This January was pretty brutal for US based stockholders. With the Federal Reserve set to raise interest rates multiple times this year, the drunken growth stock enthusiast finally had a realization that stocks don’t just go to the moon.

It was a rude awakening for many and we may even see US markets trade sideways for the foreseeable future.

The underperformance of international stocks and opening of international economies may finally see growth after years of stagnation and loss.

International company’s and especially Japan have been posting excellent returns and gotten even cheaper than they were at the bottom of 2020. Many company’s are trading at PE ratio’s equal to their dividend yield.

Peter Lynch Style Investing with Benjamin Graham Margin of Safety

Over the past month I got through with reading two of Peter Lynch’s books.

Note: You should read them in the above order.

They were excellent reads and introduced me to something I was missing in my investment analysis: Earnings growth.

Many think of Peter Lynch as a growth investor but his principles stem from buying undervalued companies based on their earnings growth potential. After realizing I disliked investing in companies that lose money, this was a welcome point of view.

But, Peter Lynch did actually invest in a lot of traditional undervalued companies many trading below book value. So I was not completely abandoning my deep value morals.

This is the edge necessary to invest in Japan. A country with so many stocks trading below net current assets, many of them profitable. But, the question was how could they be valued and ranked according to how good they were?

Growth in Japanese Net Nets

It seems a little weird to think about growth multiples when dealing with companies that are trading below their net current asset value (NCAV) and sometimes even cash. But, it becomes extremely important when these company’s almost never trade above NCAV.

Take for example two companies that are trading at NCAV values of 80%. How would you rank them?

To many value investors it may be based on any potential catalysts, or if a company is buying back shares. But, that would be missing the point. Both, are profitable and even if they were to do these things is it enough to differentiate them?

Most likely not, the question then becomes which one is growing their earnings. Because if a small company is growing its earnings quickly it will always beat out a one time boost to earnings.

In fact a company could be earning cash so quickly it may be the reason it is trading below NCAV in the first place. This generally happens to relatively unknown, undiscovered stocks.

Earnings Growth is Subjective

It was a bit difficult for me to fully grasp what was being said in Peter Lynch’s books, but I forced myself to figure out what he actually meant by earnings growth.

He often explained stocks were trading for less than earnings, which was very difficult to comprehend. Especially when he mentioned earnings growth but never explained how to find or derive it.

The truth is in this very simple formula:

(Current Full Year EPS-Previous Full Year EPS)/Previous Full Year EPS

With this very essential formula you can then derive the Price to earnings growth or PEG ratio.

To find the PEG ratio divide the PE by the EPS growth.

Little did I know earnings growth is incredibly subjective. You can figure out growth rates year over year, a 5 year average, or a 10 year average. But, what it comes down to is based on those numbers what growth can be expected in the future?

This is why stock analysis is so important and basing your investments on mere quant research is never a perfect formula to investing success.

Many profitable Japanese stocks have PEG ratios of .5 which essentially means they are 50% undervalued. Of course I take into account the dividend ratio just as Peter Lynch suggested.

You do this by simply taking the dividend yield and adding it to the earnings growth rate percentage.

Earnings Growth Rates Lag Other Markets

Why are Japanese stocks undervalued?

One reason may be the massive amounts of cash company’s keep on their books. This causes growth rates to lag. So a typical growth rate of 20% in a developed market is typically only 10% in Japan. This slower growth puts off many investors.

But, even if the growth is slower, the safety of capital, trusted dividend and 50% undervaluation make them much more attractive stocks than many highly priced stocks in the United States.

If January is to be a lesson learned, you should never pay more for a stock than its worth.

