What happens to retained earnings when dividends are paid and what that means for the dividend-paying company? Understanding the relationship between these two balance sheet items is crucial to making sound investment decisions. Unfortunately, it’s not always common knowledge.

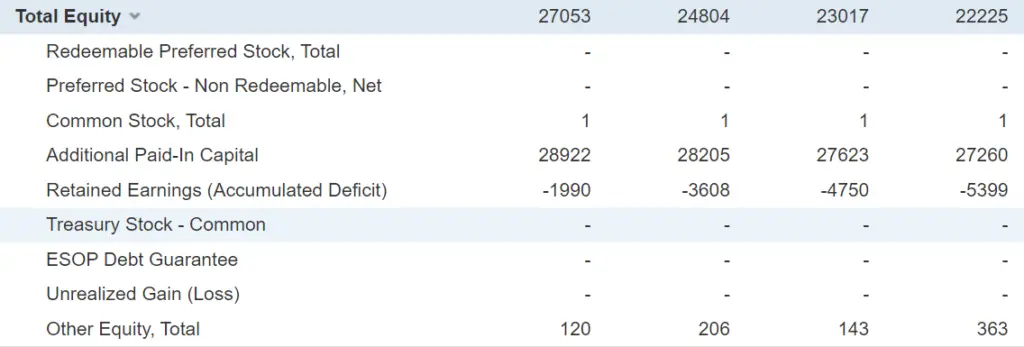

There are even situations where retained earnings have even been negative! What is all that about?

Both cash and stock dividends reduce retained earnings by an amount equal to the size of the distribution. Cash dividends have a slightly different effect on the balance sheet in that they reduce both cash and retained earnings accounts by an amount equal to the size of the dividend.

What is the true relationship between retained earnings and dividends? How are they recorded on the balance sheet, and why does it matter to an investor?

Dividends and Retained Earnings: What are They?

Before we go any further, let’s quickly go over the meanings of the terms retained earnings and dividends. If you already know all about that, please skip this section.

What Are Dividends?

A dividend is a distribution of a company’s profit to its shareholders.

What are Retained Earnings?

A Company avoids paying out its profits as dividends. This is because they need cash for research and development, expansion, and other business growth activities. More often than not, a portion of the profits are reinvested back into the business to fund operations. This portion is known as retained earnings.

So by definition, retained earnings are the portion of profits plowed back into the business instead of being distributed to shareholders.

Corporations reinvest their profits because they expect to earn a significant return on their investments and grow as a result. The reverse is also true. If a corporation is distributing nearly all its profits, then management has deemed that it is better of in the hands of investors in order to increase ROI somewhere else.

Growth vs Value

Growth stocks barely pay dividends. There are a few reasons for this including:

- Growth companies are trying to grow revenues quickly be reinvesting in the business.

- The return growth companies can get are higher than an investor can achieve on his own.

- Growth company’s may not consistently make a profit and cannot pay out profits.

Blue-chip stocks include corporations with little room for growth. Typically dividend aristocrats that don’t see much value in reinvesting most of their profits because they have saturated their market. Any attempt to grow at this point may result in diworsification. A term Peter Lynch uses in his books to describe company’s terrible attempts at diversification.

The Effect of Dividends on Retained Earnings

If you didn’t skim through the above section, you likely noticed the link between dividends and retained earnings. A company profits, distributes some of them to shareholders as dividends, and keeps the rest as retained earnings to be reinvested.

What does that mean as far as the effect of dividends on retained earnings goes?

Put simply, both stock and cash dividends reduce a company’s retained earnings. If you look at a company’s balance sheet after a dividend distribution, you’ll notice that the retained earnings has been reduced by a sum equal to the size of the dividend distribution. Depending on whether it’s a cash or stock dividend, the cash account may also be affected (more on this soon; hang in there).

The reverse is true, too. If a company reinvests a significant chunk of its income as retained earnings, the size of dividend distribution will decrease.

Retained Earnings Formula

The relationship between retained earnings and dividends is reflected in the formula used to calculate retained earnings:

- Retained Earnings = Beginning Period Retained Earnings + Net Income/Loss – Cash Dividends – Stock Dividends.

