Most of the time, the goal of investing is to increase your wealth by sharing in the profits of the worlds greatest companies. But, generating profits does not have to be your only goal. Perhaps you just love a company and its products and wish to help it through purchasing its shares. But, how does buying stock help a company succeed?

Buying shares in a company helps spread risk, raise capital, create liquidity and increase share prices. Both companies and investors benefit when share prices rise in value and a company generates revenue and profit. Buying shares contributes to overall share demand driving prices higher.

Most of the time when you buy shares in a company, it is generally an indirect benefit. This is because you are typically buying stocks from other investors vs the actual company. So it may not seem like you are helping the company, but lets look at the ways issuing shares directly help a company to see how buying shares can help.

Company Share Issuance Generates Capital For Expansion

The main purpose of capital markets are to generate cash for expansion. This is typically done when a company has proven it’s business model and is looking for a fast way to access extra capital to expand its operations quickly.

Note: During times of market euphoria many unprofitable companies are listed in the hopes that a cash influx will drive revenues and a company can eventually become profitable.

Issuing shares directly to the public also known as an initial public offering or IPO allows individual investors the opportunity to buy shares directly from the company. This generates a lot of cash that can then be used by the company to expand, attract talent and achieve greater liquidity.

A company can also can issue shares in a secondary offering. This is done when a company creates more shares to sell to the public. It creates more cash for the company but in turn can dilute existing shareholders and lower the price of the shares.

If the money created by the secondary share issuance can be used to generate greater returns than the loss of share value then it will be a net benefit to all stakeholders.

Stakeholders in this case are anyone who has an interest in the company succeeding and growing, they include the following:

- Suppliers.

- Share holders.

- Employees.

- Debt holders.

As long as the value generated is greater than the capital consumed it will always be a net benefit to all stakeholders.

Buying Shares Contributes to Share Liquidity

If you are buying shares in a company or even selling shares you are generating liquidity. Liquidity is important in capital markets because it allows capital to move to where it is needed.

Liquidity is a sliding scale and any particular company can either be more or less liquid than another. This in turn can drive price valuations. Typically the more liquid a company the less share value mispricing’s there will be. This generally thought of as the efficient market hypothesis.

If any individual shareholder has need for capital invested in a company it can then sell shares to receive cash. In the case of private markets or private companies liquidity is not always guaranteed. It may be difficult to finder buyers and sellers for all of the shares of a company you want to offload.

Liquidity is also a way for founders to cash out some of the money they have invested in the company. Going public means they no longer need to have their entire fortune locked away in the company but can instead sell pieces in order to fund other ventures or private purchases.

No matter how you look at it liquidity is one of the most important parts of capital markets and engaging in the purchase of a company’s shares helps the company and its stakeholders efficiently allocate capital to where it is needed.

Buying Shares Spreads Risk to More Participants

There is risk in any business venture. Allowing companies to access capital markets can spread that risk between more stakeholders.

The ability for stakeholders to spread their risk means that even if the company fails participants in the company can not be entirely financially ruined. Their risk is spread among many others.

Not only is the risk spread to more participants but banks lending to these companies also have another option to mitigate risk. They can convert their debt to shares and reduce the burden on the company and its interest payments.

This alone can bring a company back to profitability and raise share prices. In such a case the risk of bankruptcy can be averted and shareholders buying the stock contribute to share price increases. This increase in share prices is the single reasons why banks would want to convert their debt to shares. It’s a way for them to get their capital back and possibly make even more money.

Share Prices Attract and Retain Talent

Employees and Managers have an incentive to do well for the company if they own shares in it. So buying shares in a company can become a reinforcing principle to make a company better over time.

If share prices rise and shares can be distributed to management in the form of bonuses’ or can be used for employees as sign on bonuses it will contribute to the overall momentum of a company. So through buying shares in the company you will ensure there is always demand for shares pushing up prices.

When Share Prices Drop Too Low

There are times where share prices will drop in value. In fact they can drop below book value or even net current assets. These are situations where value investors can take advantage and generate substantial returns.

