When you first begin your investing journey you might get a few tips from friends or even do a google search for how to invest for beginners. The likely results are that you should either invest in an index fund or large profitable growth companies with a great track record. While that may be good advice, its not great advice for generating amazing returns.

New investors should invest in the smallest and most undervalued companies they can find. Investment dollars will go much farther as these companies can grow faster than large companies. Small companies are also more likely to be undervalued.

If you are just looking for typical average returns then absolutely you should invest in an index fund and call it a day. It’s the easiest and most hands off approach. But, if you are looking to maximize your returns and become a better investor keep reading.

The New Investor Paradox and How to Achieve Better Returns

As a new investor there is a lot to learn and it can be difficult to even purchase your first share of a company. But, once you buy a stock you may realize that you are just along for the ride.

The New Investor Paradox: New investors have little skill and thus end up investing against the pros because of access to information. While plenty of opportunities exist in smaller companies with less coverage, where the pros can’t invest.

Quickly you realize you are in a sea of professionals that have massive sums of wealth at their disposal. This wealth is used to hire analysts and learn everything there is to possibly know about a company. In other words, you have a massive disadvantage.

The Difficulty of Being a New Investor

If you are new to investing you probably don’t know much about the research process and it can be incredibly daunting. This is why larger companies are often times more accessible to the new investor. There is plenty of analysis to read and learn from.

The issue is all of these analysts and investors have done this research far ahead of you. They have already made their money when they purchased the stock at excellent prices, and they just have to wait for everyone to come to the same conclusions and pile on.

As a new investor, your left holding the bag and buying at a more expensive price. This means it could take years for your investment to become the very value of the price that you paid for. This is time that you don’t have to waste, so the next step is to learn how to conduct your own research.

Conducting Research for the New Investor

As an investor who wants greater returns the best way to do it is to find undervalued companies, buy them and then wait. While this wait might equal the above wait to hold a great company at a good price it will create better long term returns.

According to Tweedy Browne the following are what has worked in their investing process:

- Low Price in Relation to Asset Value.

- Low Price in Relation to Earnings.

- A significant Pattern of Purchases by One or More Insiders.

- A significant Decline in a Stocks Price.

- Small Market Capitalization.

Tweedy, Brown is a very successful investment company that focuses solely on value stocks. They have produced outsized returns following a relatively simple process.

So how can you be like them? The best and easiest way is to look for companies trading below book value. This is often called balance sheet investing as you look at the companies current value rather than their potential for future returns also known as cash flow investing.

It is by far the easiest way to invest, as long as you have the emotional temperament. The best part about the strategy and the reason it continues to be simple is because large hedge funds and ETF’s can’t invest in them.

The reason being, these companies are often ugly and because of that have become small and more difficult for large sums of money to invest in. This gives you an advantage over large funds as you can invest without moving the price.

How New Investors Can Easily Find Undervalued Companies

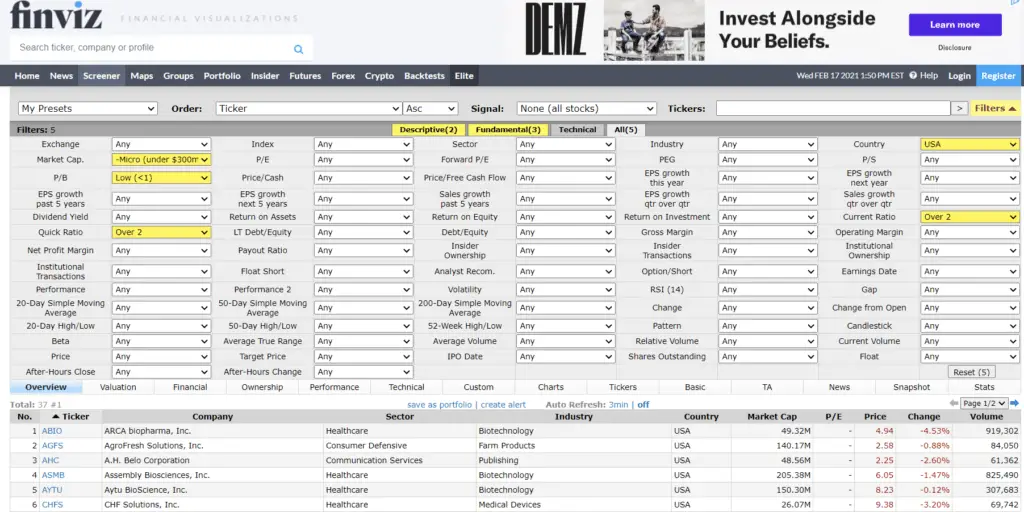

The first step to becoming a better investor is to learn how to screen for companies that have the qualities Tweedy, Brown state above. To do this we need to utilize a stock screener. There are many out there but I have found the cleanest and quick one to be finviz.com.

