When I was a child I often heard my parents talking about bank interest. I even heard it mentioned at school! As odd as that sounds. Those were different times though. When high interest rates made savings accounts a great way to store wealth. Today in the age of low interest rates, compound interest in the bank seems like a pipe dream. So its only natural to question whether compound interest or compounding in particular works in the stock market.

Compound interest specifically pertains to savings in a bank account. However, compounding is a concept common in finance. Stock compounding refers to the ability for earnings on your principle to generate their own earnings. Over time, if left untouched, your earnings will continually accelerate.

Stock compounding is considered riskier than plain old bank interest. But, the returns of stocks far exceed that of banks. This is averaged over multiple stocks as any single stock can perform worse than a safe bank asset. Bank, compounding can also be subject to inflation whereas stock assets are generally more immune to its affects.

But, I’m just scratching the surface, if you want to learn how Warren Buffett used the power of compounding to amass incredible wealth continue reading below.

Compounding Returns in the Stock Market

“My wealth has come from a combination of living in America, some lucky genes, and compound interest.”

Warren Buffett

Warren Buffett is perhaps the poster child advocating the power of compound interest. His investments have produced outstanding returns. But, he started young and at that early age he realized he needed to save.

This is because compounding starts out slow and gradually increases over time. It can be painfully slow when you first begin. Charlie Munger is often quoted about how difficult it is to reach that first $100,000 dollars. Warren Buffett understood this concept so he was incredibly frugal at a young age.

Compounding at Average Returns

In order to even start compounding your stock returns you will need starting capital called your principle. The principle terminology is the same with stock compounding as it is with bank interest compounding.

When discussing compounding in stocks an average 7% in potential gains is often cited. So lets see how much a sum of 10,000 can net you in 5 years.

| Principle | Compounding Returns 7% |

|---|---|

| 10,000 | 700 |

| 10,700 | 749 |

| 11,449 | 801.43 |

| 12,250 | 857.53 |

| 13,108 | 917.56 |

| 14,206 | 981.79 |

Not a bad return if you ask me, but I have bills to pay and 5 years is a long time! I spend $4,000 dollars in a single month!

Compounding at Higher Levels

In his early years Buffett was compounding at insane rates. He stated he could make around 50% per year. At smaller sums of money this definitely doable, but not many of us are as smart as the Oracle of Omaha. So lets settle for a very doable 20% annualized return.

| Principle | Compounding Returns 20% |

|---|---|

| 10,000 | 2000 |

| 12,000 | 2400 |

| 14,400 | 2880 |

| 17,280 | 3456 |

| 20,736 | 4147.2 |

| 24,883 | 4976.64 |

Now that’s more like it. However, its still pretty paltry. So the reality is you will need to save early to reach amazing levels of compounding that can replace your active earning income potential. A bit of sweat equity and higher savings can really speed up those returns.

The Frequency of Compounding

When talking about compound interest in a bank account you will typically need to ask the frequency of compounding. Since daily compounding will result in more money than monthly compounding.

So when talking about stock compounding its important to note that the frequency at which your money will compound. Above in the 2 situations I described, the average rate is considered in a yearly situation. Let’s be honest though, its hardly ever that consistent. You will more likely have lumpy inconsistent returns.

But, something interesting tends to happen when compounding with stocks though. You will typically earn higher returns earlier in your investing career than you will in later years. This is due to a number of factors.

- As you accumulate more wealth your taxes increase, resulting in lower returns.

- The number of investable company’s with higher returns decrease as you accumulate more wealth.

- Your risk tolerance is higher when you are younger, and decreases when you are older. This less volatile investment philosophy translates into lower returns.

So no matter how small your starting cash is when investing, its important to get started right away. Since you can make your highest returns with a relatively small amount of money. Especially today, when there are multiple platforms with free trades.

Dividend Compounding

Dividends are as close as you will get to how a savings account at a bank generates interest. The most frequently you can receive a dividend is monthly. You can get these from a few sources.

- Master Limited Partnership(MLPS): These are common in the commodities space and many oil companies distribute cash monthly.

- Real Estate Investment Trusts (REITS): These are companies that own real estate and receive monthly payments.

- Bonds: Bonds are debt issued by either banks, companies or the government. The payouts on these are referred to as the coupon and not interest. Nonetheless it acts as an interest payment. Its often called a dividend payment.

