In the United States it seems like supply chain issues are on top of everyone’s mind. Areal shots of the port of Long Beach and Los Angeles show hundreds of container ships sitting in the harbor, waiting to be unloaded.

This is happening today! But, we heard about supply chain issues back in May of this year. I even wrote about it in one of my portfolio updates. As it was unfolding, I didn’t see it really hit my portfolio in a meaningful way, at least until the most recent quarter.

This got me thinking, if the market is forward looking, how did it not see this coming? Does the market not actually predict the future?

Materials Inflation and a Weak Yen

At first I thought Japan was safe from many of these supply chain disruptions because it had better slack built into its supply chain. Even though Toyota is the inventor of just in time production, it realized slack was necessary for supply shocks early on. But, not all companies were immune to this disruption and many companies saw their revenues drop in the most recent quarter.

Supply chain issues also hit in ways that we could not have predicted. Material constraints such as chip shortages were seen in the form of materials inflation.

According to Reuters these rising raw material costs, and a weaker Yen could erode margins. Coupled with a tendency for Japanese companies not to raise prices on consumers, will squeeze profits even more. However, as demand rises for automobiles one of Japans number one exports, this could lead to a boom in sales of higher end goods exported overseas.

Lets take a quick look at imports and exports to see what areas we can exploit for future gains.

Japans top 3 exports include:

- Vehicles.

- Machinery including computers.

- Electrical machinery and equipment.

The top 3 imports include:

- Crude oil.

- Coal briquettes.

- Petroleum gas.

As you can see above higher energy prices create a real problem in the Japanese economy and a move to better renewables is a boon for the economy.

Japanese Automotive Industry

Prices for used cars has skyrocketed worldwide as consumer demand has spiked for both new and used cars. Supply chain constraints are limiting the number of cars being produced which is causing exponential price increases.

Not only is demand for automobiles increasing, but electric vehicles are beginning to usher in a new era of Japanese car manufacturing. This catalyst will playout over the next 10 years and it starts now in many of the undervalued companies in Japan.

Deloitte explains how Japanese inflation during the 3rd quarter of 2021 was fairly muted, but moving into 2022 it is expected to increase as automobile prices will be a major driver of consumer inflation.

This could create a domino effect in Japanese stocks causing them to get rid of excess cash as it becomes less valuable leading to higher rates of ROE.

Toyota’s Tesla Killer

Initially, Toyota focused on hydrogen vehicle technology in order cut emissions and create a more environmental vehicle. This put them behind in the sustainable energy vehicle market, as the technology did not work out. Toyota has recently ditched hydrogen as a feasible method of transport and announced its new bz4x electric vehicle.

Toyota being one of the largest car producers in the world coming out with such a slick, beautiful and competitively priced vehicle compared to Tesla will make waves in the EV market.

Toyota is well known for its vehicle reliability and its Prius was the first extremely popular electric hybrid on the market.

The announcement of this new electric vehicle has strengthened my automobile investment thesis. Many of the undervalued car stocks in Japan will likely rise in price over the next decade. Many of them are net nets and a few are even in my portfolio.

Some stocks to look out for include:

- Sanko Co.

- Rhythm Co.

- Mitachi Co.

- Car Mate MFG.

Disclosure: I currently have a positions in all of the above. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it from any of the above companies, or any interested parties. I have no business relationship with any company whose stock is mentioned in this article.

While all of the above companies have exposure to the automotive market, they are all exposed to varying degrees and none are pure plays. So remember to do you due diligence and compare the risks and benefits of adding any to your portfolio.

The benefit of all of the above stocks are that they all trade below NCAV and are profitable companies as of this writing.

November 2021 Net Net Portfolio Results

November was a rough month as supply chain constraints finally showed up in my portfolio. It was a relatively muted experience as many stocks didn’t react too badly to the news. It may be because forecasts were much more bullish.

Japan was also slow to vaccinate its population and during the 3rd quarter remained locked down during its Tokyo Olympics. Sadly foreigners were not allowed to partake at the in person events and spectator seats were mostly empty.

