It seems markets can’t catch a break. Inflation is out of control, interest rates are rising and now we have a major destabilization of ores, metals and oil as a result of Russia attacking its neighbor in Ukraine.

With all of this negativity and chaos in the world it seems like there is absolutely no way any of our investments can pay off and we might as well stay in cash. But, this would be your biggest mistake.

There is absolutely no reason to deviate from the course of buying cheap stocks and holding them until they realize their value. As a testament to this statement my deep value portfolio is crushing overvalued growth stocks.

It’s also important to remember that growth stocks can be undervalued on a number of metrics that aren’t typically adhered to today, like earnings growth as it compares to price.

So how can we invest in today’s markets for future growth and preservation of current wealth?

Eastern European Investing and Ukraine

I talk a lot in my portfolio reports about Investing in Japanese stocks. However, European investing is not entirely lost on me. I have invested in quite a few stocks that were cheap on Polish markets.

These stocks include companies that have done business in Ukraine, Russia and Poland. Unfortunately, the corruption around Russia and Ukraine caused those investments to perform poorly and one was ultimately a fraud and a crashed to zero.

Rule of Law in Investing

When investing in international markets it is important to focus on a country with rule of law and strong shareholders rights, especially minority shareholders. While the Polish stock market may have a lot of legitimate companies that reside in Poland those aren’t the ones you need to avoid. Companies that list inside of Poland but have significant operations outside of Poland can often be shrouded in mystery.

This is why the only profitable company I invested in had operations that were Polish. Both, Russian and Ukrainian stocks performed poorly.

If you are curious which stocks I invested in here they are.

- NTT System SA (Performed well during the Pandemic)

- Solar Co SA (Constantly lost money and had operations in Russia)

- KDM Shipping PLC (Fraud)

After learning many lessons and identifying possible opportunity. I may research more investments in Poland in the near future.

Key Investment Principles for the Polish Stock Market

The Polish stock market recently shifted from developing to developed status. The Polish economy is finally having a renaissance moment and growing stronger with the help of the European Union. There are however many perils investors may face on its exchanges.

These may include:

- Legacy companies on the exchange with business in corrupt regions.

- Currency exchange risks.

- Short term geopolitical risks.

Poland focuses heavily on eastern European markets. This is because it was previously a communist country with strong ties to the Soviet Union. Many individuals likely have business contacts in the east as a result.

Poland stands to benefit immensely from democratization and rule of law of eastern European countries and will likely be undervalued for some time. This may bring opportunity to savvy investors who can spot stocks that operate in safe regions or Poland itself.

Poland is also the only country not to have been affected by the 2008 financial crisis because it maintains its own state currency, the zloty. Poland is large enough to keep its own currency relevant and growth of companies on its stock exchange will only further push the currency higher.

Commodity Investing and Inflation

If you didn’t know already assets usually rise along with inflation. This means many commodities will increase in price. Better yet, the value of commodity heavy inventories on balance sheets also rise.

This means many balance sheets showing a rise in inventory values are not a result of extra inputs but rather just increasing the value on the books. Better, yet many companies probably don’t even change them and just realize the extra value when it sells.

So if you are holding cash during a stock market selloff that relies heavily on growth company’s you are eroding the value of your dollars.

The best way to counter that erosion is to find cheap value stocks and buy now them now.

Finbox The Most Robust Screener on the Internet

Until now I had been using sites like finviz and investing.com to screen for stocks. They were ok but they didn’t really have what I wanted, until I found Finbox.

Finbox allows me to screen for net nets easily in any country in the world. Not only that but it has Peter Lynchs famous earnings growth and yield screener or PEGY.

While screeners are not effective at finding hidden gems it does help with undervalued growth stocks and assets. It’s up to you to do the legwork to see if a company valuing it’s assets to cheaply.

If you want to try it out for a day check out my referral link. This will give us both 5 dollars toward premium membership.

