Famous Investors that include Warren Buffett and John Bogle consistently praise the merits of index investing. It can make some investors wonder why everyone doesn’t just invest with index funds.

If few investors can actually beat the market, then it makes sense to just take the average returns of the market by investing in an index fund. So why then do so many choose not to invest in index funds?

There are a number of reasons for this and below I dive into each one and the reasoning behind them.

1. Index Funds Can Never Beat the Market only Mimic it

For many active investors beating the market is their primary goal. Index investors who invest in a broad based S&P 500 fund can never beat the the market.

In these cases in order to beat the market you can’t invest entirely in the index. You can use the index to supplement your returns, but then it will become harder to beat the index the more your invested into it.

By definition your returns will be brought closer to the average as you invest in the market in its entirety.

2. Index Investing is Boring and Investors are Inpatient

Index investing is boring. It’s meant to be that way and for many investors this is perfectly fine, because they don’t care about investing and want to think about it as little as possible.

But, for investors who desire the thrill of beating the market or getting rich faster than indexers, the allure of active investing is far too great.

If you can earn returns greater than that of the average 9% then you can shave decades off your retirement goals.

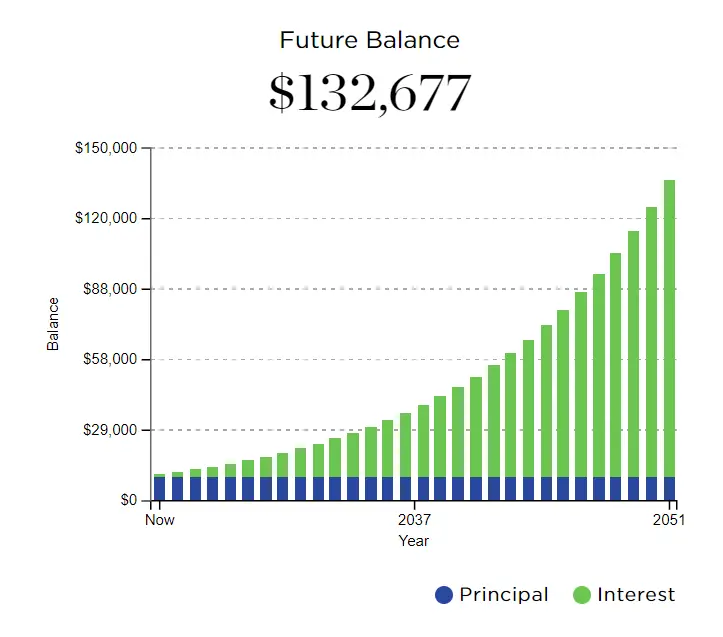

Investing $10,000 at 9% without adding any extra capital, will net you 132,677 over 30 years.

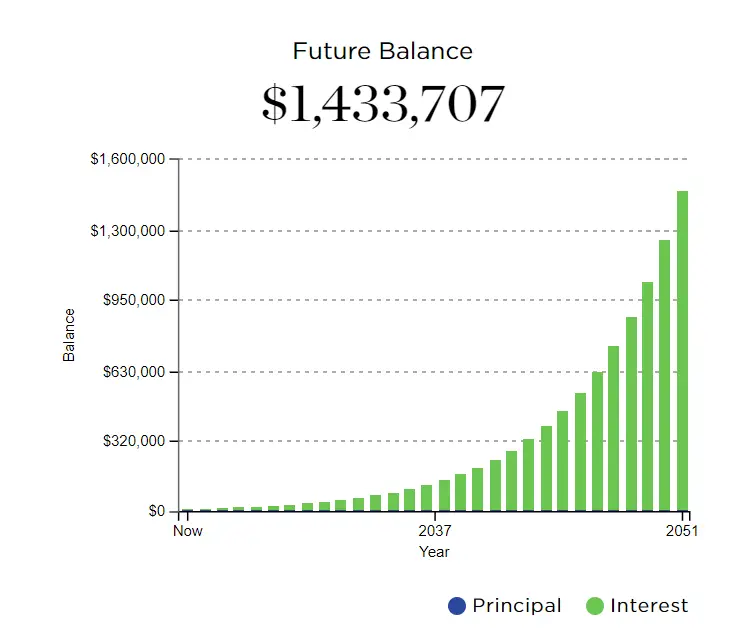

However, doubling that rate of return to 18% will net you 10 times more in returns over the same period.

