I watch a lot of YouTube. In fact I’m planning on starting my own YouTube Channel in the future since a lot of the financial information is inadequate when it comes to stocks, and I want to change that.

One of the things I see most on YouTube is market crash fear mongering. In fact for many who invest solely in tech there is a lot to be upset about, the returns have not been very good at all in 2021. But, overall the market and especially value stocks have done pretty well.

But, many would be soothsayers are coming out of the woodworks and predicting the next crash. However, this time they may be on to something. A very large company known as Evergrande in China is not looking too great and many are saying in may bring down the entire global economy as a result.

However, I’m not so sure. I’ve seen so many people talking about it in recent weeks that there has to be some hedging happening already, which will protect the overall global economy.

Nevertheless I want to dive in more and see just how an Evergrande crisis can affect my portfolio and how I might go about protecting it without rushing into cash.

Evergrande and the End of China’s Real Estate Boom

China’s population relies heavily on real estate investment. Whether it be buying homes for their sons to attract a wife, or buying to take part in the asset price inflation. It’s a part of the culture and much more reliable and concrete than the stock market.

Many Chinese even hold onto old homes knowing that sometime in the near future the Chinese government will swoop in buy their property and tear it down to build even better homes.

This could all come to a screeching halt if Evergrande contributes to the end of real estate price inflation and much of what dragged many into the middle class may be gone.

But, the real question is will this real estate collapse contribute to a global contagion?

Many think it will, but I’m not so sure.

Drawing Conclusions From The Japanese Asset Price Bubble

I’m not an economist nor should you listen to anything I have to say about Macroeconomics(but this guy is), you shouldn’t listen to anyone on the subject. The system is so incredibly complex that it cannot be realistically predicted or mapped.

This is the main reason that you should always remain invested as long as individual companies are cheap and plentiful.

Years ago however, when I first heard about the Chinese real estate market price inflation, I thought it looked a lot like Japan. So when I heard about Evergrande and the possible contagion that could wipe out the world economy, I wondered how the rest of the world fared back then.

To my surprise it was essentially business as usual. There may have been a dip in the world economy but it wasn’t widespread or terrible. In fact I grew up in 90s America and it was booming in the dot.com era.

So in my opinion it’s best to continue on with business as usual and unless your invested heavily in China not worry too much about the global effects. Just maintain a diversified portfolio of deep value stocks.

Chinese Market Crash Could Affect US Inflation

One side affect of a stock market crash in China could lead to continuing cheap labor in China. This could keep inflation lower in the United States and the rest of the world as labor prices won’t drive up consumer goods costs.

Japan to this day is still a major exporter of goods to the United States and that is because its currency price makes it favorable to produce quality goods cheaply for export to the United States.

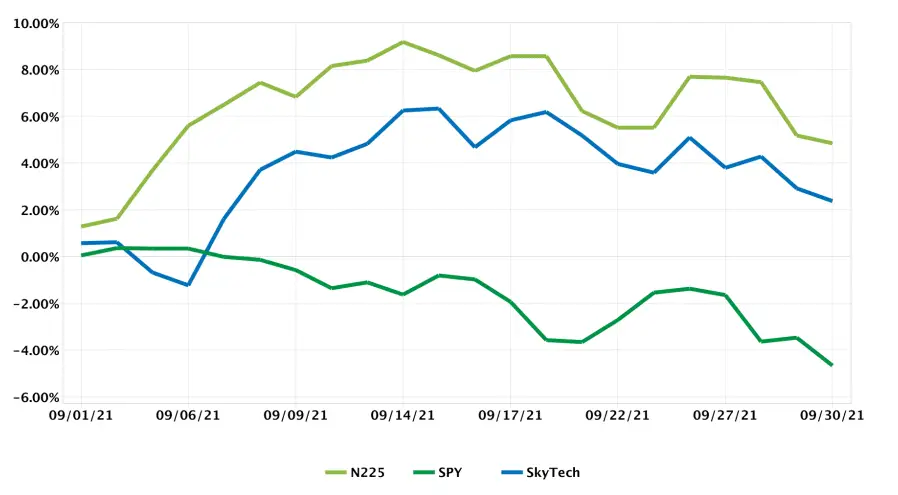

September 2021 Net Net Portfolio Results

September is notoriously the worst performing month of the year. In fact its the month where the most market crashes have happened in history. So you can imagine my surprise and happiness that I eked out a profit during September.