February 2022 Net Net Portfolio Results

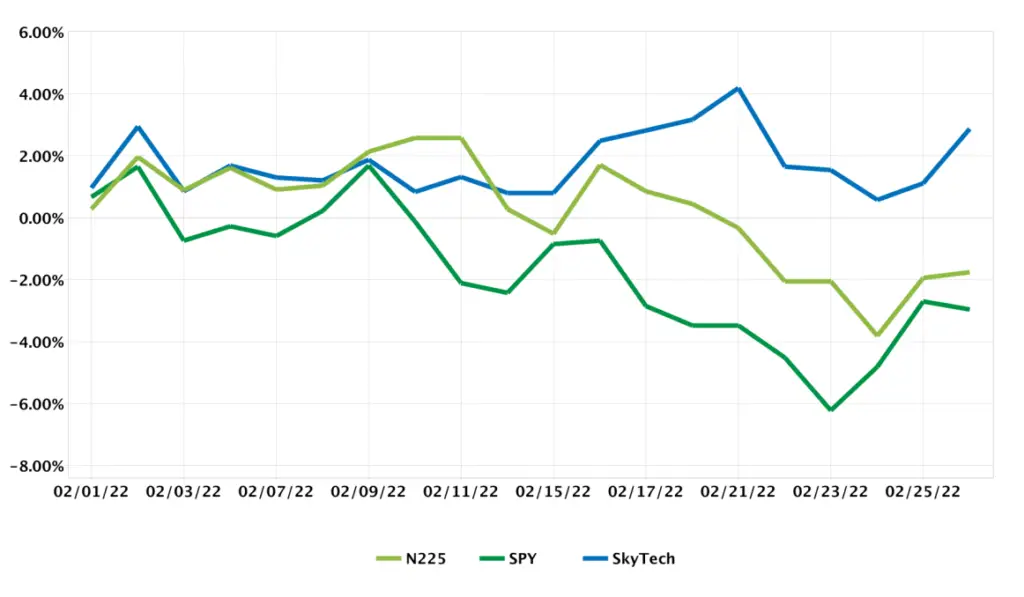

February did not seem like a particularly great month for my portfolio. But, when it’s compared to my benchmarks it’s almost unbelievable.

It handily outpaced both benchmarks and even eked out some gains. I am surprised it didn’t do better since many of my companies announced spectacular earnings. This led to their balance sheets remaining stronger than in 2018 when they had their most recent highs.

While earnings have been great, forecasts have been less than spectacular. This may be due to the increase in the price of oil which Japan is heavily dependent on imports for.

This is also weakening the Yen as a result. However, this should balance out as companies can increase revenues from increased foreign sales.

1 Year Portfolio Returns

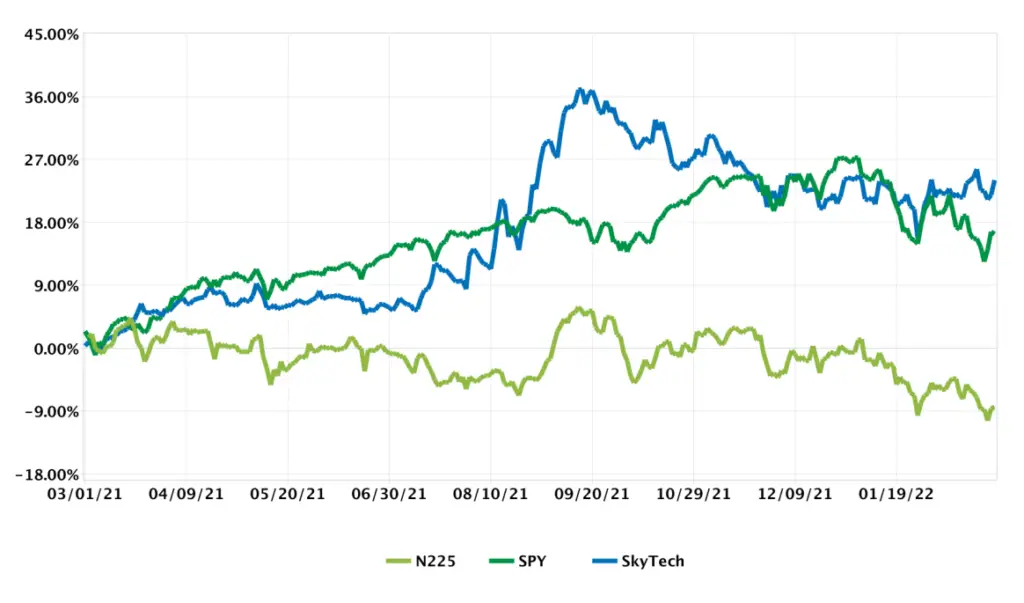

Investing in Japan over the past year has been an utter disappointment and train wreck. Why would anyone ever think you could make money in a country that is experiencing constant demographic issues and where money goes to die.

That’s would you would be thinking if you had invested in the Nikkei over the past year as it has performed poorly. However, this highlights the very real bias when it comes to investing in the main indexes in a country.

While investing in Japan during a boom of the index is certainly easier, it by no means makes it impossible to make money during a large index downturn. The problem lies in the failure of the large indexes to account for profitable small caps that are the backbone of the Japanese economic machine.

Ultimately commodities will reign supreme in an inflationary world. While Japanese companies are hesitant to raise prices, they will ultimate have to as many other companies will experience the same problems.

Japan is also heavy on commodity stocks on it’s markets and with tensions in eastern Europe their products will be in more demand as the raw materials are sourced more locally in southeast Asia.

March Goals for Portfolio Growth and Dividend Returns

Increasing dividend returns alongside overall portfolio is a priority. During the last month I increased my holdings in high dividend paying companies that are undervalued on a book value basis and have decent price to earnings growth.

During the month of March I plan to continue this strategy as most of the companies in my portfolio have an ex dividend date of March 30th. This should provide a large influx of cash that will likely be usable in the middle of Summer.

If you are curious about my net net investment journey remember to read my previous portfolio recaps.

If you are ready to start investing internationally make sure to see which brokers I use and why.

For Investing in Japanese stocks be sure to read my article on how to buy shares in Japanese companies.