This month I realized I had a lot of stocks with peculiar position sizes. They were far larger than the rest of my portfolio. This of course was by design, but it got me thinking, Why did I size them in such a way?

My position sizing is based on conviction and probability. The mathematical likelihood a stock will return a specific amount is higher than other stocks. Conviction on the flipside is a measurement that is intangible and more of a gut feeling.

I decide to double a position size if both my conviction and the variables are in my favor. I either win big or lose a little.

In this case I have more potential to beat the market if I am betting more on higher likelihoods of success. But, it doesn’t stop there. If I have even more conviction I will triple the position sizing, this is the closest to a sure thing that I can deem probable.

How a Beginner Should Size their Position

If you haven’t already you should read what percentage of your portfolio should be in one stock. In this article I outline risk and why you should have a certain number of stocks in your portfolio.

I typically have between 20 and 30 stocks in my portfolio. However, the way I size my positions it closer resembles a 10-15 stock portfolio. This is because I size positions based on conviction.

The other stocks act as placeholders for further research and timing. While I don’t pretend to time the market, I assign mental notes to how long it would take for a specific turnaround. Some will undoubtable take longer than others.

The reason I buy the stocks rather than placing on the watchlist, is because it forces you to stay invested in what the company is doing. You really don’t know a stock until you own it.

For investing beginners you should hold between 20-30 equally weighted stocks and when you become more confident in specific company’s you can add more to any individual position.

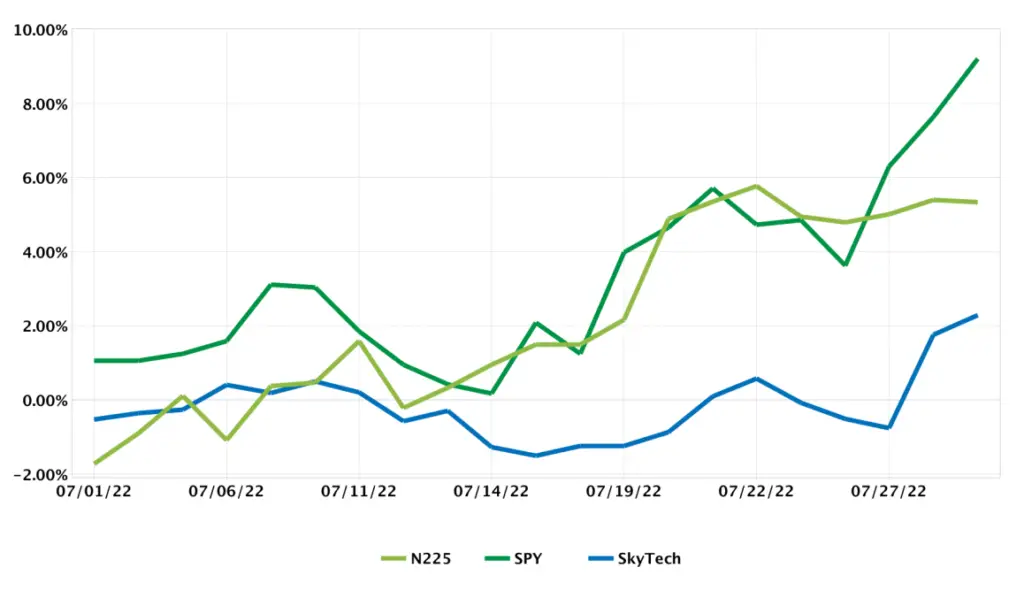

July 2022 Net Net Portfolio Returns

Finally the Yen has stopped sliding into oblivion. I have likely lost over $20,000 it potential returns this year from a weak Yen. A reversal of just currency would net me positive returns.

Both stock returns and a slight Yen reversal are ideal, as it makes Japanese stocks more competitive and makes me wealthier in my base currency.

My returns for July stunningly turned around at the end of the month. Locking in a small win of 2.28%. This was mostly due to a surprise earnings forecast and the Yen finally snapping back a bit when the US federal reserve became dovish.

Nonetheless this is promising for the rest of the year as Japanese stocks are still showing strong earnings potential.

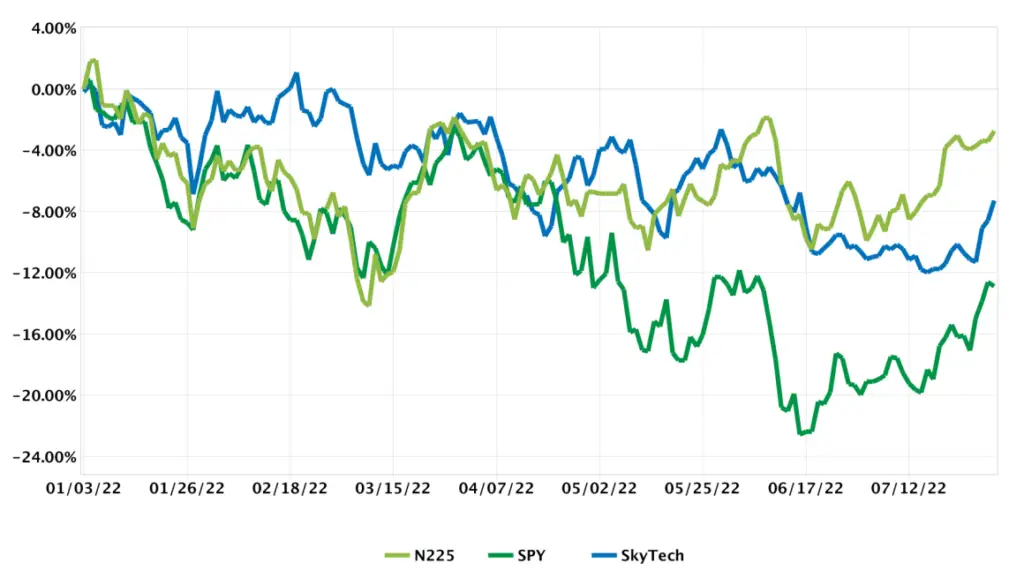

2022 YTD Net Net Portfolio Returns

The YTD returns are showing signs of life. This may be an illusion before yet another downturn like we saw in March, but it could also be an actual reversal. Either way continuing to buy cheap stocks is the goal.

Overall returns this year so far have amounted to -7.29% a stark reversal from last month. Japanese stocks are leading the charge although my portfolio is still lagging as earnings have not yet begun.

Earnings season is always exciting in Japan as that is one of the few times the stocks actually move with any kind of importance.

Homebuilders Show Signs of Breaking

Last month I noticed both banks and homebuilders were in deep value territory. Home prices in the United States are showing cracks as prices have slipped slightly. New homebuilders are also having trouble getting rid of stock.

This was inevitable as interest rates rose. Home affordability is at its lowest levels since the start of the great recession.

While this seems like it would be a negative for homebuilders I see it as an opportunity to buy before the boom times ahead.

The housing stock is still historically low and homebuilders will inevitably flourish over the next decade as millennials buy homes and start families.

August Goals and Expectations

The upcoming month is a big one in terms of earnings. A couple of my outsized positions have the potential to net me some massive gains. If this does happen, then I will have a lot of excess capital to invest in more deep value stocks.

This will translate into more content for the reader and hopefully help gain further understanding into what stocks have the greatest potential for return.

If you are curious about my net net investment journey remember to read my previous portfolio recaps.

If you are ready to start investing internationally make sure to see which brokers I use and why.

For Investing in Japanese stocks be sure to read my article on how to buy shares in Japanese companies.