If you haven’t been living under a financial rock for the past 30 years you may heard the Japanese stock market has still never been higher than it was in the late 80s. This has lead many to wonder as to why? Countless theories have been proposed but none actually are proven.

Debt to GDP, demographic decline, and inefficient corporate spending are among leading theories as to why Japans markets have not recovered. However, total available stocks and zombie companies could be an overlooked problem in stagnant Japanese markets.

As a contrarian its my responsibility to uncover profitable stocks by opposing popular opinion. As it turns out this may be the very reason Japanese stocks have still not recovered after so many years as I’ll explain below.

Debt to GDP and Demographic Decline

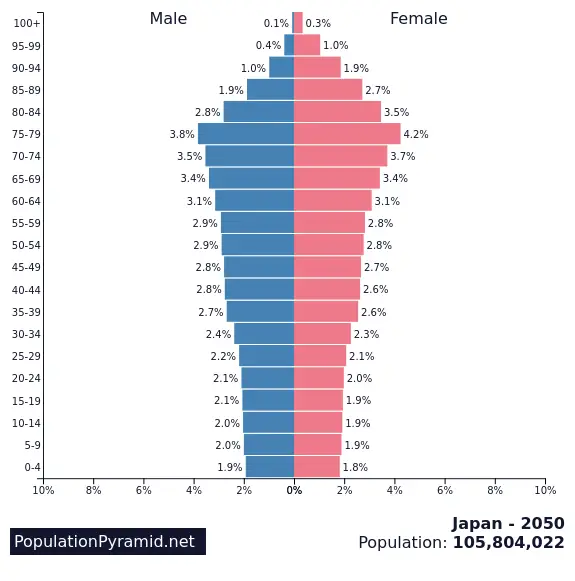

Demographic decline often explains away Japans market decline and keeps investors from actively buying stocks in the country. After all if there are less consumers buying goods it will lead to less GDP growth.

This issue will only get worse and looks like is not being resolved. Ultimately this will leave to bigger debt burdens for the smaller population in the future.

Growing debt to GDP is another problem Japanese markets face as a result of multiple underlying issues, one of them being demographic decline.

Japans current debt to GDP sits at 266.2% as of 2020. The largest in the entire world. This fear of a growing debt reinforces investor fears and keeps many away.

While debt to GDP and demographic decline seem like the ultimate reason for Japans slow economic death in fact its a small part of the overall reason for poor performance in the markets.

This is because GDP is made up of many components other than personal consumption of the population. These include:

- Personal consumption

- Business investment

- Government spending

- Net exports

In the United States personal consumption is up to 70% of GDP. For Japan in 2020 it made up 54.6%. So Japan makes up for its lack of consumption through exports and government spending.

While demographic decline can help explain Japans troubled markets, it cannot ultimately explain it away entirely, which leads me to another theory that many investors may be missing out on.

Debt to GDP as it Compares to Total Available Stock Listings

One of the components of GDP is business investment. The problem is that many listed stocks in Japan have valuations below book value. This makes it difficult to raise excess capital without hurting EPS and devaluing investor capital.

This creates a negative feedback loop that causes lower rates of growth because of less investment which leads to less GDP. If more investors invested in Japan it could break the cycle.

Japan requires a lot more investment to break this feedback loop than many realize. Because of the number of stocks and capital currently available on Japanese markets.

Below is a comparison on major markets around the world as they relate to debt and GDP.

| GDP and Stocks | Germany | United States | Japan |

|---|---|---|---|

| Debt to GDP | 68.72% | 128.1% | 266.2% |

| Total Listed Stocks | 438 | 4854 | 3832 |

| Total GDP | 3.806 trillion | 20.94 trillion | 5.065 trillion |

Japan is the worlds third largest economy and has significantly more stocks than the fourth largest economy Germany. Either a reduction in stocks or an increase in overseas investors is ultimately required to offset this discrepancy.

In the United States this situation is usually resolved through mergers, but in Japan company acquisitions and shareholder activists are uncommon.

This leaves governmental and overseas investment as the only other way to increase GDP and push up business investment. It may also be why Japans central bank decided to invest in securities and potentially what has saved the country from total collapse.

Japanese Stocks May be Smaller Than German Ones

Japanese stocks are potentially smaller than German stocks. So this may answer the stock quantity problem, but upon further investigation it doesn’t make much sense. The Total GDP and overall balance sheet valuations tell a different story.

The overall price to book value of Japanese stocks is 1.16 vs Germany’s 1.47. If Japans market were to triple in value it would put Japan more in line with the United States in number of stocks. This would inflate it’s book value but the book value may also be understated.

These indexes also don’t account for the many smaller stocks that are below a book value of 1. The Nikkei 225 only tracks the 225 largest companies in Japan.

While this seems logical on the surface there may be problems with this theory which I push anyone to explore. But, I do hope you can keep an open mind.

Japans Zombie Companies a Drag on the Economy

Zombie companies originated in Japan as an explanation for inefficient markets. These companies make just enough money to service their debts but offer little in the form of actual growth.

This may be why so many stocks exist in Japan. Coupled with the lack of mergers and acquisitions this becomes a long term issue. However, it still doesn’t explain why stocks priced below cash and book value can’t acquire these companies or at least grow to steal their customers.

In fact these may be happening albeit very slowly and could snowball into actual growth in the not to distant future.

An End to Japans Stock Market Predicament is Anyone’s Guess

After doing this research into the size of of markets, listed stocks, and government debt levels there is still no clear reason as to why Japan has not regained stock market prominence. I leave it to the reader to decide whether or not the number of available stocks and lack of capital are responsible.

While we will likely not know until its markets finally rebound, we can take steps to invest in stocks that show clear signs of undervaluation. No matter how slow it happens or how long it takes, individual companies will likely revert to the mean and outperform as they have always done.