Cash is nice to have, it can buy you things after all. It also offers a sense of security so its nice to have some cash on the side in order to either take advantage of opportunities or to provide relief when things in life go awry. I recently grappled with how much cash I should keep in my own portfolio and I’ll tell you why I changed my mind and now hold minimal cash in my portfolio.

5-10% of a pure investment portfolio should be in cash. Cash drag on a portfolio can hurt long term returns especially for younger investors. However, some active value investors hold significant amounts of cash when hunting for bargain stocks.

Its important to hold limited cash in an investing portfolio but you should always have some kind of emergency fund that is in place to cover your expenses for at least a 3-6 months. The number differs depending on how high your expenses are. Many wealthy investors also hold more cash for piece of mind since investing returns are not as important.

Experts on Cash and Portfolio Returns

Experts can’t agree on exactly how much cash should be in a portfolio. The range given can be anywhere from 2-20%. 5-10% is the most often cited amount of cash that should be kept on hand and is likely the point at which portfolio drag meets risk reduction.

This is likely because of all the factors that go into deciding how much cash to hold. These include:

- Age.

- Risk Tolerance.

- Style of Investing.

- Cash flow considerations.

While I’m not an expert on portfolio theory I do know a thing or two about analyzing value stocks. I use this to guide me on how much cash to hold. If I can’t find bargains then I keep little cash, but if those bargains dry up I hold much more cash.

Cash Drags on Portfolio Returns

If you have cash in your portfolio its most likely not generating returns. With low interest rates idle cash is not earning savers very much. This cash is also losing value from inflation.

Younger investors are more at risk for cash drag in their portfolio because of the time value of money. If they are holding too much cash in their portfolio their compounding returns also decrease.

For this reason I think its important for younger investors to rely on their cash flow while their investments compound. This can either be from a job or a small business. Another way to reduce stress and cash drag and to increase compounding is to reduce expenses and save more at a younger age.

Potential Returns for Idle Cash

Compounding is almost like magic. But, it only works if you are generating consistent returns on cash.

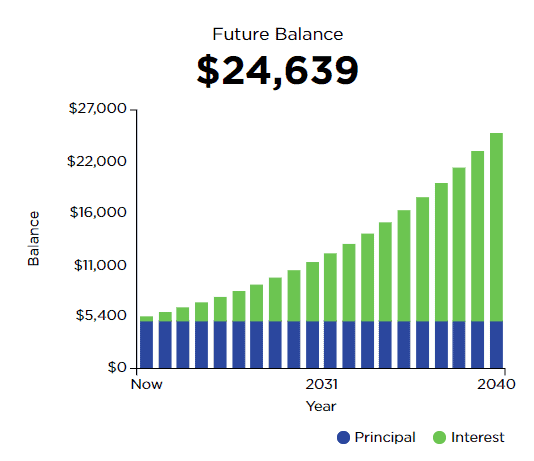

Let’s take a look at what just 5% of $100,000 dollars compounded at 8% in your portfolio would have returned over 20 years.

This example doesn’t even take into account inflation. On average your money decreases in value annually by 2%. $5,000 in cash will have lost about $2,457 in purchasing power if compounded annually. While in reality your cash does not lose value. The price of goods you pay for has increased.

This is the main reason why I currently stay fully invested if I can find bargains in the stock market. I still hold some cash to cover costs and the end of year taxes.

When Value Investors Can’t Find Bargains

Don’t try to time the market! If you are holding cash waiting for the market to crash you could be waiting a long time. This is not why value investors like Warren Buffett hold large amounts of cash. The reason they hold cash is because they are looking for opportunities.

While the amount of cash that maintained in a portfolio should be relatively low. There are times where it makes a lot of sense to keep cash on hand.

- The market is overvalued and bargains are hard to find.

- You are nearing retirement in an overvalued market.

- You have tax burdens that need to be met at the end of the year.

Excess cash in overvalued markets are part of the reason why value investors underperform growth investors and why the debate about which style of investing is better is constantly shifting. Since there are so little opportunities in an overvalued market the cash is dragging on a value investor’s portfolio. But, eventually there will be a market correction or an opportunity to invest in a cheap stock will arise.

This is why its important to keep some “dry powder” or cash in your portfolio when you cant find any cheap stocks. If you are curious how I define cheap stocks check out my 10 factors to consider when buying a value stock.

Value Investors Buy Companies with Cash

As a value investor part of my strategy is finding companies that hold significant assets and in many cases this means cash. Because I am holding companies that have significant amounts of cash this helps ease my mind when it comes to holding a stock that may be falling in price.

The cash is always worth the same and can only be degraded over time from inflation. Luckily for value investors the returns are far greater than the cash degradation from time.

Buying companies with excess cash serves two purposes, it reduces cash drag in a portfolio and lets the company take on the burden of deciding how to compound that cash. It comes with the added benefit of holding a company that is already cash flowing and hopefully growing.

Cash Flow From Dividends, Rebates and Call Options

If you are currently holding near zero amounts of cash in your portfolio and nicely diversified, dividends, rebates and call options can be a source of cash flow in your portfolio. Its easy keep smaller portions of cash in your portfolio when you know you have extra cash. especially in the form of dividends hitting your portfolio at regular intervals.

When it comes to rebates and call options they can be riskier and sometimes unpredictable without volume. However dividends can be very reliable if you focus on companies with these traits:

- A dividend Champion or Aristocrat: These are dividends that have been paid for long periods of time. For 10 or 20 years even.

- A company with a lot of cash or cash equivalents: These companies are ready to whether any downturn in the economy and keep their investors happy.

Rebates are more difficult to earn extra cash from since you have to take into account your tax burden. Dividends are taxed differently when you are loaning out your shares and could affect your dividend strategy.

Call options are an advanced form of cash flow and I myself am still learning how to properly utilize it in a portfolio. However, I did find an excellent resource which I can hopefully learn from.

How to Reduce Extra Cash Efficiently

While it will potentially increase your portfolio performance to reduce the amount of cash in your portfolio as quickly as possible its not always the best option.

Many investors including value investors will allocate specific percentages of cash to invest in different parts of the year. This will achieve two things.

- Ensure you are investing in a variety of value stocks.

- Dollar cost averaging during market fluctuations.

There is nothing worse than piling all of your cash into a few stocks only to realize there are better stocks to invest in just 3 months later. While this might not seem like a problem, selling one stock to buy another can reduce your returns, so the benefit of switching stocks must be greater than if you were just holding cash.

Psychology of Holding Cash in a Portfolio

It may be difficult to sleep at night if you are constantly worried about how you will pay your bills from month to month. So in a situation like this it doesn’t make sense to be fully invested if you don’t have a cash emergency fund.

This is why its important to keep at least enough cash to pay your bills during a market downturn. It will make it that much easier to stomach holding on to your stocks during a massive downturn. There is nothing worse than being forced to sell during a market downturn before your thesis is realize and it will hurt your overall returns.

Holding cash in your portfolio could also help to reduce volatility. However, less volatile stocks are probably a better use of your funds. As mentioned before buying companies with lots of cash can also help lesson volatility and reassure investors in times of trouble.

It’s also better to have higher cash reserves as you approach retirement. There is nothing worse than retiring and then experiencing a massive correction.