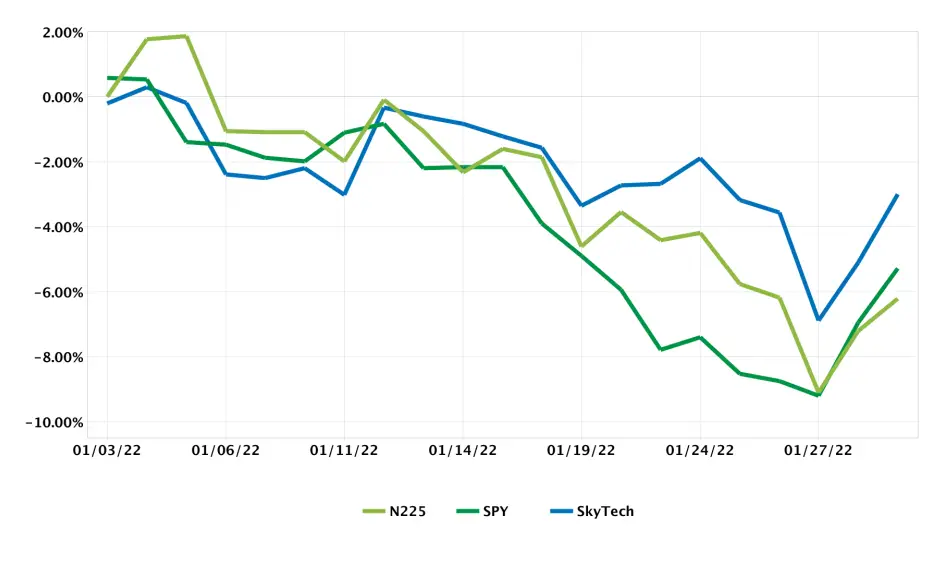

January 2022 Net Net Portfolio Results

January was a rough month for tech stocks.

This caused my portfolio to fall alongside the major indices.

The total return for January was -3%. A poor performance for this month, but it did outpace all the major indices which I am very happy about.

Not to mention all of the stocks I’m invested in don’t announce their earnings until early February. Many of those stocks will likely have better results than they did the previous quarter.

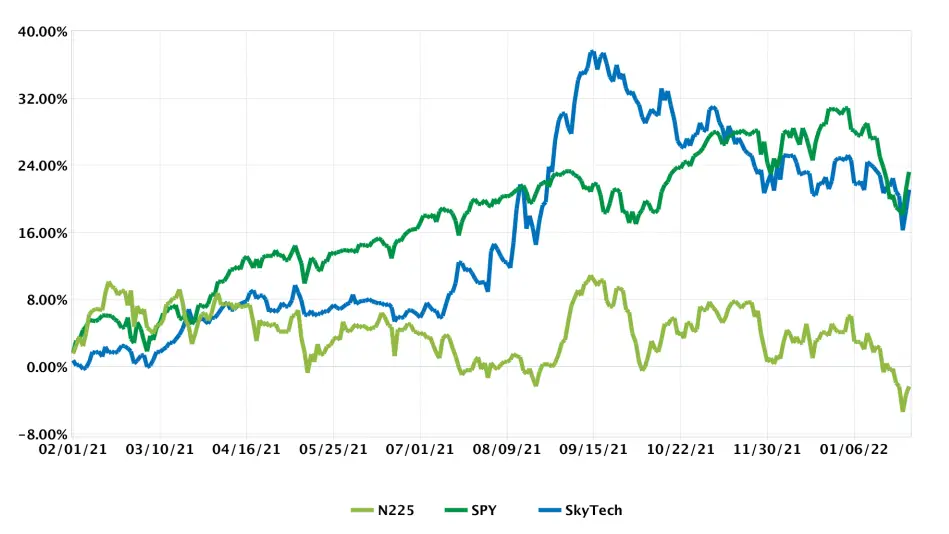

1 Year Portfolio Returns

Since YTD returns don’t really mean much in the very first month of the year, I’m going to start posting a 1 year trailing report of my portfolio returns.