The most common way companies will payout dividends is on a quarterly basis. Luckily they tend to payout at different times, so if you own enough dividend companies you can smooth out your monthly returns.

Lastly, you can get payed out annually or bi-annually. This is less common in American companies but I highlight how common dividends are in Japanese stocks in another article.

The best way to let your wealth compound is to reinvest your dividends. I tend to not re-invest automatically, but rather use the money to buy cheaper stocks to boost my returns.

How a Corporation Compounds

When talking about stocks it can be easy to get lost in the numbers. You need to remember the stocks you invest in are companies with real people working at them. Every single day is building upon the last, so your stock is actually compounding at every second with the accumulation of everyone’s efforts.

This is sometimes hard to see since a company reports its earnings on a quarterly basis, so you it would be easy to think they your rate of compounding is less than a daily bank account. In fact a company compounds faster than that, down to the second and technically beyond, since you corporations are the accumulation of everyone’s efforts.

How to Achieve Higher Returns

Now you may be wondering how can you beat the average returns of the market? Well its simple, and you can even see how compounding may have its limitations. Nothing can grow forever at such high rates. It will eventually hit barriers to its growth that make it difficult to keep up those levels.

This is why Warren Buffett often comments on how it’s more difficult for him to earn outstanding returns today than it was when he was younger. No the market has not changed, it is not harder to gain higher returns. Instead Warren Buffett notes returns are harder to come by because he has so much money. He cannot efficiently invest all of that wealth.

Think of it this way, if he wanted to buy a company generating 50% per year in returns, he couldn’t because companies like that are small. He would end up buying the entire company and it would still make up only 1% of his portfolio. Thus it wouldn’t even matter to him.

But, for you and I we could by this company easily, and not be able to purchase even a single percent of the whole company! We could then achieve that fabled 50% per year far more easily than the master himself.

Stock Compounding is not Guaranteed

Investing in any one individual stock will not always result in a positive compounding effect. Many companies will lose money if they are not competing efficiently. This could result in a loss of capital. This is why you will always need to invest in a group of companies to avoid any pitfalls a single stock may have.

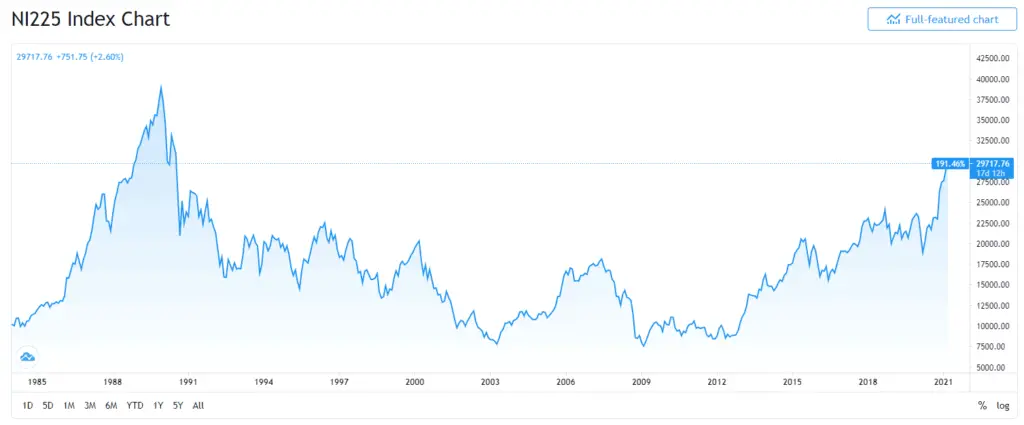

But, sometimes even that is not enough. Such is the case in Japan.

The country had an incredible run until the early 90s. At that point the country was plunged into a deep recession and did not recover until 30 years later. That’s a long time to wait for compounding to take effect. So how do you avoid that problem?

The key is to essentially buy stocks where the valuations are irrational to the downside. This means investing in company’s that are selling for less than the assets on their balance sheet. Right now since there is a lot of negative sentiment in the Japanese market, it is the best place to find these sorts of stocks.

Not to mention, it’s getting close to surpassing its heights back in the late 1980’s. This could generate a lot of hype around the market again, pushing up the prices further. I can see the headlines now, Japan emerges from the depths of a 30 year recession.