I’ve been targeting the Japanese Stock market lately in my endeavor to uncover value, and cheap dividend stocks. However, Japanese dividends are a bit different than you would find in the American stock market and it can take some getting used to.

Bi-annual Japanese dividends are paid in the 2nd and 4th quarter. Annual dividends are paid in the 2nd quarter. This differs from the quarterly payments of American stocks. Japanese stocks also have longer periods between ex-dividend and payment date at 3 months compared to America’s 1 month.

This difference between the two countries got me wondering, is there a reason for this difference and if so is there any benefit to it? I had to dig deeper. So, if you want to see what I’ve uncovered and need a better answer to how Japanese dividends are paid out, continue reading below.

How Japanese Dividend Payouts Work

When I first started investing in Japanese companies I was confused about their dividends. It also didn’t help much that many websites and even my own brokerage were reporting incorrect data! (I actually informed my brokerage of the issue, and it seems fixed for everyone now.)

With the way the numbers that were displayed on some sites it was showing the ex-dividend in the future, while the payment date was in the past. This is obviously wrong, so how do payouts actually work?

It actually took receiving the dividends after a full year to truly understand it, this is mainly because it was hard to understand the bi-annual dividend raises and cuts.

You see, when dividend percentages are calculated annually they tend to extrapolate the numbers into the next year, but they report them bi-annually for that full year. Also the financials being in entirely Japanese, especially for smaller companies, does not help.

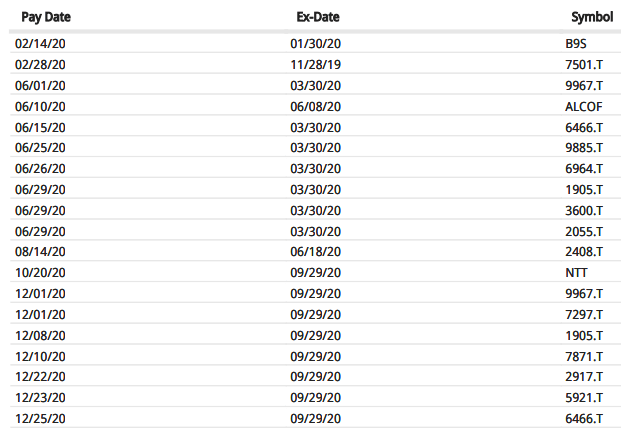

So for the benefit of all you still confused, and wondering how Japanese dividends are paid out check out my full year report.

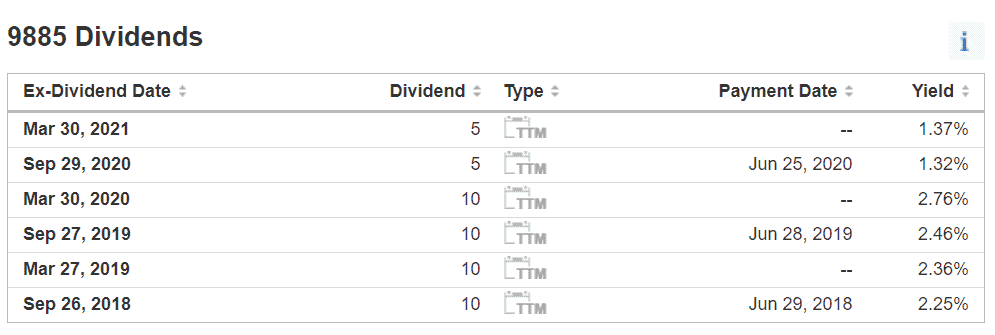

Now for companies that pay out bi-annually this is easy to understand. 6466 for example is shown twice and has two pay dates and two ex-dates. But, for some strange reason I’ve found a phantom ex-date on some places around the web. This is likely because these websites are trying to automatically pull data and fit it into a specific bi-annual parameter.

