I’m a deep value investor at heart, but it doesn’t hurt to understand all facets of a business. Especially when it comes to the cash generated from existing assets, and how much continuous investment is needed to maintain that cash generation.

Free cash flow (FCF) can be negative in many situations, even while net income is positive. High levels of investment in new projects or spending on research and development are some common reasons. Growth stocks often have negative free cash flow in order to grow their business rapidly.

I’ve been investing for years, but always put off understanding how free cash flow can affect investments. With solid knowledge of earnings growth, net income and return on equity I think its time to delve deep and find out when its really time to worry about negative free cash flow.

Lumpy Negative Free Cash Flow

This type of lumpy free cash flow which appears to be uneven takes place when company’s have variable or cyclical business models. Some Examples include:

- Project-based businesses: This can include construction companies, consulting firms or engineering companies.

- Cyclical businesses: Most notably these types of businesses operate in a feast or famine climate and may include automotive, retail and construction firms.

This type of free cash flow makes it challenging for a company to manage it’s financial resources and its harder for investors to forecast future cash flow.

Reasons why free cash flow is Irregular

Smaller companies may also have higher irregularities in their cash flow. One time events can throw off cash flow investors. It’s one reason deep value investors don’t put too much emphasis on cash flow analysis. However, knowing why free cash flow either jumps or drops can prove useful.

Some examples include:

- One-time events: Unproductive assets are sold off creating a one time increase in cash flow. Lawsuit settlements can also affect cash flow during the quarter or even year.

- Upgrading Equipment: All companies have some type of equipment costs that may be fixed, but upgrading equipment to stay competitive can impact cash flow greatly.

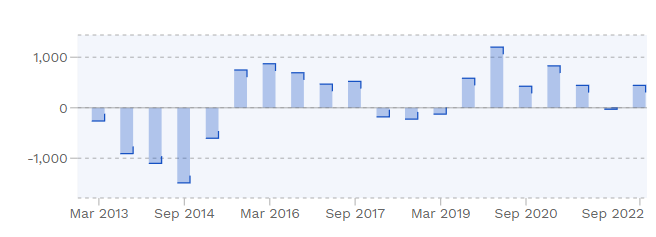

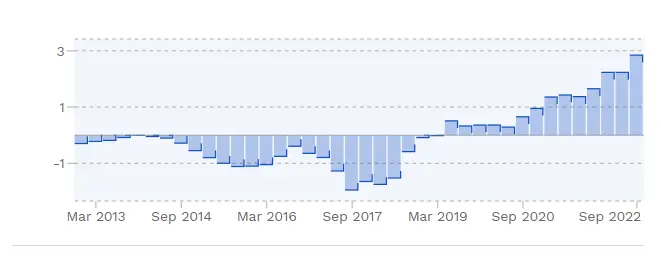

Below is an example of a stock that operates in the construction business and has irregular cash flow.

In order to contemplate this as a viable investment its important to smooth out the lumpiness of the cycles and see if the company has an overall positive free cash flow. This will leave room for error and allow for dividend increases and company earnings growth.

I utilize Finbox in order to screen for stocks and product charts like the one above.

Consistent Negative Free Cash Flow

Negative free cash flow can fall into two camps:

- Growth stocks with variable expenses

- Failing businesses with debt burdens and unprofitable assets.

In order to decipher which type of business you are looking at you can either head straight to the cash flow statement or take a look at the balance sheet. If book value is below 1, its likely you are dealing with a failing business.

Traits of a Failing Business

Failing businesses aren’t always a bad investment. Many can actually be the most profitable investments. They could be one sale of an unproductive asset away from profitability. However, these types of businesses over the long term are destroying value and future cash flow if that cash flow remains negative over a long period of time.

Failing businesses will have trouble raising capital and often will take on debt to fund the business destroying value in the process.

Growth Stocks with Variable Expenses

With growth stocks its much more important to look at earnings growth. As long as a stock is growing its earnings negative free cash flow should not be an issue.

On the cash flow statement its important for investors to decide if variable expenses are worthwhile investments in future cash flow. These may include:

- Research and development.

- marketing.

- Productive asset accumulation.

Tesla is an example of one company that grew, while maintaining negative free cash flow. It was able to achieve this by growing revenues, selling shares above book value among other things. It also spent a ton of cash on research and development in its early years before production even began.

Things to Look for In Positive Free Cash Flow

Positive free cash flow is the most important metric to investors at the end of the day. Leftover cash has many uses including the ability for a company to buyback shares and payout dividends.

There are times where positive free cash flow can be an illusion though so its important to dig into the financials and see where these potential problems may exist.

Debt in and of itself is not an issue, but when debts are beginning to pile up it may become an issue.

If a company takes out a loan and uses the proceeds to fund its capital expenditures, it could potentially increase its free cash flow, as the loan would be used to finance these expenditures rather than using the company’s own cash.

This becomes a problem if the loans rates are higher than the potential value of the asset purchased as it will reduce its free cash flow in the future.

Free Cash Flow and How it Differs From Net Income

Free cash flow is a measure of a company’s financial performance that represents the amount of cash that a company generates after accounting for the cash it needs to maintain or expand its operations.

Net income, on the other hand, is a measure of a company’s profitability. It is calculated by taking a company’s revenues and subtracting its expenses. Net income is an important measure of a company’s financial performance, but it does not always provide a complete picture of a company’s financial health.

There are a few key differences between free cash flow and net income:

- Free cash flow takes into account a company’s capital expenditures, while net income does not.

- Free cash flow is a more conservative measure of a company’s financial performance, as it excludes non-cash items such as depreciation and amortization.

One interesting development is that net income can be positive while free cash flow negative, as explained above this happens mostly with growth companies that are investing in research and development or marketing.

Free Cash Flow and Dividend Cuts

When it comes to income investors one of the most important question is whether your dividend payouts are safe. Companies can suddenly cut dividends and without warning, even when their payout ratio doesn’t seem excessively high.

By, paying close attention to cash reserves and the cash flow statement you can spot dividend cuts before they happen. If a company has few cash reserves and their cash flows suddenly take a hit it may be time to start looking for another value stock.

Free Cash Flow Worries Among Deep Value Investors

I was a deep value investor before I ever dreamt of learning about free cash flow. I never had a need for it or even worried about it all that much. In fact, many of the companies I owned were unprofitable.

Free cash flow is not that useful for stocks that are trading below book value, negative enterprise value or net current asset value. These stocks are so cheap they could liquidate and you could make money.

However, Japanese stocks are a bit of a different breed. They trade at these ridiculously low valuations and many of them are profitable. This poses a problem since I need a way to differentiate them from each other. This is where free cash flow analysis is helping to distinguish incrementally better trash stocks.

I hope my analysis of negative free cash flow has given you a better understanding on how to tackle your individual investments and maybe some other articles on this website can help you further.