Normally I don’t pay much attention to the forex market, but October had me looking much more closely.

As I saw my portfolio shrink in value I began to take notice because it wasn’t just because the companies I owned dropped in valuation.

Turns out the Japanese Yen became weaker during the month of October, by 2.23% to be exact. This led to an extra loss of the same amount in my portfolio!

So why did the Japanese Yen drop so much and is currency risk a problem in my portfolio?

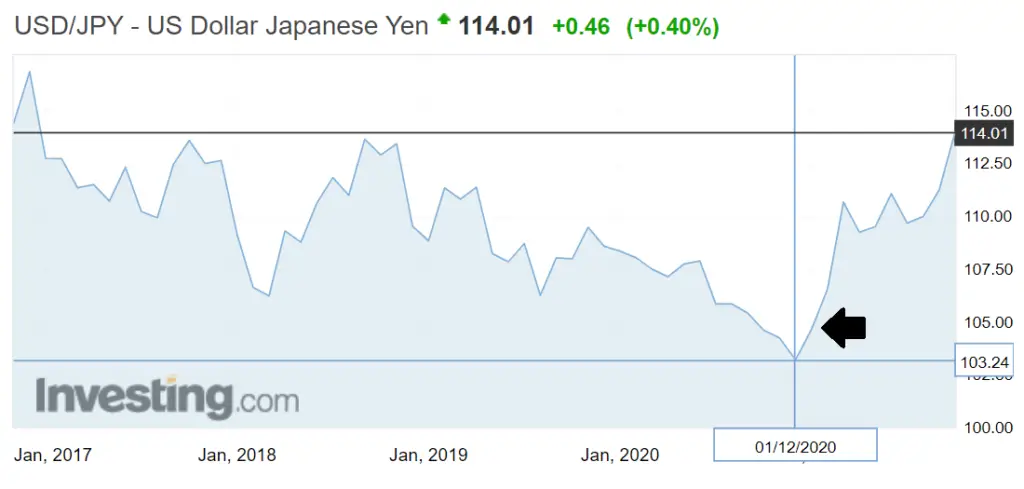

Japanese Yen Weakness Against the Dollar

The Japanese Yen is considered a safe haven currency. This means during times of economic uncertainty and turmoil the Yen strengthens in value.

Nobody really knows why this is, other than it almost being a self fulfilling prophecy at this point. So during 2020 the Yen strengthened in value as a result. It’s only now falling back down to a level it was at just before the global shutdown.

It’s only just now that the Yen is going back to previous levels. This wouldn’t be much of a problem if it weren’t for one of the reasons why the Yen is becoming weak, Oil.

Japan is dependent on oil imports in order to supply their energy needs. Even more so since they decided to shut down many of their nuclear power plants in 2012 because of the Fukushima disaster.

So as oil prices rise globally, Japan is stuck importing more expensive oil leading to a massive outflow of Japanese Yen.

As oil prices continue to rise it could provide opportunity for Japanese based companies that are focused on renewable energy. But, is currency risk really something that we need to worry about in our international portfolios?

Currency Risk in an International Portfolio

My base currency is the US dollar, but of course I have a great deal of money wrapped up in the Japanese Yen. So its weakness is actually pretty bad for me.

The thing is, does it matter that much?

I mean a decline of 2.23% in one month can be a pretty big deal especially if your returns are only around 9% annually. In fact the Yen has declined by 8.99% over this past year. That would wipe out any returns for an international investor.

The difference between normal international investing and the types of companies that I invest in, are that the returns are higher. In fact they are so much higher that even after a 9% hit in the currency value I am still beating the S&P 500 Index by over 10% ytd.

The reality is that currency fluctuations compared to the movements of small cap companies are negligible. These types of companies tend to have much better returns than their larger counterparts. Especially when you invest in ones that are undervalued and have a lot of cash for potential share buybacks.

Another side benefit of a weaker currency is that exports increase since the products become cheaper on international markets, leading to an increase in company revenues. So in my opinion currency fluctuations are not something to worry about, but something to take advantage of.

In fact if you have US dollars this may be one of your best opportunities to buy cheap Japanese stocks by converting your strong dollar to a weaker Yen. The only other better times would have been 2015 and right before 2008. That is roughly another 9 percent difference which could make or break another year.

