Near the beginning of this year many crypto enthusiasts were calling for Bitcoin to surpass 300k. I very bearishly said, you will never see 60k ever again. I had hoped many would heed my warning.

I’m a millennial and yet, I’m not too fond of cryptocurrencies. Don’t get me wrong, I love the concept and use case. It’s just the wild west mentality, and the outright fraud that leads many astray that I cannot accept.

This is why when the bubble finally popped I was happy, finally an end could come to what could become far worse.

The End of Cheap Money and Unraveling Crypto

Cryptocurrencies finally hit their breaking point as the federal reserve brought an end to cheap money. Rising interest rates made it impossible to leverage returns in markets and that fuel cheap borrowing.

This coupled with the waning pool of greater fools finally began to unravel the entire system. This led to high profile coins and platforms swimming naked to financially implode.

Stable coins like Luna and Tether have cratered and this created a renaissance and re-evaluation into what the value of all cryptocurrency truly is. Essentially debt and risk are being taken out of the system. This is beneficial, as it takes the market back to fundamentals.

How Crypto Relates to Deep Value Stocks

As the party ends and the hangover sets in, more clear minds enter the financial markets. The only way forward is to value stocks and technologies at their intrinsic value. Overvaluation is inefficient and leads to less potential growth.

This is why market downturns need to happen. To restore efficiency to markets.

It’s difficult to value stocks that are in market bubbles. Greed gets in the way of rational decision making.

This is why I prefer to invest in deeply undervalued stocks on both an earnings and balance sheet basis. It is very clear when they are undervalued, all it takes is investment and a little patience.

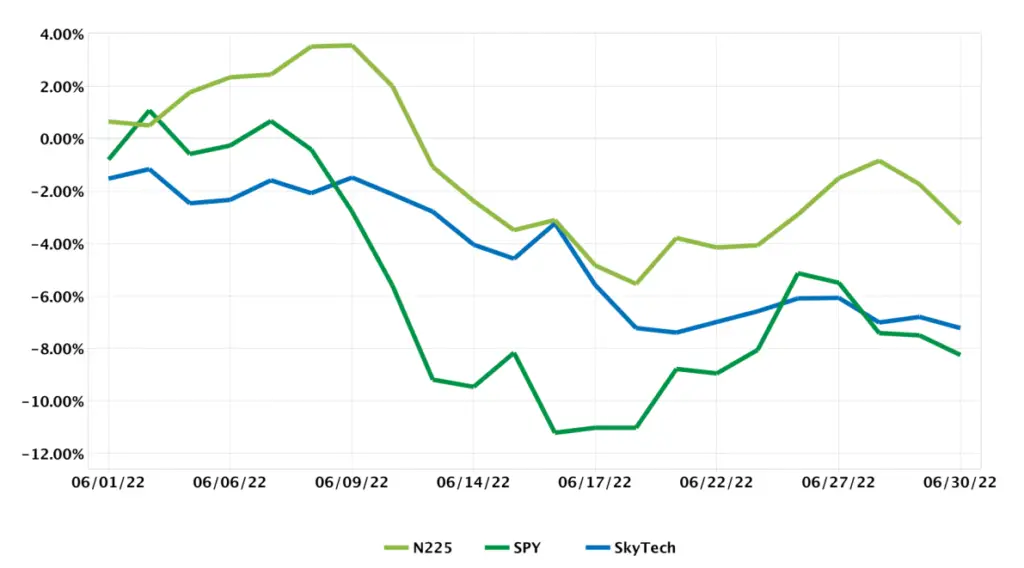

June 2022 Net Net Portfolio Returns

Talk of recession and fear and pessimism abound in June. This led stocks to fall amid a selling frenzy and a flight to safer bond assets.

This also led more capital to run towards the dollar as interest rates rise. My portfolio narrowly beat the SPY as it was bogged down by a weak Japanese Yen.

My overall returns for the month were -7.23%. I spoke too soon last month as I was more excited for this years summer months. It looks like no matter what year it is The end of June beginning of July is likely always a good time to buy stocks.

A lot less attention is paid to markets as parents and kids take those much anticipated summer vacations.

