what Benjamin Graham was investing in when he wrote his now famous books. Japan currently has the single largest collection of net net stocks in existence.

It’s also one of the safest markets to invest in, as there are less potential frauds in developed markets.

I know what you might be thinking if Japanese stocks are so great why has the market suffered for going on 30 years now. Well, that may very well be because of the zombie companies that exist. These companies have high amounts of debt and are very inefficient, but because debt is so cheap in Japan these companies survive when they shouldn’t.

Which leads me to another important piece of information to look at and that’s ROA or return on assets. The typical hurdle rate for most investors is 7%, but a lot of Japanese companies trade below that. This is because of the heavy levels of cash that these companies hoard due to low inflation.

But, that’s not the only reason these companies hoard cash they also focus on all stakeholders. This is important with Japanese companies and includes taking care of the following:

- Employees.

- Management.

- Distributors.

- Suppliers.

- Stockholders.

The stockholders are not any more important than the other stakeholders and Japanese companies as a result are very slow to adapt. Mergers between Japanese companies is also a rare and slow process compared to in the United States.

Because of all this Japan has been slow to rise in value, but this may be changing as corporate governance has become a priority in Japan.

Japanese Stock Market Returns

While its true that the Japanese markets have not hit the highs of the 1990’s the current generation of millennial investors would have net a profit if they had invested anytime in mid to late 1990’s. Even now 30 years of company profits are still undervalued in Japanese markets and are ripe for the taking.

If you are interested in learning more about deep value Japanese investments and net nets in general be sure to check out my monthly portfolio updates and see for yourself just how lucrative Japan can be.