Margin of safety is important when it comes to investing. Ensuring your capital is safe is the number one rule in investing. But, its also important to compound your wealth as quickly as possible. That’s why I’ve been learning as much as I can about ROE, or return on equity. It seems we are in good company since this is one of Warren Buffets favorite ratios.

The problem is I have a hard time buying assets for more than their book value, I just can’t wrap my head around how much I should be paying for ROE. I’m sure it will get easier as time goes on, but for now, there are plenty of stocks out there that are selling for less than current assets and have an ROE that’s greater than 10%.

Thesis: Hosiden is one of these Japanese Corporations selling for less than net current assets. It also has a TTM ROE of 11.71% as of this writing. It recently doubled its dividend making its yield greater than 4%, and its trading for less than it was 4 years ago when its financials were weaker than they are today.

There has to be a catch, how can such a wonderful company be trading for such a cheap valuations. In order to find out we will do a deep dive and analyze this company to see if there are any red flags or if its just an undiscovered gem.

The Cheapest ROE on the Japanese Stock Market

- Share Price: 1300

- NCAV: 88%

- PE Ratio: 7

- Dividend yield: 4.23%

- Payout Ratio: 26%

- Total debt to equity: 10.49%

- Growth Rate: 8.6%

Now, I know what you are thinking, how could I possibly know this is the cheapest ROE on the Japanese market. It may very well not be, but its probably pretty close.

In order to find this stock I cross referenced the Shame Index with Net Net Hunters raw screen, which mainly has stocks trading below net current asset value.

The Shame Index by contrast has companies that are trading above a valuation of 10B Yen market cap and generally focus on having higher ROE than most other shares on the Japanese market.

It doesn’t take into account book value, and many of the companies trading on it are even trading below book value.

High Growth Rate and High Dividends

Probably the most interesting aspect of Hosiden is its growth rate compared to its price, but if you look deeper it gets even more interesting.

Hosiden has a lot of cash on its balance sheet, more than it should. If it bought back stock with half of the cash it has on its books it would achieve a growth rate above 10% and an ROE around 13% and further increase its EPS.

If it put its cash to better use and was able to achieve a higher ROE by purchasing assets that could help it compound faster it would be an even better value stock or at that point maybe even a growth stock.

Hosiden recently increased its dividend which signifies it has a great deal of confidence in the future of its operations. While I would be especially excited for this dividend increase, it seems it may not be permanent as I found in its company financials it is part of a special dividend or what Japan refers to as a commemorative dividend.

An increase in it’s base dividend would further increase confidence in the company’s financials, but it seems Hosiden may be holding back for some reason, and is issuing a special dividend to appease shareholders in the short term.

Sales Composition Difficulties and Future Outlook

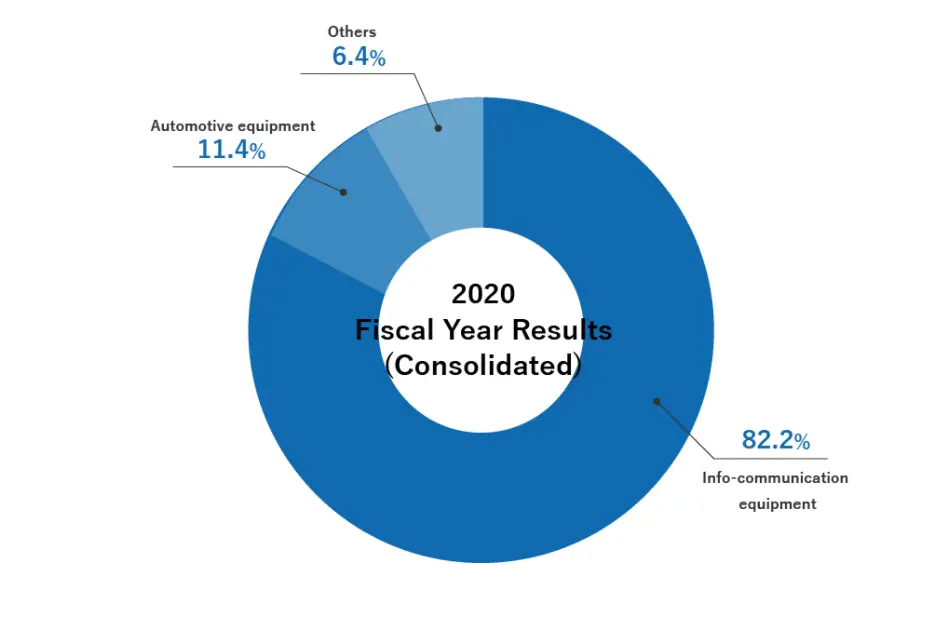

Hosiden is a semiconductor manufacturer for many types of electronics. It primarily focuses on the information and automotive sectors as these are its largest revenue sources. It is not limited by just those things, as it also dabbles in many other areas, including EV charging and wireless charging.