When screening for potential companies my method is to select all and then filter according to the below:

- Market cap: under $300 mil.

- P/B value <1.

- Country: USA.

- Quick ratio over 2.

- Current ratio over 2.

You can add additional filters as you see fit but those are the most basic. This is just a tip to get you started, now comes the most difficult part. The research.

In order to conduct research you will need to look at each of the screened companies and look for qualities of a company with potential.

- Make sure the company has manageable and low debt.

- Is the company currently profitable? If not can it become profitable?

- If the company is not profitable how much cash does it have to burn?

If the above questions have favorable answers its then time to dig into a 10K. The 10K is a filing that a company posts once a year and covers important aspects of the company with cold hard facts and not too much color from managements opinions.

It’s best to use the 10K to evaluate trends and inform your own opinion about the company. At that time you can decide whether or not it is worth it to risk your investment on that company.

Qualitative vs Quantitative Investing

Qualitative investing refers to the quality of an investment taking into account management, company moat, products, etc. A quantitative approach refers to the numbers and is usually associated with the balance sheet for value investing and the income statement for growth investors.

The above research path I discussed is considered both qualitative and quantitative investing. It leverages both in order to find the best company that has the best possible outcome.

However, many investors can choose to invest with just a qualitative approach or a quantitative approach. Many investors do just this and I myself lean more towards the quantitative side.

The benefits of utilizing both can not be understated and its mainly how Warren Buffet became the success he is today. As your skills advance qualitative investing becomes more important, but never underestimate quantitative investing.

Quantitative investing can keep a new investor out of harms way. It can keep an investor grounded as a story that is painted by management proves to be a red herring in the path to the company and its recovery. Quantitative investing can help keep emotion out of investing, until you can learn to gain control of those emotions and invest with a rational mind.

Make Investing Rules and Follow Them

Probably the most important part of taking the leap to becoming a better investor even if you are new to investing is making your rules before you invest.

Making rules and sticking to them is your greatest asset to keeping emotion at bay. While these rules can be bent, if you find yourself stressing out or generally uncertain or in uncharted territory absolutely fall back on them.

Below is an example of the rules I have set up for myself based upon what works in investing according to multiple studies including the above mentioned Tweedy, Browne.

- Hold for a minimum of one year. (avoid higher taxes)

- Buy below book value.

- Sell above book value.

- Hold a minimum of 20 stocks to avoid the risk of investing in any single company.

- Sell after 3 years maximum no matter what.

These rules are my own and I am constantly tweaking the countless variables that arise around them. Follow the rules at your own risk and make sure to conduct your own due diligence.

Warren Buffetts Number One Rule

Warren Buffet is often quoted for his number one rule: Don’t lose money. But, I think a lot of people misunderstand this. They take it as don’t let the stock price drop and cut your losses if it starts tanking.

Whether or not it has given rise to the almighty stop loss. The above thought process is dangerous. In fact stop losses are creating massive issues in the system and create what are known as flash crashes.

To give you a bit of comfort imagine this scenario. You do all the research and value a company only to buy it and watch the price fall. It starts to make you wonder if you made a mistake. In this case you have not lost money, the stock has only gotten cheaper and in fact should make you want to buy more.

Walter Schloss a famous value investor was quoted saying:

“If a stock is cheap, I start buying. I never put a stop loss on my holdings because if I like a stock in the first place, I like it more if it goes down. Somehow I find it difficult to buy a stock that has gone up.”

So don’t take Buffett’s number one rule out of context and take solace in Walter Schloss’s words.

Index Funds For New Investors

If you are more of the passive investor type then buying an index fund is likely the best move. If you are a younger investor its suggested that you invest in a small cap fund as they are considered more aggressive and can get better returns than large caps.

However, I find it a bit of a disservice to suggest that those on the brink of retirement should avoid these funds. Especially since they offer great returns and added risk is negligible compared to large cap funds. In fact, an index fund owns a basket of hundreds of stocks which negates the risk of any single company going bankrupt.

The second reason may be because smaller companies pay less dividends, which means less income. But, I have not found this to be the case and there are plenty of index funds that focus on dividends as well.

How to Buy Your First Stock

Whether your take my advice and start investing in smaller companies with a basic knowledge of what value is or you decide to index invest you will need a brokerage.

If you are curious what brokerages I use, visit my brokerage page for some information. I will keep it updated to the ones I currently use.

Once you set up the brokerage buying your first stock is simple. Set up a buy order and enter the number of shares you wish to buy. If you are investing in smaller companies you must absolutely use the limit order function. Without it, you could be paying more than you wanted to.

I hope I have given you enough knowledge to begin your investment journey the right way and take heed of the new investor paradox. Be sure to check back and read everything you can about investing.