Lately I’ve been obsessed with value investing. My whole strategy revolves around buying companies trading below net current asset value.

In other words the company has more current assets than the stock is worth. But, I began to wonder if companies with a negative enterprise value existed. In other words can a company have more cash than the price its trading at?

Negative enterprise value arises when a company has cash on hand worth more than its entire operation less its debts. The company can essentially buy all of its shares and pay off debt on the same day. They are usually found during recessions and have small market capitalizations.

Now obviously there are a lot of reasons a company wouldn’t or even couldn’t buy out all its shares, but why and how do these types of companies exist in the first place?

Calculating Negative Enterprise Value

In order to find out if a company has negative enterprise value its a fairly simple calculation.

EV=MC+Total Debt−C

Where EV is enterprise value, MC is market capitalization and C is cash or cash equivalents.

In order to figure out a companies market capitalization simply multiply the share price by the number of shares. I typically multiply the number of diluted shares, since it is a more accurate representation.

This calculation differs from net current asset value in that it does not count items like receivables or inventory, which could be worth less than cash. It is by far a more conservative estimate since cash has a specific value.

Why Negative Enterprise Value Happens

This is a pretty impossible question to answer since there can be limitless reasons for this to happen. From individuals selling a stock out of fear, to a company not being proactive with its own shares.

Here are some reasons I can see how a company could have negative enterprise value:

- Panic selling drives the share price down below the company’s value of cash.

- A company does not realize it is trading at incredibly low levels and does not buy its own shares in response to facilitate better returns for existing shareholders.

- A company has an excellent quarter and generates massive cash returns, but nobody notices and the stock is not bought.

Now, I know what you might be thinking, these are pretty rare companies, and there is no way they exist on a regular basis or even for more than a few days. I’m here to tell you that you would be wrong.

I come across these kinds of companies on a weekly basis. While they may be short lived, they certainly last longer than just a few days, in fact they last for months if not years.

International Investing Opportunities Abound

These sorts of companies however, are not typically found during market euphoria. But, they are found in countries around the world and Japan in particular.

I’m not sure why exactly they are so prevalent in Japan but one reason may be the low interest rates. If inflation is not occurring at a healthy rate, the cash on the companies books is not losing value, so it may make more sense to hold onto it.

If they hold onto that cash long enough they can likely find excellent opportunities for growth and expansion.

What I don’t understand is how a company can be 30% undervalued according to its cash and the company in question doesn’t think to buy back its own shares. Since that would offer a simple quick return.

Many companies do come around to this fact and do begin repurchasing their shares driving up the stock to fair value. If you bought during that time you could have received a healthy gain.

Why Negative Enterprise Value is Good for Small Investors

Negative enterprise value is terrible for the company in question. The company does not have the ability to raise funds for expansion and it has lost the trust of many of its investors.

But, for a company looking to make an acquisition or an enterprising small investor like yourself, it is very good! It means that you are able to buy a company that is sitting on a literal treasure chest of cash.

Why wouldn’t you want to trade 50 cents and immediately get a dollar in return!

While negative enterprise value stocks are an excellent opportunity there are some things to look for and situations to avoid.

- Don’t buy stocks losing a ton of money every quarter

- Buy stocks that are either making money every quarter or losing very little.

- Look for potential catalysts that could increase revenue. Acquisitions, or events that could produce better returns.

- Make sure the company is paying a dividend or in an area with good shareholder rights. Some companies could be frauds. Regular dividend payments prove a company has excess funds.

- If the company is actively selling shares below its enterprise value.

- Don’t buy if the company has recently gone through an IPO.

Where to Find Negative Enterprise Value Stocks

The best place to find these types of companies are in countries that have a lot of stocks listed and are typically in a recession. You will also need to look for very small companies, since large investors can’t invest in small companies they are more likely to exist.

In order to search for these types of companies you will need to use a screener. My current favorite is from investing.com.

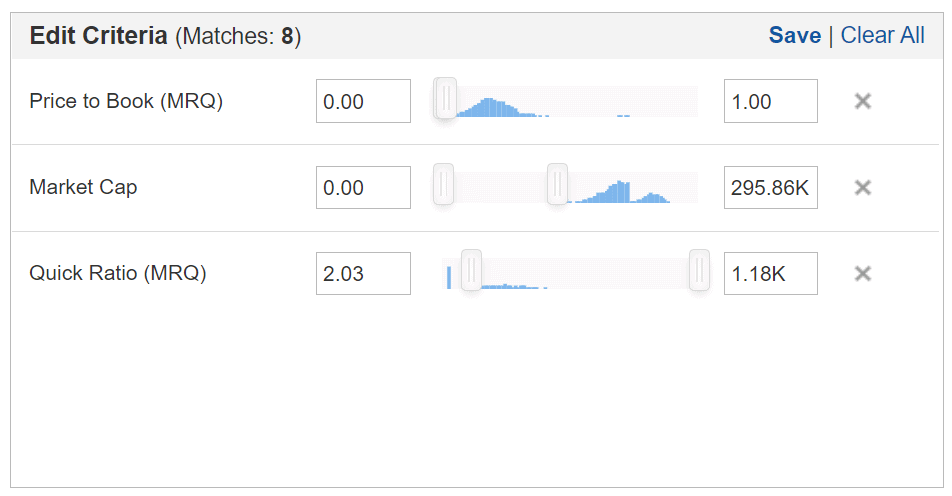

I typically screen for the following:

- Price to book value < 1.

- Quick ratio < 2.

- Market cap < 250 Million.

After you screen for the above information the really tedious part begins. You will need to manually search through each company and its balance sheet to evaluate its financial health.

Then use the enterprise formula to calculate if its negative. If you determine a company has a negative enterprise value then its up to you to perform further research to see if its a sound investment. There are no guarantees but the odds are in your favor.

Note: One reason its important to have minimal screening criteria and to manually sift through stocks is because many stocks have a lag effect. For example if a stock becomes profitable in one quarter it may still not show a positive PE ratio because those are often extrapolated throughout an entire years worth of earnings.

Negative Enterprise Value Screeners

While there may be some free negative enterprise value screeners, I have not found any to be truly effective. They often skip over really great investments or turn up a lot of nonsense. That’s why I think its best to do a simple screen and investigate each of the stocks yourself.

Finbox is a paid screener that gives you professional information at a fair price. It’s truly the best screener I’ve found thus far. Finbox does offer a free trial and with my referral link you will get 5 dollars towards their premium membership.

It truly is a fun and rewarding treasure hunt.

Negative Enterprise Value Research

Unfortunately, since many wealthy and established investing institutions can’t invest in these small deeply valued stocks there is very little research on them.

What we do have is research on deep value stocks and not negative enterprise value in particular.

For example Tweedy Brown a successful investing firm wrote: What Has Worked In Investing. This piece of work establishes that companies below book value outperform. And since you can’t have a negative enterprise value without the stock being below book value, it stands to reason your returns will be similar if not better.

Other than that piece of work we have accounts of great investors such as Joel Greenblatt and Warren Buffett who both invested in deep value and make excellent returns.

If you found this article interesting you might also be wondering about negative price-to-book value and the risks and rewards it presents.