I attribute this small profit to an interesting bump in the Japanese stock market. Known as the Suga rush. The prime minister decided not to run for re-election and because he had become so hated at the time it pushed the stock market higher.

This is why the Nikkei performed especially well and my portfolio followed suit, while SPY had a negative month.

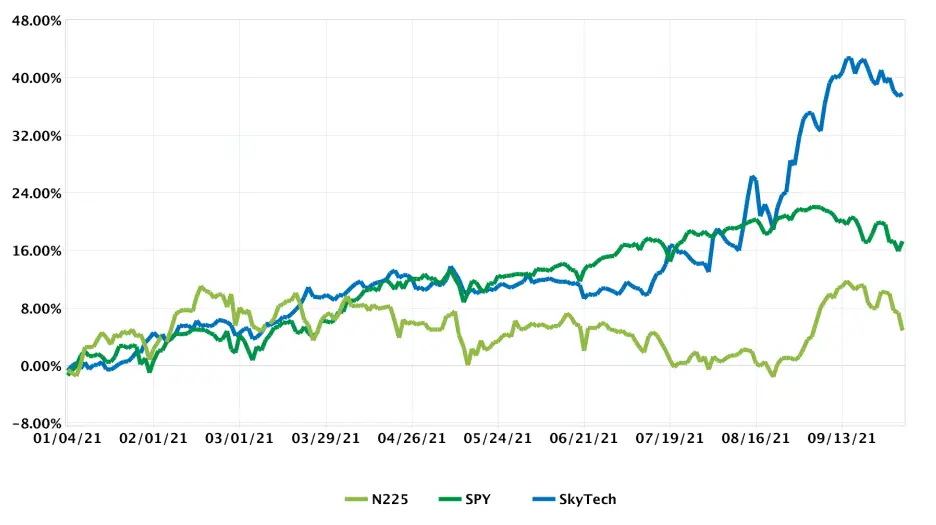

2021 YTD Net Net Portfolio Returns

Moving into the last quarter of the year my portfolio has broken out against the other indexes. This should drive decent returns throughout the remainder of the year as long as the stock I am most heavily invested in remains steady into the 4th quarter.

My returns have been very great this year and even as the rest of the world worries about Evergrande I am incredibly confident going into 2022. It may very well be the year the Japan breaks out and finally brushes off its stigma of where money goes to die.

The Japanese market looks so incredibly cheap and corporate governance is always improving. The real question is if Japan values become inflated where to next?

I will look more into it once Japan rises in value and hopefully it will, but maybe India and South Korea are promising places.

Iron Ore Plays and Goals for October

Something I never thought I would be interested in is iron ore, but it seems that a demand slump in the raw material has dropped prices and stocks around the world. A few Japanese stocks showed up on my screen that deal with iron ore and they look very attractive.

It may however, be too early to invest.

Since these companies are coming off of a supply shortage and higher than normal prices their earnings are inflated making them look better than they will be in the next six months. So there may be more price drops before a turnaround.

One of the reasons for the drop in iron ore is China lowering steel production in an effort to reduce pollution, this is likely directly related to the 2022 Winter Olympics and will likely be the trough for iron ore prices.

An Evergrande crash and a drop in steel demand from the real estate sector in China may also prolong and contribute to an iron ore crash.

Iron ore will be an interesting industry to watch as I’ve gotten pretty tired of watching oil constantly and hopefully I can exit all oil positions next year.

Evening out My Portfolio

October will be an excellent month to take a look at my smaller portfolio positions and decide whether to hold onto them or add more to them. Since they are such small positions they don’t contribute much to my portfolio and I would rather not have to use the mental effort to track them if they are not worthwhile.

I will likely try to add to the best of them, but a few may exit my portfolio forever in an effort to reduce the total number of stocks I track every month. Its currently sitting at 23 and I’m looking to be slightly below 20.

If you are curious about my net net investment journey remember to read my previous portfolio recaps.

If you are ready to start investing internationally make sure to see which brokers I use and why.