Have you ever heard the phrase,” Sell in May and go away?” I never really thought anything of it and research suggests it doesn’t affect the market in any significant way. But I can’t help but wonder if maybe there is some truth to it?

At least as far as stocks that a lot of smaller investors buy. Since most aren’t large professional investors they may be taking a summer break with their families.

During the summer months it’s important to keep your focus and not let small downturns or flat markets affect your psyche. As I sit here dripping in sweat, typing away at my keyboard I am reminded of Peter Cundill and his book, There Is Always Something To Do.

This book often stresses the importance of patience and during these summer months the markets can seem boring without any financials coming out to excite most stock investors. We have to wait until the end of July an beginning of August for those.

So wait we will, but at the very least we can set ourselves up for success by reviewing trends and positioning our portfolio for the best possible outcomes and concentrate our holdings in our most sure bets.

Extreme Heat Wave and Infrastructure

The summer heatwave is here and its a big one. Its causing all sorts of problems and s revealing massive holes in both infrastructure and energy vulnerability.

California can’t keep up with energy demand and or import enough electricity to power all of its cities without turning to its most hated ally, oil. During a record heatwave it has had to turn on many oil powered peaker plants just to keep up with demand.

This along with summer driving, and air travel is driving oil prices higher. High oil prices are likely in our future until renewables can finally catch up to demand.

Green infrastructure is also seriously lacking which makes it even more inevitable that oil prices will have one last run before leveling out. President Biden is working on his infrastructure bill and it is seriously needed as the lack of government investment in infrastructure over the past few decades has been appalling.

Once the infrastructure bill moves forward it should boost the well being of all American citizens and lead us to a brighter future with great returns on all market investments.

June 2021 Net Net Portfolio Results

One of my goals in May was to keep some cash on the sidelines in order to be in a position to take advantage of any downturns that would take place during the rest of the year.

In June I decided to put all the idle cash in my portfolio to work. This is partly because I’m drawing down on some on my gains in my US portfolio and doubling down on my international net net picks.

I successfully concentrated my portfolio this month and I now currently have 27% of my portfolio in just a single stock. Unfortunately, at the time of this writing I cannot reveal this stock because it would be a huge conflict of interest and potentially front running the stock, but in the future I hope to report on the gains it will make for the remainder of the year.

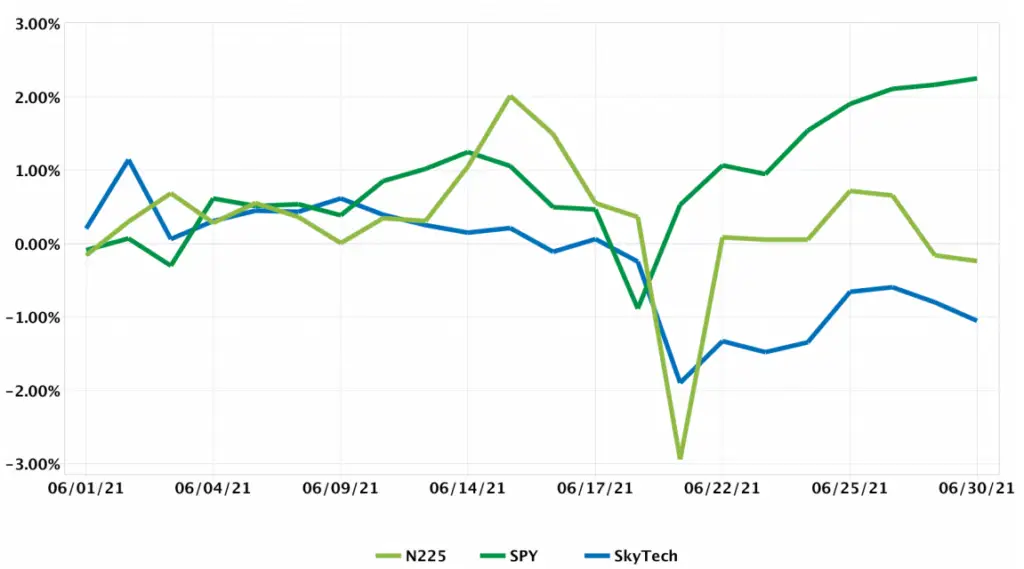

June was an interesting month for my portfolio. There was a rather large drop in markets on a single day and in unison my portfolio along with the SPY and Nikkei dropped in value. In just days both benchmarks bounced back from the drop, while my portfolio has lagged behind.

