It astounds me how numerous self help stock market investing gurus have cropped up over the year and gain any sort of notoriety. This year has been a great year for many value investors and the market as a whole. So these gurus are happy to take credit for what the market is already doing.

The hilarious part is when they suggest you buy Apple, Costco, or any sort of megacap company that dominates the indexes. They are of course perpetuating the overvaluation of these companies, but it has become normalized because of all the excess capital sloshing around in the American capital markets.

They tend to forget the advantages individual investors have and fail to exploit them.

“The amateur investor has numerous built-in advantages that, if exploited, should result in his or her outperforming the experts, and also the market in general. Moreover, when you pick your own stocks, you ought to outperform the experts. Otherwise, why bother?”

Peter Lynch, One Up On Wall Street.

While many value investors have done well in 2021, high flying growth investors and Kathie Wood followers are actively licking their wounds as they prepare for a new year. Both growth and value gurus say stick to the strategy and you will achieve quality returns. But, which strategy should you choose?

Why You Shouldn’t Take Sides in the Growth and Value Debate

I am a staunch value investor, but this month I read One Up On Wall Street by Peter Lynch. My understanding of growth stocks is fairly limited but, I am actively trying to change this. After reading the aforementioned book I realized that growth investing and value investing are joined at the hip, at least if you look at it another way.

For example, companies can be making money hand over fist and still have low value indicators like book value and the PE ratio. This means you can invest in companies on the cheap that have massive growth potential ahead of them.

The biggest takeaways I had from Peter Lynch’s approach on growth vs value were:

- Growth rates should include dividends.

- PE ratios should be related to growth rates. Higher PE ratios are allowed if growth rates are high.

- Excessive debt is bad for both value investors and growth investors alike. Remember this when investing in growth stocks.

So, one of the greatest investors on the planet, Peter Lynch, invested in profitable growth companies trading with low value indicators?

This was a revelation and really confuses me when I see how unprofitable companies are somehow making new highs in the stock market. I’d rather invest in a company not burning cash or diluting me and it seems Peter Lynch does too.

How to Invest in 2022 and Beyond

What is an investor supposed to do in 2022?

In my case I have very little capital in American markets.

Why Weyco Makes Sense

Weyco is a company that has both value and growth fundamentals aligned. It was hit hard by the pandemic but diversified intelligently and stands to benefit both both its acquisition and some semblance of normalized business activity.

Here are why the numbers make sense:

- Weyco’s PE ratio is only slightly above its ROE when its dividend is added to the ROE the PE ratio is lower than its growth rate.

- Weyco has a ton of cash and very little debt.

- Inventory turnover exceeds industry averages.

- Payout ratio is safe at 60% and the dividend grows every year.

Weyco is known for its business dress shoes and recently acquired a casual hiking shoe company. This along with its winter boots selection provides powerful diversification that should propel revenues.

International Stocks are Very Attractive

Most of my portfolio is in Japan. The stocks are just cheap and revenues are set to explode. Most of the stocks in Japan have very low growth rates but the PE ratios are also comparatively low. This is the only negative according to Peter Lynch.

High PE ratios and high growth rates lead to higher overall growth. So its better to invest in those when you find them. However, so many PE ratios exceed their growth rates by such a large degree its difficult to invest in them as it would take a lifetime to make back your investment assuming growth stalled.

Therefore stable growth rates are much safer and often the tortoise beats the hare in these situations.

December 2021 Net Net Portfolio Results

After a couple months of losses December finally brought some positive returns. This is mainly because of one Japanese company that released earnings that were stellar.

The last quarter was rough for Japanese stocks and productivity, but this beacon of hope shows the next earnings cycle will be a positive one. This also proves my theory that markets, at least in the small cap space, are not forward looking.

