Over the past month I have been fairly flat. Growth stock investors have been claiming the stock market is in a freefall and the topic of inflation has been brought up a lot in the news.

It has been an interesting month to say the least and I finally closed on my refinance. So I should be finally getting some extra capital to utilize for investing. The problem is, I don’t feel like the United States Stock market is the safest place to put my capital to work.

Luckily over the past couple of years I have been building my knowledge of net net stocks and in particular Japanese net nets. In fact most of my portfolio below is actually in Japanese Yen.

The Topic of Inflation and Safety In Japan

Talk of inflation is everywhere in the most recent Berkshire Hathaway meeting Warren Buffett even stated they are raising prices in commodities across the board and are even seeing prices of their inputs rising.

The federal researve has been explaining that their metrics are not reporting any inflation. But, as a whole they are looking at the entire market as a metric. So it is valid that there will be no inflation in the service industries that have been essentially wiped out.

The problem is products or physical items are more in demand than ever before and with a weaker labor for participation it is creating a shortage, all the while there is more money chasing fewer and fewer goods.

Japanese Commodities and Inflation Haven

The Japanese Yen has typically been a safe place to store wealth when it comes to inflation. It may be because Japan is well known for having to constantly combat deflation. This is why I feel much safer investing in Japanese equities. But, its not to avoid inflation its just because the stocks are the cheapest and highest quality that can be found.

Many of the companies in Japan produce products and are not service oriented companies. This makes their inventories and cash heavy balance sheets very resistant to inflationary forces that currently plague the United States.

April 2021 Net Net Portfolio

This month was another positive one in the net net portfolio. But it may have just been because of one stock that surprised me at the end of the month. There has been talk of a buyout and the price of the stock immediately rocketed up to nearly fair value.

But, since the talks have not concluded in an ultimate sale price and the company is still very cheap an am currently holding for more concrete news. I may end up selling if the price rises to far above NCAV but its currently a wait and see approach.

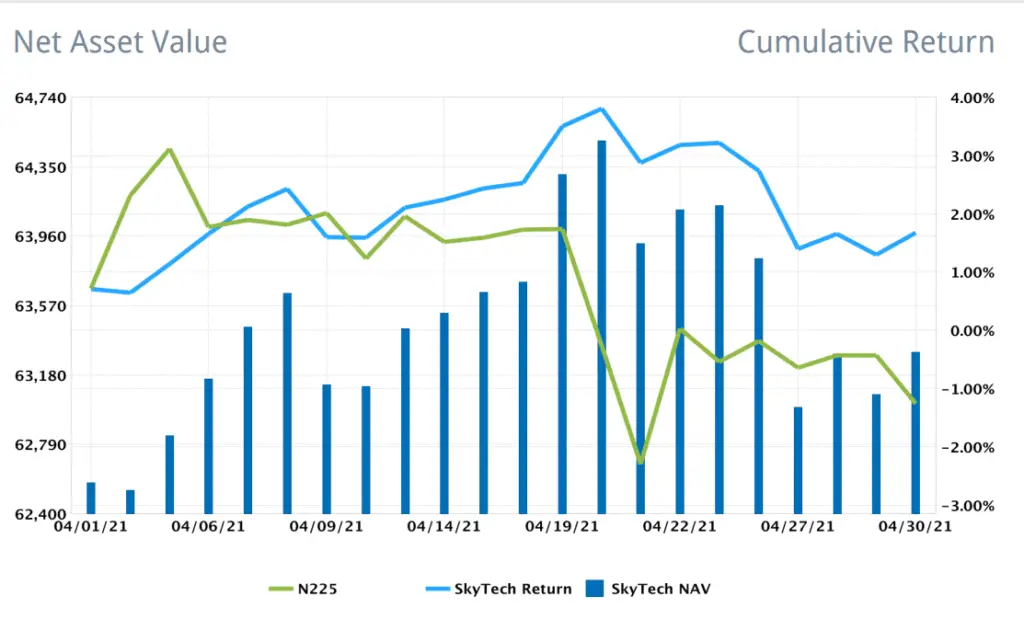

Overall comparing my portfolio to the Japanese Stock Index N225 I beat it by over 2%. My total return for the month was 1.67%. Which all things considered is fairly good since I already had a stellar March.

One of my largest holdings and currently most favorite stock dropped by nearly a percent. The percentage is a weighted comparison of my entire portfolio, so its pretty substantial. This is a spot where some extra investment might push my portfolio to new heights once the earnings start to hit in May.

I am currently planning on investing half of my refinance money and holding the other half for a market downturn in the United States which will likely come eventually. I am also expecting a post May drop in Japanese equities and American ones as the market typically performs poorly during the summer months.

Avoiding Hyperinflation in a Stock Portfolio

The best way to avoid hyperinflation is to invest in assets that will rise along with inflation. This means commodities a lot of the time. Especially ones that will be in high demand. I don’t suggest investing directly into commodities but rather buying companies that have pricing power.

While bitcoin will undoubtedly rise in the event of hyperinflation it won’t rise as much as solid profit producing companies that produce necessary goods.

What you should be doing is putting your money to work as much as possible and keeping as little cash on hand as possible. However, having some dry powder is also important, since inflation could evaporate and lead to a crash as soon as the economy opens up and money is chasing more services and fewer goods.

If all else fails make sure to have at least some of your money in farmland or farmland type stocks. I have a few stocks in my portfolio that a heavily focused on farmland. They have mispriced the valuation on the farmland on the books and many of the stocks I own are selling portions of their farmland to finance new activities or pay shareholders.

What I’ve Learned Investing in Net Net’s for 3 Years

Sometimes when you think a stock is down and out it will surprise you. As is the case with the stock that rocketed up in price during April. The stock in question is Sin Ghee Huat and I had pretty much left it for dead in my portfolio. But, these types of stocks have a way of surprising.

In no way would I advise investing in this stock after it has jumped to its net current asset value but I just wanted to highlight that sometimes patience is the best way to invest. Another point I would like to make is that a stock my be right for some people but not for others.

There are a multitude of different reasons why you should not invest the same way as somebody else.

- Your volatility tolerance is different.

- You find more enjoyment from dividends that from companies that lose money.

- Your ethics may differ and belief in specific products.

- It may be the right stock but the wrong price.

The last bullet point really hits home, because its the basis of value investing. A stock is always a buy for the right price. As is the case for the above mentioned stock it was a buy at a much lower price, but I would not buy it now, but I also need a compelling reason to sell it. For me that’s when I find a better stock to buy that I can replace it with.