Oil prices as a result of Russia being cut off from most of the developed world is causing havoc throughout the commodities market. Simultaneously, the largest sources of wheat and barley in the world may be a black swan event brewing in the background.

Ukraine and Russia account for a 3rd of the worlds wheat exports. Conflict between the two nations could lead to a massive rise in the price of wheat products leading to starvation and politically instability.

Farmland and food production companies will be the greatest beneficiary of this awful trend. This is why targeting companies with land that focus on food output are a great place to find bargains.

Even if these companies are above book value on paper they could be well below it in reality. This is because inventory has not yet been adjusted to reflect rising prices.

Searching for Inventory on Balance Sheets

If you need further proof and a visual representation on what is happening I found this reporting on current events.

With this background information on the current food security and worldwide inflation, we have a sufficient reason to look closely at inventories to spot opportunity.

Inventory Turnover and Inventory Quantities

I recently wrote an article on Seeking Alpha about a company I have owned for some time. Even now I learn new things and discovered a rather large discrepancy in future vs current prices.

Revenues are typically realized when inventory is sold, but this is not what inventory is typically valued at. In times of inflation commodity inventory values increase but are not realized until sold.

A company with larger than normal inventories could stand to benefit greatly in these situations.

We can even spot better than normal opportunities by studying how fast inventory turns over.

Inventory turnover is shown above in the efficiency section at investing.com. It also compares inventory turnover compared to the industry average. If the company has a lower than normal inventory turnover in a high demand commodity this could result in near term outsized earnings.

According to Investopedia inventory turnover can be calculated by:

Cost of good sold/Average Inventory=Inventory Turnover Ratio

It is important to note that the inventory turnover ratio is also a measure of a company and it’s efficiency.

So it’s important to measure whether cost of goods sold is a result of higher sales or a result of decreasing efficiency. Viewing this over multiple years can give a basis on whether or not costs are ballooning, falling or flat.

Last Thoughts on Inventory

Inventory on the balance sheet could mean almost anything. Before diving into a company make sure you look at the company’s annual reports to decipher what exactly is in their inventory number.

This will help you better distinguish between quality inventory and depreciating inventory. I found out recently on the Smart Sand 10k that sand inventory was realize after it was pulled from the ground and processed.

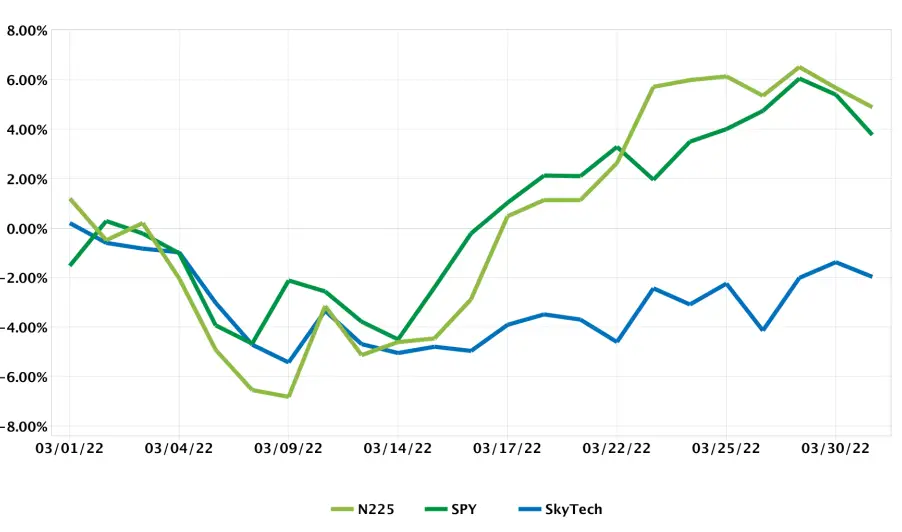

March 2022 Net Net Portfolio Returns

March was a rough month for my portfolio. Sadly it wasn’t even the overall returns of the stocks in my portfolio that underperformed. It was the Japanese currency in comparison to my base currency in USD.