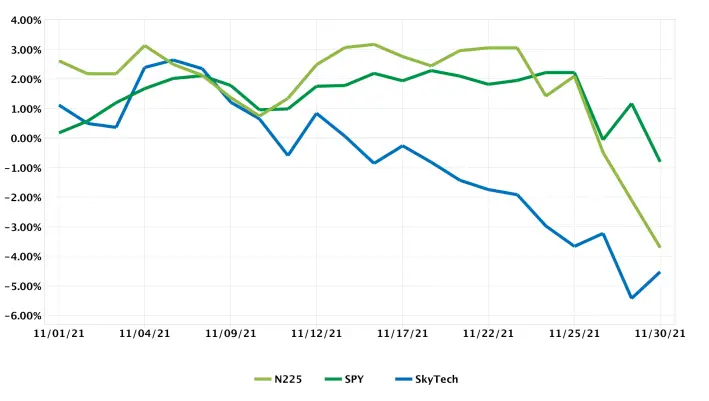

This month the portfolio dropped by 4.52%. Overall all indexes below were in the red for the month and Japan dropped sharply as a new lockdown hit the country.

I took the opportunity to shift around my portfolio and sell of some long term losers which didn’t fall nearly as much as my winners and cycle the proceeds into the most promising stocks.

Stocks will likely dip until the rest of the year but will may see an explosive rise in January towards value as interest rates begin to rise into 2022.

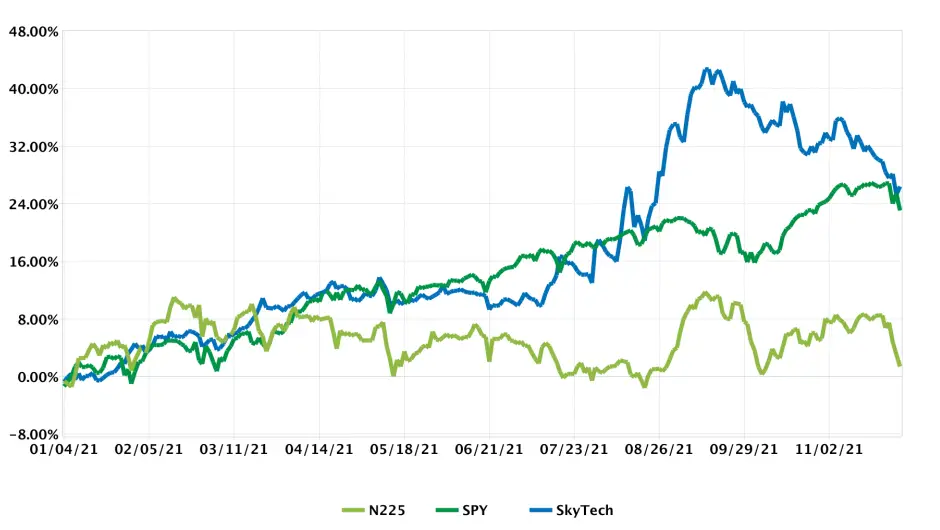

2021 YTD Portfolio Returns

The Japanese stock market has performed poorly this year and nearly all gains have been wiped out for the entire year. In this type of market you would think it would be difficult to do well.

This is likely because the Nikkei only tracks 225 stocks in a sea of over 4000 individual companies. Many of which are profitable small cap companies overlooked by much of the market. This ads to the perception that Japan is where money goes to die, when in fact the opposite is true.

Returns have certainly dropped as we draw near to the end of the year. New lockdowns and fears in the market have contributed to an accelerated move downward.

Tax Loss Harvesting and December Goals

I have begun my tax loss harvesting and potentially averted a large tax bill as some of my big losers have been with me since 2018. My portfolio looks extremely healthy at the moment and since taxes are still on the lower end took some profits off the winners.

December will be a time of reflection as I decide where to put money to work for the entirety of 2022. The most promising area I mentioned above was the automotive market. I am also taking a look at tech peripheral companies as they become available since many of these saw outsized returns from the start of the lockdown and are trending lower as revenues lower overall.

If you are curious about my net net investment journey remember to read my previous portfolio recaps.

If you are ready to start investing internationally make sure to see which brokers I use and why.