I spend a lot of time researching and analyzing stocks, but then it dawned on me. I’ve never analyzed the stock of the company I trust with my portfolio. Are my investments safe if Interactive Brokers fails? In this Article I answer that question and then conduct an analysis of Interactive Brokers.

Interactive Brokers is SIPC insured up to $500,000 for securities and cash combined and $250,000 for cash. In the event of bankruptcy all assets can be sold or transferred to another broker with little interruption to the customer. All securities are owned by investors and are only held, not owned by a clearing firm.

I find it really interesting that stocks are covered up to $500,000 by the SIPC especially when the investor is the sole owner of the stocks. Is there something deeper to the SIPC and is it a mechanism to spread risk to multiple banks?

In the Event of A Broker Bankruptcy

To understand what would happen if Interactive Brokers goes bankrupt we need to find a few examples of when this actually happened in the past.

An easy place to look for such bankruptcies was during the 2008 financial crisis. This is where Lehman Brothers and Bear Stearns both met their demise. In this situation, JPMorgan Chase bought the assets of Bear Stearns and assets were transferred to Chase.

In both situations the SIPC steps in to facilitate the transfer of assets. Depending on how well the clearing firm kept records will determine if the SIPC will need to make investors whole with their stock and cash protection coverage.

There have been times where some stock records have come up missing. In this situation it is important to have good records of the stocks that you own and not rely entirely on your brokerage. This will help prove that you in fact did own those stocks and the SIPC can reimburse you.

A Clearing Firm is not Always Your Broker

A clearing firm keeps record of the stocks that you own. They keep a record of when the stock was originally purchased and at what price it was purchased.

In the case of Interactive Brokers, they handle their own clearing. This means that all stock records are handled in house. This is not the case for all brokers.

Webull as an example, does not handle its own clearing instead it outsources to Apex Clearing. Apex actually handles a lot of the newer brokers on the street, like Robinhood and SoFi.

When I transferred my stocks from Wells Fargo to Webull my original purchase price and day of purchase did not load into their system correctly. When I inquired as to why, they told me to update the information in the app. I wondered why they had placed so much trust in me after all that’s how taxes are calculated. I later found out Apex had all of the original documentation and it would be sent to me when it was time to do my taxes.

Is Interactive Brokers Safe to Keep Money?

All brokerages are required to keep assets of its customers and its own assets separate. It is illegal for them to dip into customer assets in order to fund their own operations. This means your money is safe, but this does not mean the broker itself cannot fail.

Up until now I’ve explained that there are a lot of agencies and government regulations keeping your money safe, which makes the risk of total loss difficult if not impossible to achieve. But, there are still some risks to loss of capital. Therefore our next stop is looking at the company financials.

Studying the financials of Interactive Brokers is a bit different than analyzing whether or not it is a good stock to buy or not. In fact, it could be an excellent place to keep your money, but a terrible company to invest in. They are not mutually exclusive.

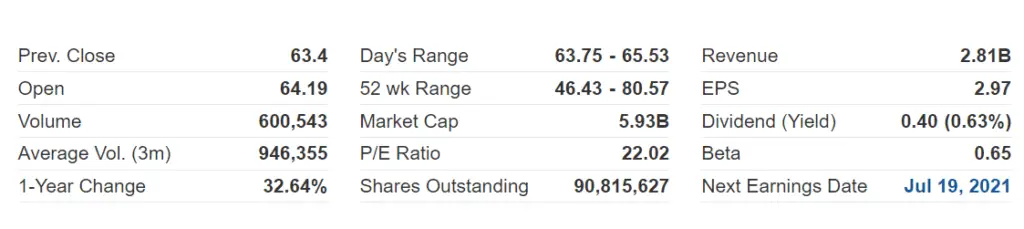

The first stop to look at whether or not Interactive Brokers is financial healthy is to check whether or not its making money. In fact it is, with a PE ratio of 22.02 it is making money. While the PE ratio does not signify the stock is undervalued and worth buying, we know now that its a profitable company.

Even though Interactive Brokers is a profitable company, is it financially stable?

After all if the company loses profitability it could quickly succumb to debt and be forced to file for bankruptcy. Fortunately Interactive Brokers holds no long term debt. If necessary it could issue long term debt in order to fund its activities while regaining profitability.

If long term debt starts increasing then it may be time to worry about Interactive Brokers financial condition and to make sure you diversify your brokerages if you are holding a lot of your wealth in Interactive Brokers accounts.

International Versions of Interactive Brokers

Unfortunately, international versions of Interactive Brokers don’t have the same agencies protecting your money as it does for United States customers. Interactive Brokers as listed on the Nasdaq is covered by the SIPC but not all LLC’s that fall under their umbrella may be subject to it.

In this case you will need to look at your local governments for protection. Most countries have at least some form of protection for consumers in case brokerages fail but not all do. It may be even more important to look at Interactive Brokers financial health in this situation.

Foreign Securities and Foreign Exchange Trades

The SIPC protects against stocks within member companies after verifying with Interactive Brokers it also protects international stocks.

This means if you buy stocks from a foreign exchange and hold it in your SIPC member broker then in the event of a bankruptcy your stocks are covered. This however does not include foreign currency.

As far as I can tell foreign exchange trades which I would assume to be currency is not covered. This is why its probably best to keep your currency in your home country’s denominations when not being used to purchase stocks.

Final Thoughts and Cases Where Your Money Isn’t Safe

It’s always best to spread your wealth throughout many different brokers and banks. This spreads your risk and keeps you below the SIPC protection limits. I currently use two different brokerages but plan on using still more in the future.

There are situations where your money may not be covered by the SIPC and while there might be numerous special situations here are a few that I believe could affect you.

- Engaging in share lending negates SIPC protection.

- Foreign exchange trades.

- Investment contracts or fixed annuities not registered with the SEC.

- Futures contracts.

Digging deeper into any situations where your money may not be safe is always beneficial. Now that I know my foreign currencies may not be covered in the event of failure I will be able to keep less on hand to reduce my risk. Its also nice to have a piece of mind that foreign stocks are safe in the event of my brokers failure.

Although a safe broker may not always keep you safe from a poorly performing stock. Make sure you read about the 10 factors I consider when buying a value stock.