So the allure of being able to at least double your returns is definitely worth the added risk. Remember the more capital you acquire, the more difficult it is to achieve higher returns.

3. Many People Don’t Invest at All

Putting investing aside for a moment, one of the greatest reasons everyone doesn’t invest in index funds is because a lot of people don’t invest at all.

They just have too many other more important places to put their money or are living paycheck to paycheck.

The thought of putting a small portion of their money into an index fund just doesn’t seem worthwhile. And if you think about it, there are much better non stock market places to put those funds to good use.

4. Index Investing has Become more Complicated

Index investing isn’t what it used to be. Indexing became so popular entirely new indexes were created and more index funds arose.

This created thousands of different ways to index. Instead of just buying a broad based fund you could now invest in obscure small caps, internationally focused funds or dividend focused index funds. They have even been split between value and growth indexes.

With so many new index funds simple market averaging index funds were no longer the norm. Instead many investors would have multiple index funds in their portfolio to be sufficiently diversified.

The typical portfolio would consist of the following:

- Large cap fund

- Mid cap fund

- Small cap fund

- International fund

- Bond fund

Some variations may include dividend index funds or a distinction between growth and value. REIT’s have also become a popular index in their own right.

5. Index Funds Poorly Invest into Small Cap Stocks

Small cap stocks are tomorrows large caps, at least in some cases. This means they could potentially grow into the next Apple if they are fast enough compounders. The trick is investing in these stocks before they get large.

Index investors will have a lot of trouble investing in these stocks because index funds just have too much money. If they were to invest even a small amount of their total capital into the stock they would potentially be able to buyout the entire company.

This means that many small cap index funds really don’t adequately invest into small cap stocks. In fact most of the stocks in small cap index funds are actually mid cap stocks.

6. Index Funds Still Contain Fees

No matter which index fund you choose you will have fees to contend with. These fees are just the cost of management, but depending on the index fund they can vary in percentage.

One way to sidestep this is to invest in individual stocks. With many brokers like Webull, the one I use, now offering free trades, it doesn’t make sense to pay index fund fees when you can clone the index for free.

It will take some management on your own part to keep up with the index but you can easily sidestep those fees and learn more about your holdings than you would otherwise if they were all stuffed in a single index.

7. Index Funds Will Potentially Have Lower Returns

Famous investor Michael Burry has consistently warned that index funds are in a bubble.

Burry worries that as more people index it creates less price discovery. This leads smaller stocks to languish while larger stocks get more capital and attention.

It leads to less efficiency in the market overall as the overwhelming amount of capital goes to large bureaucratic companies. This leads to less innovation and competition as a select few companies dominate.

8. Company 401K’s Don’t Allow Index Investing

Unfortunately, your retirement portfolio doesn’t always give you much choice in investments. My first company that offered a 401k only allowed me to invest in target date funds. This forced me to invest in a fund that included mutual funds alongside index funds.

Other publicly traded companies only give you stock in the company your working for. This creates issues for the uninformed investor and is yet another reason everyone may not index.

Fortunately, some 401k’s do allow you to invest in index funds and it really just depends on the company you work for.

9. Investing in Individual Stocks Creates Better Exit Strategies

Investing solely in index funds leaves you at the mercy of the market overall. If the market as a whole is doing poorly and you need cash then you are guaranteed to sell at a terrible time.

However, if you own individual stocks there may be some that are still performing well that you can take some gains from to hold you over while the market rebounds.

I explain more about how this works in my rebalancing in a bear market article.