Investing can be scary, especially if your a beginner and are not accustomed to some of the volatility. When you decide to start straying away from ETF’s and invest in individual stocks it can be daunting. One of the biggest questions is portfolio allocation or in other words what percentage of your portfolio should be allocated to a single stock.

5% is the average that should be allocated to a single stock. This is based on a portfolio of 20 stocks. Statistically, this is the point at which your unsystematic risk becomes negligible. It’s been suggested that a portfolio should range from 10-30 stocks depending on your risk tolerance.

As you can see the percentage of your portfolio allocated to a single stock can actually change depending on how many stocks you have in your portfolio.

Of course this assumes that you allocate equal amounts of cash to each individual stock and even if you did that it won’t stay the same throughout an entire year. As you can see it can get a bit messy.

Unsystematic Risk and Protecting Against Ignorance

Not all of us can be the world renowned Warren Buffett and neither do we even have to try. He was once quoted that “Diversification is protection against ignorance.” So it is often thought that diversification is the enemy of excellent returns.

While this is true that the very best returns are reserved for those who do extreme research, it doesn’t mean you can’t earn excellent returns while holding more companies.

In fact you can even hold 30 companies but not have equal quantities of capital in them but instead put more cash into stocks that you feel have a higher likelihood of being successful. These types of stocks are also known as high conviction stocks.

But, I digress. Why is unsystematic risk important?

Well it really comes down to good luck and bad luck. There is always risk in any investment. You could have done all the research in the world and have a perfect candidate stock to make a ton of money from. But, then sadly your stock becomes the next Enron.

You’ve lost everything. Because of this you have no cash left to even invest in your second most favorite stock. This is unsystematic risk. So its important to spread our bets so that we can achieve the best statistical returns over time.

Investing Isn’t Perfect and is Sometimes More Art Than Science

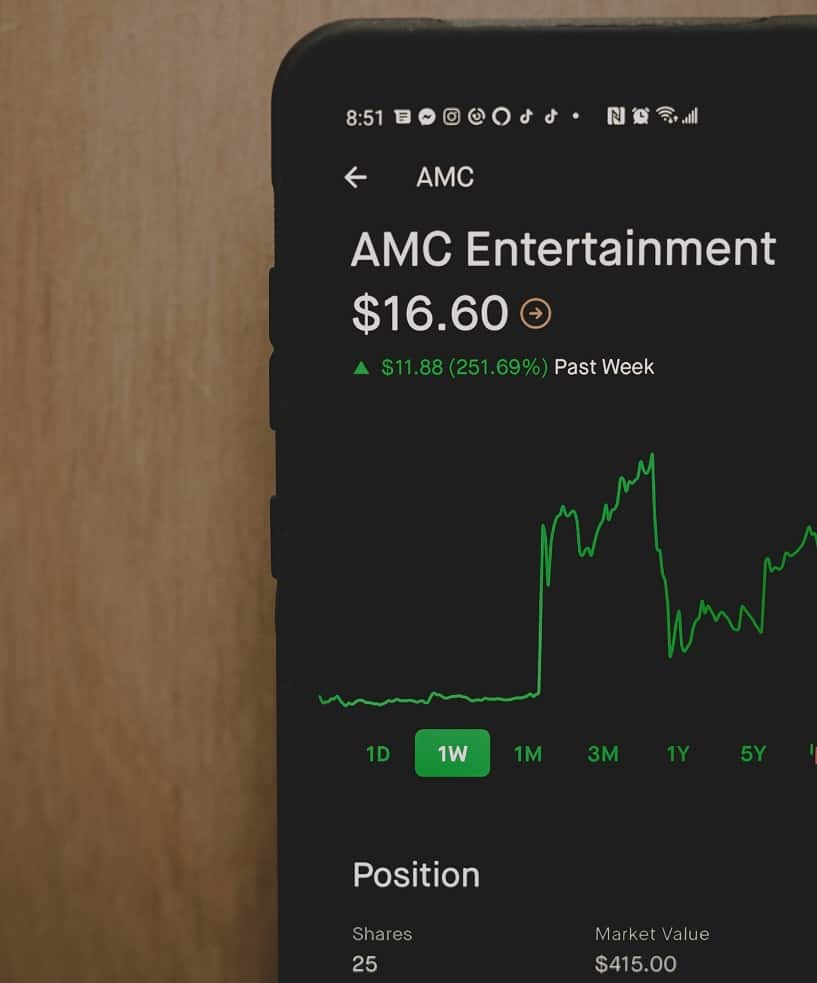

Returns don’t go up in a straight line, I know shocking. So your portfolio position concentration will be a bit lumpy throughout the year. You may end up with one stock that takes up 10% or even 20% of your portfolio. If this is the case then it may be time to re-evaluate your position.