Low share prices can hit a company hard and will be the death of many heavily indebted companies. This is because they will have no way to generate capital that is greater than the value lost by selling extra shares. In these situations a company will be stuck and unable to rise in value unless it can turn around its operations.

If a company’s shares drop to these low levels and its not heavily indebted it even has the option to buy its own shares to generate value. If it buys its own shares when they are cheap it can turn around and sell them in the future for a higher price when its operations improve.

In this situation it is retaining shares to later sell and if a company wants to really invoke shareholder confidence it can retire those shares and drive a stock price higher.

Examples of When Buying A Stock Helped it Survive

We don’t have to look very far in recent memory to find some very compelling examples of where public sentiment and simply buying share in a stock pushed it into success. There are quite a few.

- AMC Theatres.

- Gamestop.

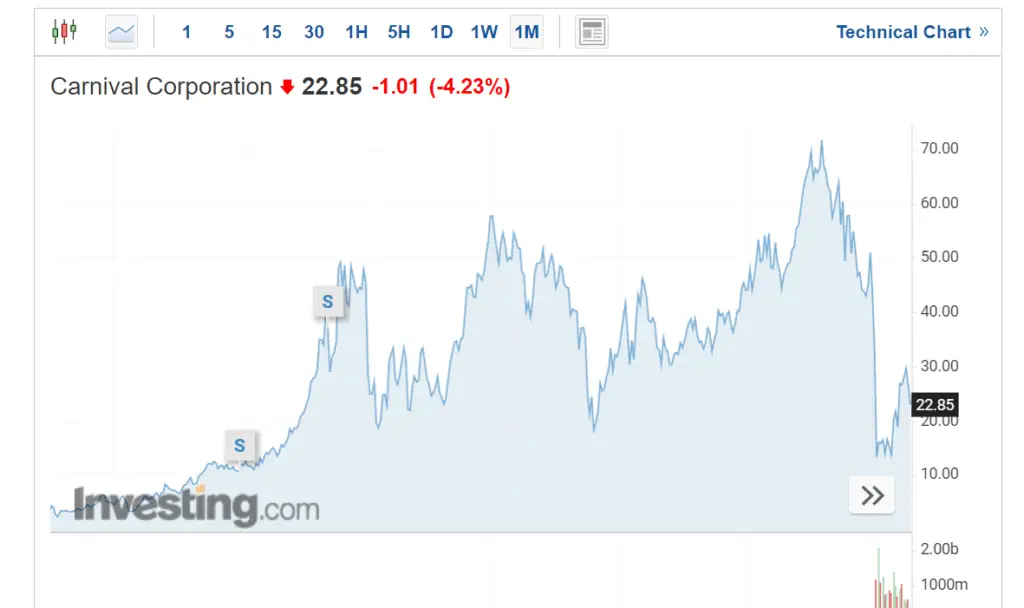

- Carnival Corporation.

While the above examples are not great examples of stocks that you should be buying, they are instances where simply buying shares saved the companies from bankruptcy. The above stocks were able to issue more shares at a higher price in order to continue operations.

The individuals who took part in the buying frenzy most likely saved these stocks from financial ruin, however it may have been at the detriment of their own net worth. Only time will tell if their investment can regain its value and more. In the case of the cruise lines this is entirely likely but may take some time.

Market Capitalization and Varying Levels of Impact in Share Price

Market Capitalization is the size of a company and can be figured out by multiplying the share price by the number of shares the company has issued.

When it comes to market capitalization larger companies usually have higher levels of liquidity as more analysts are viewing them which leads to more people trading them. The smallest companies have less liquidity and a higher chance of being traded for less than its actually worth.

It’s these small market capitalization companies that have the highest potential for great investment returns and are where you as an individual investor can make the most impact. Most large investors can’t even touch these stocks at all because just a small amount of their capital will move the price. Some smaller investors may even need to buy shares over weeks and months in order to avoid driving the price up too quickly.

The best way to find out if your buying of the shares will affect the share price is to look at the daily volume. If you are trying to buy more shares than the average volume traded you will need to rethink your buying strategy and spread it out over weeks.