Now, if you look at the above formula, you’ll notice two unfamiliar items: the beginning period retained earnings and the Net income/loss. Since these significantly affect retained earnings, let’s quickly review them.

Beginning period retained earnings are the previous accounting period’s retained earnings carried over to the current accounting period.

Net income and loss are pretty self-explanatory items. The reason I deemed them “unfamiliar” is to point out something investors tend to forget when talking about dividends.

- The beginning period retained earnings are lower than the net loss. Regardless of whether the company pays or doesn’t pay dividends.

- The beginning period retained earnings balance is higher than the net loss. But, the company pays dividends higher than the difference.

Negative retained earnings can be a sign that a company could be on the brink of bankruptcy. Some company’s even use debt as a vehicle to continue paying out dividends while trying to turn a company around.

Other times companies will have negative retained earnings if they are a growth stock being fueled by debt and share issuances. A notable example being Tesla.

If you retained earnings decreasing its a good idea to be skeptical. Management may be more concerned about retaining the dividend to prevent share price decline and protect their bonus than the company and its longevity.

Now that you understand the general relationship between dividends and retained earnings, let’s delve into the nitty-gritty details of how cash and stock dividends affect the balance sheet.

How Companies Account for Cash Dividends

Cash dividends affect two sections of the balances sheet:

- The shareholders equity and cash accounts.

- When a cash dividend is declared, the corporation records a liability in the dividend payable account. Once that dividend is paid, an account entry is made to reverse the dividend payable. This removes the liability from the balance sheet. The net effect is a reduction in the cash and retained earnings accounts by an amount equal to the dividend

As an investor, you won’t see the liability entry in the dividend payable account when the dividend is declared. The only thing you’ll notice is the final recording of the reduction in retained earnings and cash. By the time a company releases its financial statements, it’ll have already paid the dividend and recorded it in these two accounts.

How Companies Account for Stock Dividends

Unlike cash dividends, stock dividends don’t affect the cash account. They only affect the shareholders’ equity section in the balance sheet.

When this type of dividend is declared, the figure to be debited from the retained earnings account is computed by multiplying the dividend percentage by the number of outstanding shares and the prevailing market price. Once this figure is calculated, it’s debited from the retained earnings account and credited to the common stock account.

Thus, the net effect of a stock dividend is a reduction in retained earnings and an increase in common stock.

Dividend and Retained Earnings FAQs

After establishing that dividends reduce retained earnings, let’s look at some of the FAQs about these two accounting entries to help you make sense of the financial documents you’ll encounter when evaluating investment opportunities.

If Dividends Reduce Retained Earnings, Why are they Paid?

Retained earnings are essential for funding growth in a company. Given this crucial role, it’s easy to wonder why companies may choose to pay dividends. Most commonly, companies pay dividends to incentivize investors to continue holding stock. Consistent dividends can also help corporations attract new investors.

Do Dividends Affect Net Income?

Dividends do not affect net income, the difference between revenue and expenses reported on the income statement. On the other hand, the effect of a dividend declaration and payment is restricted to the balance sheet. Specifically the stockholders’ equity section.

In other words, dividends aren’t expenses and thus can’t be captured in the income statement.

What this means for you is that dividends aren’t what you want to be looking at if you’re trying to understand the specifics of a company’s profitability.

Profitable companies are more likely to pay dividends than those closing the accounting period on a deficit. But, the best way to prove profitability is by looking at the income statement; and not how many times the company has paid dividends in the past.

Can Dividends Be Disadvantageous to Investors?

It’s not always good news for investors when companies pay dividends out of retained earnings. Some investors are less concerned with distribution and more interested in stock appreciation. If you’re such an investor, you don’t want your company paying out dividends as it ads to a tax burden and slows company growth.

It can also be a sign that company management doesn’t think it can derive financial benefit from reinvesting its retained earnings.

Why Investors Care About Retained Earnings

Positive retained earnings signal to investors that a company is healthy. Many growth stocks post negative retained earnings as they funnel more cash and debt into growth. This signals to value investors that a stock is speculative and should not be based on common value fundamentals.

If you are a dividend investor it is also important to make sure large company’s have positive retained earnings so you know your dividend is safe.

Reach out to us at exploitinvesting@gmail.com if you have any questions. Be sure to share it with friends on your favorite social media platform.