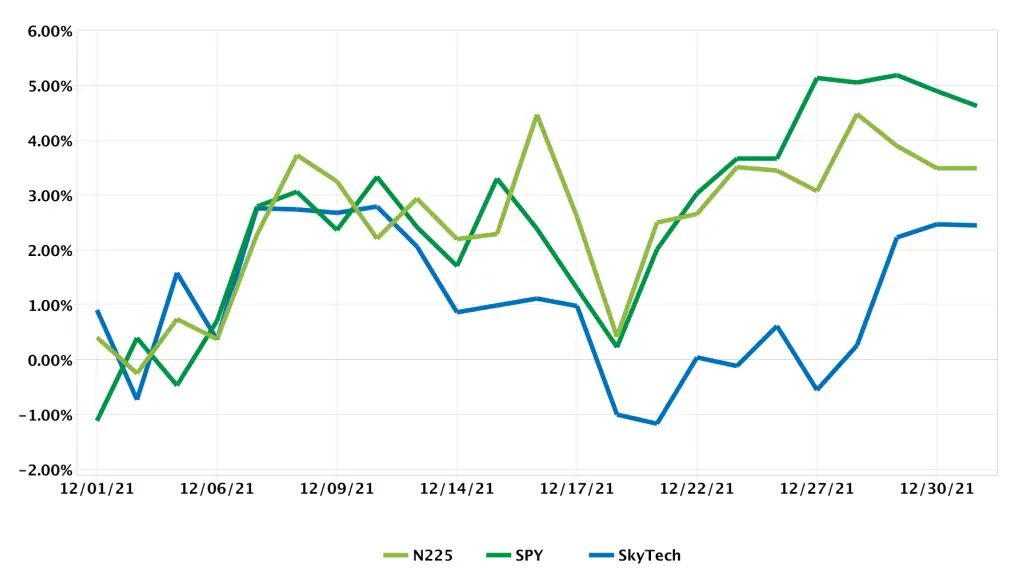

My returns for the month were 2.45% falling below both Japanese and American indexes. While returns were not that great mid December was a great time to find bargains moving into 2022. The last week of December saw markets start to move upward signaling the coming up a profitable January.

Sadly the rise of SPY near the end of December does not bode well for the majority of investors following the popular gurus of today. Many of which are supporting the wrong part of the index, returns could potentially be a bit rough in 2022 and it will be interesting to see how these gurus try to spin it.

2021 YTD Portfolio Returns

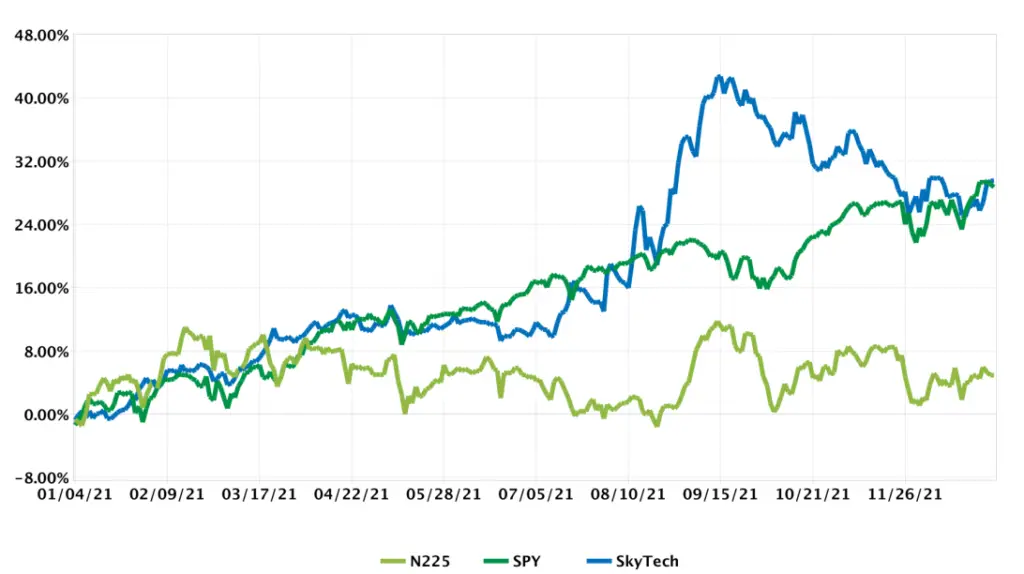

It was neck and neck at the end of the year. But, in the end my portfolio eked out a slight win to SPY.

The final numbers were:

- 28.75% SPY to 29.51% SkyTech a close .76% difference.

For $100,000 invested that’s a total of $760 extra. I guess that’s enough for me to pay for this website for the next 20 years. But, over a lifetime this compounded number will be extremely beneficial.

I did surprisingly well since the Japanese index returned a paltry 4.91%. It just goes to show you that index investing can differ wildly from investing in individual companies.

2022 Goals and a Solid Portfolio Foundation

Over the year I came to the realization that investing in profitable dividend stocks was the best way to invest. Of course I also love cheap assets so finding valuable asset plays is always beneficial.

Moving into 2022 growth investing is on top of my mind. But, only if it makes sense from a value perspective. So far the following year dividend paying value stocks with slow and steady growth are making up the base of my portfolio.

I will dig deep into asset plays and turnarounds to provide extra alpha to my portfolio. But, even without them I hope my portfolio base will still beat the market.

If you are curious about my net net investment journey remember to read my previous portfolio recaps.

If you are ready to start investing internationally make sure to see which brokers I use and why.