This is very interesting and also frustrating at the same time. Nothing changed about any of the companies in my portfolio and neither did the fortunes change for the two benchmarks in question. All that has happened is my portfolio became more undervalued compared to the underlying fundamentals.

While times like these came be a bit frustrating, its important to remember it is exactly because of this type of phenomenon that value investing is so profitable. When financials roll around and earnings surprise investors, value stocks tend to boost their returns and deliver exceptional results.

Benchmark Comparison Portfolio Results After One Year Recovery

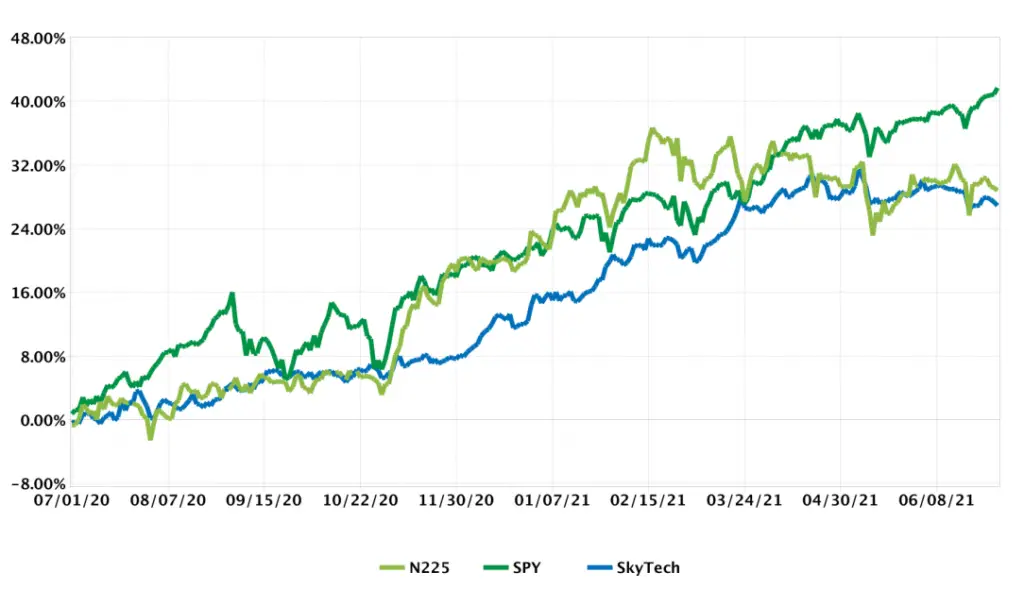

This month I want to review the past year and how it compared with two large cap benchmarks. The Nikkei 225 and the S&P 500. In particular I was curious how the recovery was affecting both the American and Japanese stock markets.

It came as no surprise that the American stock market won out, but the Japanese stock market actually did far better in the first quarter than the American one did. This surprised me and if it were not for renewed fears brought about by a new lockdown in Japan it may have continued to outperform.

My portfolio in comparison to both the Japanese and American markets sadly underperformed. This may be due to my portfolio not taking part in the massive jump in November. This was likely the result of the presidential election, and its curious how Japan followed the American Markets upward.

It looks like only large cap stocks took part in that increase and my portfolio just sat on the sidelines, slowly moving up in value. Eventually my portfolio overtook the Nikkei 225 and has been running about neck and neck with it for the past few months.

Because of some of the moves I have made in my own portfolio I expect to overtake the Nikkei and hopefully come close to the returns of the American markets as 2021 comes to a close.

Note: It’s important to remember that all above results are a snapshot in time and the returns of any strategy must be subject to at least a 5 year timeframe.

Goals for the Month of July

I am currently fully invested so there is not much I can do in my portfolio other than to sell stocks. The problem is my portfolio is undervalued and selling any shares right now is not in my best interest.

The best course of action right now is to take a hard look at my underperformers and analyze them to see if they still deserve a spot in my portfolio. They may be cheap but, there is no point holding them if they are not going to contribute outsized returns.

I also plan on looking deeper into Japanese stock market governance as times are changing and more activism is taking place. This may just be the turning point everyone has finally been waiting for and I want to time to get in on the ground floor.

If you want to learn more about the Japanese stock market over the past few decades, check out this very informative YouTube video.

For any of you younger investors out there be sure to read about how you can invest aggressively in your 20s and actually take on less risk. Something I wish I learned when I was younger.

If you are curious about my net net investment journey remember to read my previous portfolio recaps.

If you are ready to start investing internationally make sure to see which brokers I use and why.