One thing to remember about currencies is they tend to oscillate rather than compound in value. This means over the long term you don’t need to worry about currency risk because your stocks will compound faster than a stable currency will drop in value.

For example, if you bought the Yen back in 1996 you would have been paying the same amount of US dollars for it than you would be today. So it may hurt in the near term, but remember over the long term its meaningless.

Remember to research company fundamentals and invest in the company not the macroeconomic picture, also known as bottom up investing.

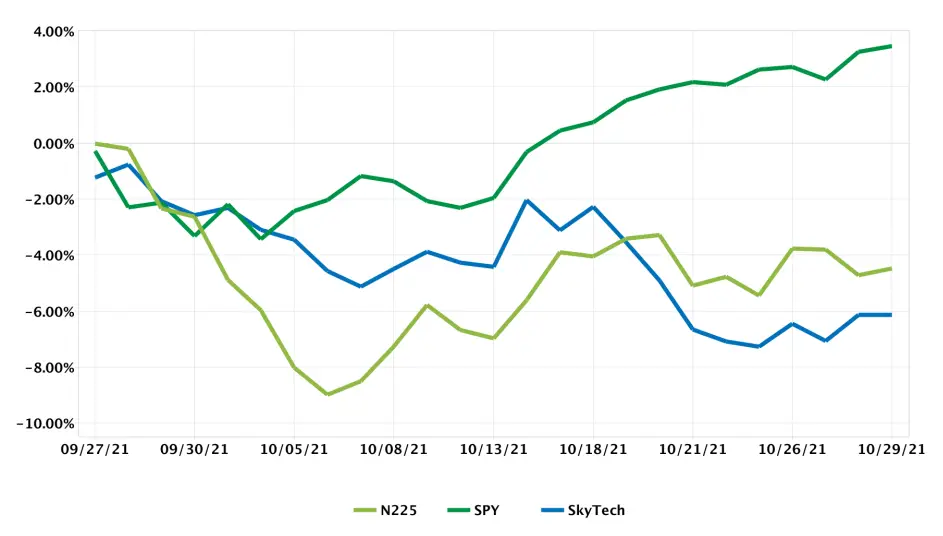

October 2021 Net Net Portfolio Results

While tech stocks had a nice return and the American stock market flourished during the month of October my portfolio tells another tale.

My portfolio dropped by a total of 6.14%, mostly due to a drawdown of my previously explosive stock, but also a decrease in the value of the Japanese Yen.

I am not too concerned about this months loss as it is because of variables out of my control. The best course of action is just to buy cheap companies and hold them until they return to their intrinsic valuation.

The beginning of November is when most of the companies in my portfolio report their earnings and many have a lot of potential.

Absence of Market Crash and Chinese Meltdown

Markets didn’t crash in October just as I suspected, in fact the very markets that were in imminent danger posted excellent returns. Evergrande paid their international bond, avoided default and everything seems to be going great. On the surface at least.

In reality the Chinese market is slowing down and experiencing some massive power shortages. This could potentially be just the tip of the iceberg, so its important to remain cautious. As a result of this upheaval in certain sectors there are bound to be opportunities. Especially in energy, so keep your eyes open for bargains.

Keeping Watch on Iron Ore Markets

Last month I commented on iron ore as a possible play, but what I didn’t understand at the time was the relationship between iron ore and steel.

Iron ore prices slumped while steel prices went through the roof. This is likely a result of supply chain and energy issues. It is costing far more to turn raw iron into steel, therefore pushing up prices for the finished good. This could potentially be counteracted by a slowdown in the Chinese real estate market so as of right now its something to watch.

November Goals and Tax Harvesting Season

As mentioned before, the final earnings of the year are upon us, so depending on how those earnings play out and what the company valuations look like post earnings, action will need to be taken.

I will likely sell off some long term gains and reinvest them in cheaper companies, while offsetting any short term losses I have for the year. I also plan on doing some deeper research into stocks I own and stocks I plan on buying with great potential. So be sure to read up on those.

If you are curious about my net net investment journey remember to read my previous portfolio recaps.

If you are ready to start investing internationally make sure to see which brokers I use and why.