I can assure you though, that after much experimentation and purchasing shares before and after the phantom ex-dividend date that it had no effect. I received the dividend in full on the real ex-dividend date as is shown above. In particular I looked at 9885.

Ex-Dividend Date vs Record Date

Japanese stocks have the ability to choose whether they want to disperse annual and bi-annual payouts. According to the JPX website the dividend record dates are March 31st and September 30th.

This is a full day after the ex-dividend date. If you are trying to engage in arbitrage, I highly recommend you don’t, for the reason that its incredibly confusing.

The reason for this is that even if you buy the stock on the 30th you will likely not be the shareholder of record on the 31st as there is some transition time taking place.

So if you want to buy the stock make sure you hold it well ahead of the ex-dividend date. Not to mention stocks around this time usually rise just because its dividend season. So if you are looking for good deals its likely best to buy after the 31st.

The Benefits of Annual and Bi-Annual Dividend Payouts

It doesn’t make much sense. Obviously quarterly dividends are far better for the investor and having more payments would lead to faster returns. As the old saying goes, money now is worth more than future money.

In essence the compounding effect happens much quicker the sooner you receive your dividend. But compounding your dividend is not the only consideration when it comes to dividend payout frequency.

There is no easy answer as to why Japanese dividends are the way they are, but its possible it has something to do with the companies themselves.

Since they are only paying out once or twice a year they have more cash on hand that can earn them money throughout the year. This helps the company fund longer scale operations without financial worry. So, its likely this long term thinking that has formed this dividend payout preference.

Drawing Conclusions from Quarterly vs Monthly Dividend Payments.

In order to get to the bottom of why Japan pays out annually and semi-annually we need to draw some information from quarterly vs monthly payouts.

As Inzkeeper on Seeking Alpha so astutely mentioned, dividend payouts have costs, and paying out a yearly dividend is likely to reduce this cost significantly.

However, it should be noted that the compounding effect is much greater from yearly to quarterly, than it is from quarterly to monthly. The only problem is how can you compound something you can’t buy?

Japanese Stock Lots for Purchase

A lot of brokerages and ETFs allow you to DRIP or roll your dividends directly into the stock. However, according to Interactive Brokers, the broker I use, this is only available to US and Canadian listed stocks and preferred shares.

This makes compounding your investment a moot point when it comes reinvesting your dividends. Since you will need to come up with enough cash to purchase a whole share.

Not only that, but in Japan you can’t just buy one share. You have to buy shares in lots and the minimum lot of shares you can purchase is 100.

This is likely to reduce costs for the company and possibly the exchanges. But, it does affect our compounding efforts. Since this is the case, we can throw the compounding argument almost entirely out the window.

I say almost because there are a few reasons you might still want to be paid sooner than later: (assuming annual vs bi-annual dividend payments)

- You are working with large sums of money, have significant holdings on one company and can purchase a full lot.

- You want to buy another cheaper stock, that will cost less overall.

As you can see dividend distributions in Japan are tricky, and once you receive them it will take some strategy and skill to put that new money to work. So be prepared.

How Taxes are Paid on Japanese Dividends

I am not a tax professional and can’t give you any real advice. What I can tell you is what happens to me when I receive Japanese dividends.

I am a US citizen so my experience is solely for those living in the United States, however you may be able to draw some comparisons.

When paid a dividend in a foreign country such as Japan, they withhold the taxable portion of the dividend. As of this writing I believe it is 20% for those living within Japan but only 15% to foreign residents. I can back up this 15% as I’ve done the calculation on my own dividends.

Since this money is withheld, you will never see it. Instead its like paying a sales tax. The good news is when it comes to paying your taxes in America you can utilize the foreign tax credit to get a full credit on that tax paid.

This is so that you will not get double taxed. It may be that some are scared to invest internationally for fear of the tax situation, but rest assured you will not be double taxed. This is not the case for all countries though, Japan is a nice exception.

If you are interested in investing in Japanese stocks with excellent dividends be sure to check out my stock analysis section on this website.