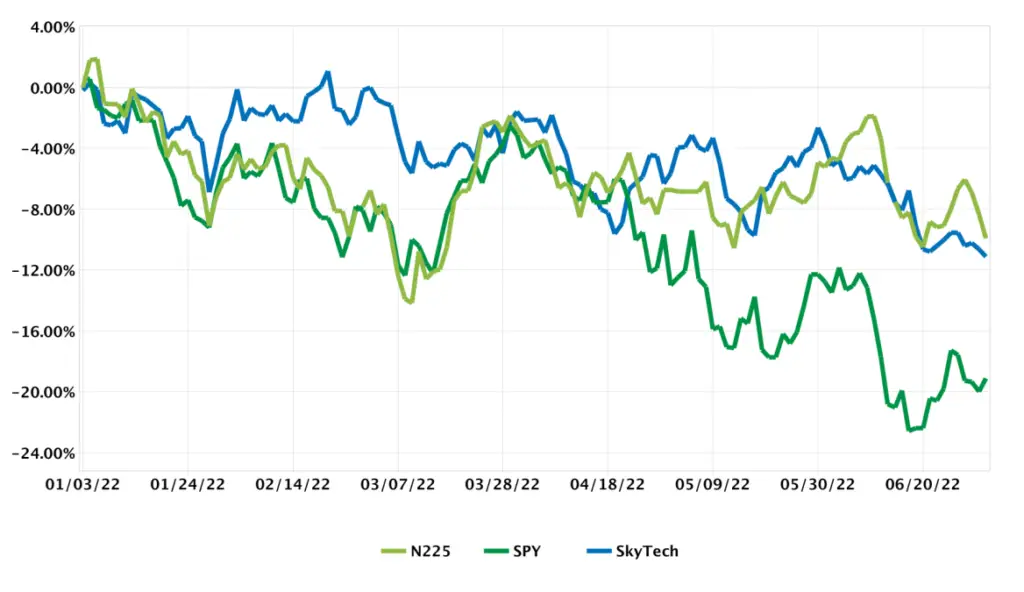

2022 YTD Net Net Portfolio Returns

This has been the worst 6 months in the stock market in 30 years, according to news outlets. While my portfolio wasn’t spared in the market downturn, ultimately my ultra conservative net net portfolio seems to be faring well.

While my returns narrowly lost to a pure Nikkei 225 portfolio, upon further investigation my stock selection is crushing the index.

If I had hedged the yen I would be positive for the year by about 10% as my stocks picks have performed well. The Yen is the poorest performer in my portfolio as it has lost around 20% of its value.

While this is not ideal, it is a learning experience. It’s also not concerning for me as I’m young enough to learn from this mistake and the Yen is likely to revert to back to previous levels as Japanese interest rates eventually will rise enough to buoy the currency.

Overall returns for the year thus far are -10.97%. I am well positioned to take advantage of all of the cheap stocks currently in the Japanese stock market. In fact I can’t get enough cash for all of the stock deals in both Japan and the United States.

It’s a nice problem to have albeit a little frustrating.

What to Look For in The Coming Recession

It seems almost inevitable that a recession is coming. While I don’t necessarily believe it will happen I do know there are some very unloved parts of the economy that are looking very attractive.

Both banks and homebuilders are incredibly undervalued. Both on a low PE ratio and book valuation. Rising interest rates have many afraid houses will become unaffordable and earnings will evaporate.

While this is a plausible thesis there are some holes in it that could leave us with some profits.

- The United States has not build enough houses for those who want them.

- Banks have plenty of capital and they have a greater spread in loans vs interest rates.

- Laws and regulations have created more opportunity zones for housing construction.

One opportunity in home building is Beazer Homes. Its incredibly low PE ratio screams undervalued, while its price to book ratio of just .5 is an excellent margin of safety.

Another Japanese homebuilder I’ve already researched is FJ Next. Homebuilding in Japan is not nearly the issue it is in the United States, but there is still plenty of opportunity for new homes to be built among the millennial population. Also many wealthy millennials are buying and building second homes in Japan, most notably popular YouTuber PewDiePie.

Long Live Crypto and Financial Stocks

Blockchain technology is here to stay. But, your efforts may be misplaced investing directly into Bitcoin or Etherium. Instead look at many of the financial institutions cropping up to support the technology.

It’s likely companies like Coinbase will morph into financial firms that utilize blockchain technology to facilitate fiat currency transfers. As bitcoin will live on as a medium of exchange rather than a currency in its own right.

If you have been burned by the crypto apocalypse, maybe it’s time to invest in safe assets that grow your money tangibly. Learn the tools of the trade here at ExploitInvesting.com and reap the benefits in the decades to come.

If you are curious about my net net investment journey remember to read my previous portfolio recaps.

If you are ready to start investing internationally make sure to see which brokers I use and why.

For Investing in Japanese stocks be sure to read my article on how to buy shares in Japanese companies.