Below is its current percentage of its sales according to its website.

This breakdown is slightly out of date and since then it has lost revenue in the automotive segment. This is because of the chip shortage in the industry. The backlog on automobiles and the demand spike could make automotive a bigger part of the overall pie chart in the near future.

Earnings vs Revenue

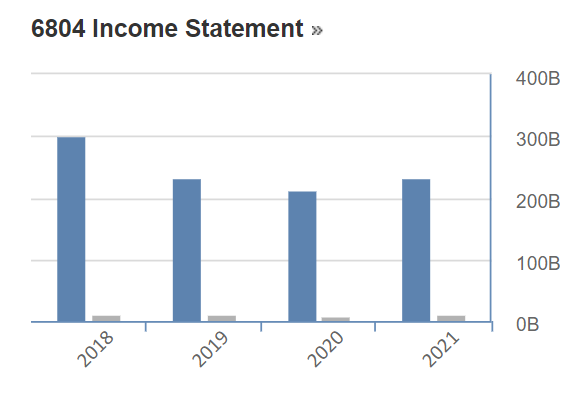

The only reason for undervaluation that makes sense is the reduction in revenues since the year 2018. Revenues are still far below 2018, but income has actually increased since then.

While revenues are lower both the balance sheet and the profitability of the compare are far better than before. If this is what lower revenue looks like I will gladly accept.

The segment that reduced the most was mechanical components as it decreased 26% for the past six months ended. This is Hosidens largest segment so a reduction there may be what has investors skittish about Hosidens future prospects.

However, It looks like Hosiden is positioning for a future in alternate reality and renewable energy, two leading investments for millennials in the coming decades.

Research and Development to Expand Revenue and Margins

Hosiden works with a number of other company’s to develop cutting edge technology. While they may not have a lot of revenue currently each one has the potential to generate massive returns.

Some examples include:

- Lightweight flexible Perovskite solar cells to be used in mobile and IoT.

- Bluetooth 5.0 and 5.1 certification.

- Ultraleap Limited technology for touchless interaction.

The best part about all of these technologies is they are not some far off dream like self driving cars or the newly coined metaverse, but rather tangible technologies that exist. Not to mention the touchless technology of Ultraleap has gained a new audience as consumers are pushing for more hygienic solutions to shared surfaces.

Hoiden’s quarterly report explains that there will be mass production in this space, but take this as a grain of salt as it has been translated by google from Japanese. If this technology becomes more mainstream and less niche Hosiden could benefit as one of the manufacturers of this technology.

Electric Vehicle and Technology Push

Ultraleap is being touted for its application in automobiles, not to mention the huge push to produce Perovskite solar cells will undoubtedly push Hosiden to pull a larger portion of its revenues from the automotive segment.

Electric vehicles are quickly entering a fever pitch as automotive companies are pushing into this hot new segment. This is going to push charging into the forefront and expand sales for Hosiden.

Potential Risks and Final Thoughts

Hosiden recently surged in price. Just a few months ago it was trading for less than 1000 Yen per share. This quick increase in price can be attributed to the special dividend announcement.

After such a quick jump in price the stock may languish at these levels for a year or more. This is because many Japanese net nets barely trade over net current asset value for very long. On the flip side a slump in price could provide a better entry point.

The future technologies are the only thing that may push Hosiden above its NCAV, that is if they are successful, but there is risk involved.

Another important risk to note is Hosiden’s dividend strategy. Its increase in dividend is potentially a special dividend and may not continue into the future. This could further depress Hosidens stock price if it does not stay committed to returning value to shareholders in the form of capital returns or high returns on investment.

Hosiden’s return on equity is very attractive, especially since it has so much cash weighing it down. If Hosiden continues to hold such large amounts of cash and fails to put it to work it will also create a drag on the company. Activist investing in Japan is still relatively new and unlikely to happen in the near future.

Disclosure: I currently have a position in Hosiden. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it from Hosiden or any interested parties. I have no business relationship with any company whose stock is mentioned in this article.

For those interested in investing directly into small Japanese stocks the best way is through Interactive Brokers.