Viewing the returns below its very clear that Japan is having a very difficult time managing through the Coronavirus pandemic. However, my heavily weighted Japanese portfolio is keeping pace with SPY by focusing on key industries.

The total returns over the past year have been 21.06%. This narrowly missed beating SPY that began its massive tech runup and the introduction of meme stocks.

The Japanese market had negative returns over this period as the major companies did not see any rise in profits. Key Japanese industries did see some action and that’s where I placed most of my bets.

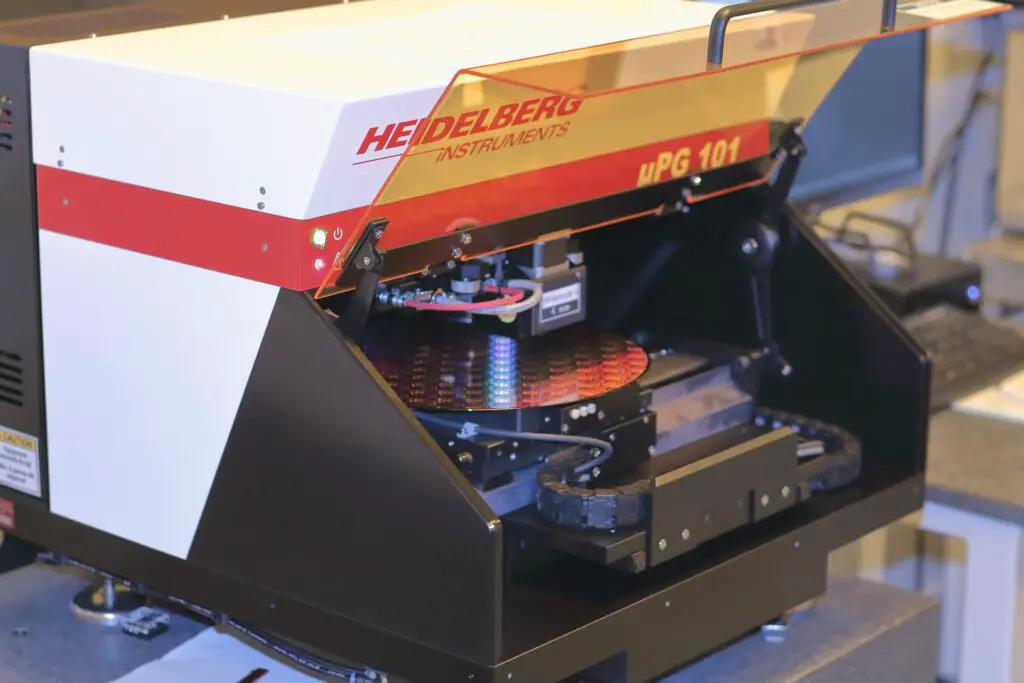

Part of the strategy was to buy companies with large inventories of already made semiconductor parts. This was a way to get ahead of supply chain issues and proved to be very lucrative.

Some of these companies include:

- NKK Switches.

- Rhythm Co.

- Mitachi.

Part of my thesis for this year 2022 I mentioned in my November portfolio report. It revolves around the auto industry and as such includes many companies that would benefit from a rise in production and sales. Especially with the EV market as a catalyst.

February Goals for Portfolio Growth to Compound Quickly

As I have outlined throughout this article EPS growth is a very important part of growing wealth. If you want to hold a company in your portfolio longer than a few years you need to pay attention to earnings growth.

My portfolio is evolving from just focusing on companies trading for less than their assets. Since many Japanese company’s have trouble trading above their assets its important to look at their earnings growth.

Also, by focusing on company’s that trade below assets, earnings and offer a relatively high dividend yield I can sleep at night knowing I have many variables working together to produce high returns.

If you are curious about my net net investment journey remember to read my previous portfolio recaps.

If you are ready to start investing internationally make sure to see which brokers I use and why.

For Investing in Japanese stocks be sure to read my article on how to buy shares in Japanese companies.