This month’s update took a minute to get up as a result of being sick, but it was an eventful month nonetheless.

May brought a surprise that I didn’t expect. One of the stocks I began researching suddenly exploded in price. It increased around 200%, which is more than double the price it was when I began my research.

It turns out the company was being purchased by another which immediately drove up the price. This is common with net net stocks or low price to book stocks but in Japan much less so. So you can imagine my surprise at missing the excellent turn of events.

This isn’t the first stock I’ve missed on a run up and it won’t be the last. It’s also not the first time I’ve been through such an event only to see the stock fall back down to previous levels.

Stock Price Explosions and How to React

In the case above its a very cut and dry sell and reinvest the profits in another cheap stock. That’s why it is by far my favorite outcome. In Japan these situations are less common, so I’ve had to resort to earnings growth as an alternative avenue of return.

There are many causes for a stock price to suddenly start increasing at a rapid rate these include:

- Catalyst news, such as a game changing product or sale of unproductive assets.

- Company is being bought by another.

- Surprise earnings.

- Aggressive stock buybacks and upward momentum.

Above are some of the common ones I’ve seen, but there are countless reasons for a stock to suddenly explode in price, and in the small cap realm another silly one is possible.

- Amateur investor accidently bids up the price.

The last one typically happens with the very small stocks. I’ve actually tried on some stocks around 50 million USD to no avail, with more capital I may begin to affect it. This is after throwing 20,000 at a single stock, so it takes a lot of capital to move the needle.

Of course its much better for stocks to rise on substantial news. For example, great long term earnings and being bought out at double the price.

Take Advantage of The Pop

Being obsessed with turnarounds and earnings after successfully investing in a great company I missed a chance for a quick profit that could be earning me higher returns.

The below stock: Charle Co.

A Women’s underwear company… I know glamorous!

Well they, posted excellent earnings and it looked like the company had finally turned a corner. Only for the stock to plunge back to previous levels when forecasts looked less rosy.

In situations like this its important to not become greedy, you should always at least take some profits, even if you believe the company is turning around and has better days ahead. It can often take longer than you think.

In this situation taking half the profits would have netted me a free look at its future profits where I can put my capital to work elsewhere.

Now my money waits, and eventually I may just give up and move on.

Of course with enough research, you may realize holding the entirety of your position could be more beneficial but, in the above situation I didn’t have time for research and it cost me dearly.

There’s Always Another

Warren Buffett describes investing with his famous baseball pitch analogy. You don’t get struck out by not swinging at strikes. Instead you have an unlimited number of strikes and you can wait until your ready to hit it out of the park.

I’ve done this on a few occasions, but there is no substitute for experience. So you need to get up to bat. For example, the stock above I described is called Mutual Corp and below is its stock chart.

There was no way of knowing that would happen. So unfortunately it was a missed strike. But, this is much more likely to happen when buying cheap stocks than when buying expensive ones. So we just need to keep with the strategy and keep on buying.

There are equally as many stocks exploding in price that I don’t own, as there are currently in my portfolio!

There are even more stocks out there that I don’t have money to even own and yet want to own! So remember there is never just one opportunity, there is an endless sea and a lifetime to explore them all.

Polish Stocks Market Remains on the Horizon

The Polish stock market research remains on hold as the situation in the region, unfortunately, will likely go on much longer than anyone can predict.

In this inflationary environment the current safe haven is in commodities and Japanese stocks are the cheapest in the world. With the Yen falling rapidly they are becoming even more desirable.