The question is did the stock rise dramatically faster in value than your other positions?

If this is the case you then need to determine if the stock is still cheap. If it is you might want to hold on to most of the stock but sell off a portion in order to buy cheaper stocks in your portfolio.

This is known as portfolio rebalancing.

It can be done once per year, or more often then not it will be done sporadically throughout the year depending on how concentrated your portfolio becomes.

If your new to investing, you should typically only rebalance your portfolio when certain rules that you have laid out before hand come to fruition. This takes the emotion out of investing and helps returns over the long term.

Volatility and the Correlation to Single Stock Concentration

Volatility is often described as beta. You can either have beta in your portfolio as a whole or you can have beta in an individual stock.

The more stocks you have in your portfolio, the less likely you are to have a high beta. In other words the less likely your portfolios net value will swing from one extreme to another.

Beta is not always a bad thing though. Often times people want as little of it as possible, it is less stressful after all, but what if you could harness it to increase your returns?

That’s exactly what value investors do.

Joel Greenblatt for example developed the Magic formula. He would find companies with the best earnings yield and return on capital and rank them. Then he would add those rankings together to get an overall picture of how one company ranked out of all stocks measured.

Doing this he was able to achieve above average returns with a lower downside volatility over time.

So its not always bad to have volatility in your portfolio. Especially if you are buying extremely cheap stocks. These stocks don’t have much farther down to go but they can rocket up really fast. Think of it as heads you win 150% tails you lose 50%. That’s a bet I would take.

So to recap our original question.

- Higher stock concentration increases volatility.

- Volatility is not always a bad thing.

- High conviction stocks deserve a higher concentration in your portfolio.

- Diversification is not ignorance you can still get great returns buying cheap stocks.

Diversification Across Sectors of the Economy

So you might be thinking, “Should I make sure I have equal numbers of stock in different sectors of the economy?”

My answer may surprise you, but no. I actually don’t pay much attention to that at all. This is because I do a bottom up style of investing, where I find the cheapest value stocks and invest in them. No matter what part of the economy or country they reside.

Often times my portfolio will become concentrated to one sector, but if its the cheapest sector its the most likely to have higher returns when it bounces back.

ETF’s Offer Extreme Diversification

Part of the purpose of diversification is to keep you sleeping well at night. If you are invested in 10 companies that you have well researched then more power to you and enjoy your good nights sleep. But, for many closing in on retirement a lot of fear creeps in.

ETF’s offer an extreme level of diversification. If you are investing in an S&P 500 Fund then you are investing in 500 companies all at one time. Now that’s some good diversification.

Better yet in case large cap companies look a bit pricey you can even invest in a small cap ETF. If you don’t have time to track, research or even set up your own rules for investing than this is your best bet. But, because its so easy I would suggest you don’t invest in just a single ETF but a few.

A good ETF portfolio would consist of:

- Large Cap ETF.

- Mid Cap ETF.

- Small Cap ETF.

- International Developed ETF.

- Emerging Market ETF.

Investing in ETFs in this fashion will protect you from any long term underperformance of any region or sector in the world.

How to Invest in the Real World

Like I said before investing is not always nice and neat as its made out in literature. It can get messy. The reality is your portfolio will not always stay at the same number of stocks. It will fluctuate depending on how many quality stocks you can find.

My portfolio for example is currently sitting just above 20 stocks. I like to keep it around that level so that I can sleep at night and not worry about any individual stock wrecking my portfolio.

But, if I do come across a stock with really great potential, I may put 10% or even more of my portfolio percentage into it. This is because you don’t come across extremely high quality stocks everyday and you should take advantage when you find them.