The JPY fell by a phenomenal amount in just one month. It was a 6.5-7% handicap on my portfolio as a whole. This is likely why you see a rise in the Japanese benchmark and comparatively flat move on my returns.

You will also notice below that the Japanese Yen started depreciating on March 9th and that was around the time when the Japanese benchmarked moved upward while mine flatlined.

The Japanese Yen is the weakest it has been since 2015. This provides an opportunity to buy cheap Japanese stocks with more expensive dollars. Since currencies tend to oscillate in a range rather than rising or falling in perpetuity this is only a minor inconvenience to a portfolio rather than a permanent setback.

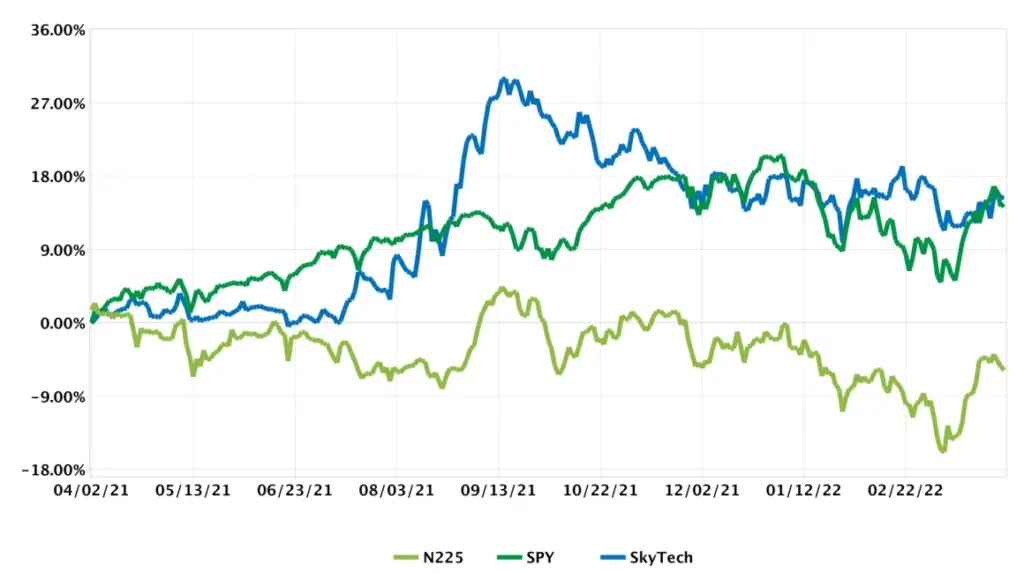

1 Year of Portfolio Returns

Equities around the world appear to be range bound. As inflation rises they are buoyed by the increase in prices of commodities. But the overall efficiency of the global economy is in a freefall as geopolitical events and a still fearful global tourist economy lead to rising costs without added production.

This will ultimately lead to a downward trend in global share prices if efficiency is not restored to global markets.

Over the past year I have seen my returns fall slowly without any meaningful bump in equity returns. Investors rightfully fear the end of globalization. The only hope is for nearshoring and onshoring efficiencies to outpace the need for a now inefficient global transportation network.

April Goals for Outperformance

With the largest month for Japanese dividends coming to and end, its time to focus on company earnings and potential catalysts for growth again.

A great deal of focus is on chip manufacturing and electric vehicle production as this was a long term play. Near the end of this year this should hopefully come to fruition. Tourist focused plays could also become a beneficiary as the countries begin to re-open their borders.

It is also my plan to thoroughly research the Polish Stock market for opportunities. With the influx of refugees into Poland this will create growth and demand in a fast growing economy that is under capitalized.

Email Exploit Investing For Questions You Want Answered

The end goal of this website is to educate individual retail investors on the opportunities of international small cap investing. But, we don’t always know what struggles everyone is experiencing. Let us know at exploitinvesting@gmail.com and we will do our best to research, discuss and answer the topic submitted.

If you are curious about my net net investment journey remember to read my previous portfolio recaps.

If you are ready to start investing internationally make sure to see which brokers I use and why.

For Investing in Japanese stocks be sure to read my article on how to buy shares in Japanese companies.