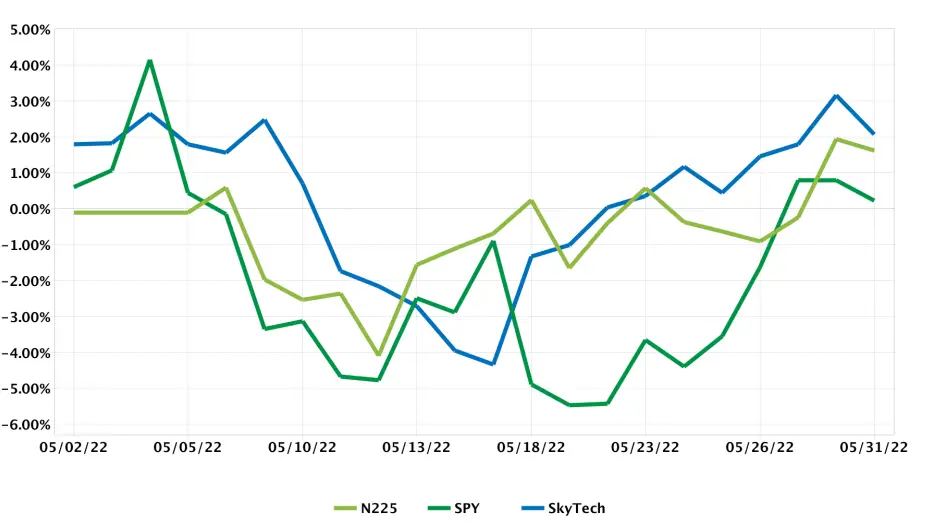

May 2022 Net Net Portfolio Returns

This month I managed to beat all of the indexes I’m currently tracking. This caught me by surprise especially since I was dead last in the middle of the month.

It seems Japanese stocks began to surge despite the currency weakening or rather maybe because of it?

Nonetheless I managed a 2.07% return this month and this summer is looking far more promising than last summer’s boring returns.

Energy prices and interest rates rising are causing a shakeout of high debt stocks and many investors are returning to balance sheet investing.

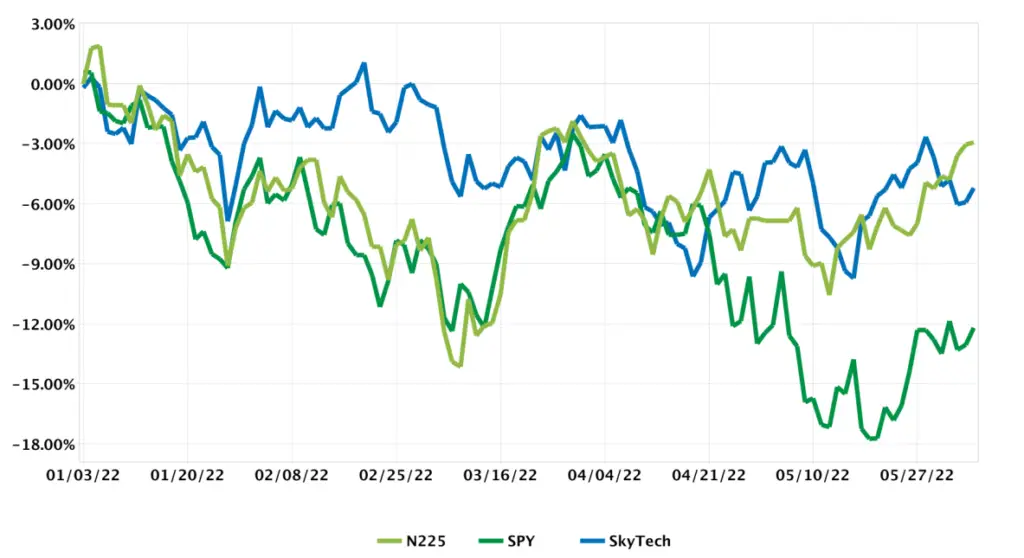

2022 YTD Net Net Portfolio Returns

If you are Japanese and have no need for currency exchange then you are doing quite well this year, especially if your investing in net nets and not the Nikkei which is still negative.

My portfolio while losing over 20% of its currency value still remains only -5.63% YTD.

My portfolio unfortunately has a Yen drag as I’m learning a lot about currency fluctuations this year. Japan has decided to keep its ultra low .25% 10 year risk free bond rate going with no end in sight.

This has led the currency to become devalued. Many think this is on purpose and it may well be. But, it shows that while the currency is being devalued the stock prices are keeping pace well, as my account is buoyed by their increases.

Eventually the Japanese risk free rate will have to rise and along with it, the currency with strengthen netting me all the returns I’m currently not receiving.

June Goals: Take Profits and Reinvest

This month I have already begun selling off my largest holding as it ascends into overvaluation territory and picks up speed. This is netting me some cash that I can use to invest in what I perceive as safer stocks from a balance sheet point of view.

I am Shifting some of the profits to stocks in consumer cyclicals rather than industrials. This is because this summer is looking to be a massive re-opening for Japan as its accepting tourists for the first time in a long while.

I will also be on the lookout for any spikes in price to sell off smaller holdings in my portfolio that I have less faith in.

If you are curious about my net net investment journey remember to read my previous portfolio recaps.

If you are ready to start investing internationally make sure to see which brokers I use and why.

For Investing in Japanese stocks be sure to read my article on how to buy shares in Japanese companies.